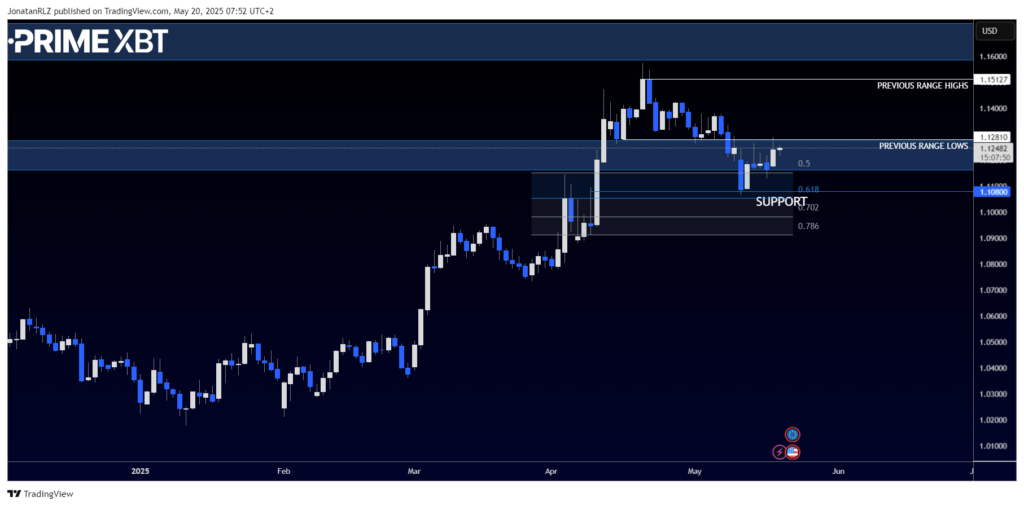

Last month, EUR/USD delivered a powerful breakout above the 1.1200 area, trading at levels not seen since early 2022. This surge prompted speculation among investors that the euro might be entering a new market cycle, especially after establishing a range above previous high timeframe resistance.

However, the breakout eventually gave way to a retracement, taking price back to the 1.1080 region. This level aligned with the 0.618 Fibonacci retracement of the latest leg to the upside, providing strong confluence and attracting buying interest.

Since that retracement, EUR/USD has found support and is now climbing back toward the previous range lows, a level now acting as local resistance. A reclaim of this area could be an early signal that the market is once again ready to test higher ground, potentially re-entering the bullish structure that had been forming.

Zooming into the 4-hour chart, we see a clear ascending triangle forming. The two most recent swing lows have bounced from key technical zones, specifically the 50% and 0.618 Fibonacci levels, further reinforcing the bullish structure. The upper boundary of the triangle is defined by the previous range lows around 1.1300, which now serve as key resistance.

Breakout traders will be watching this 1.1300 zone closely. A strong move above it, especially with rising volume, could confirm a breakout. In that case, the next area of interest lies at 1.1370.

All eyes are now on whether EUR/USD can break this resistance and continue building momentum to the upside.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.