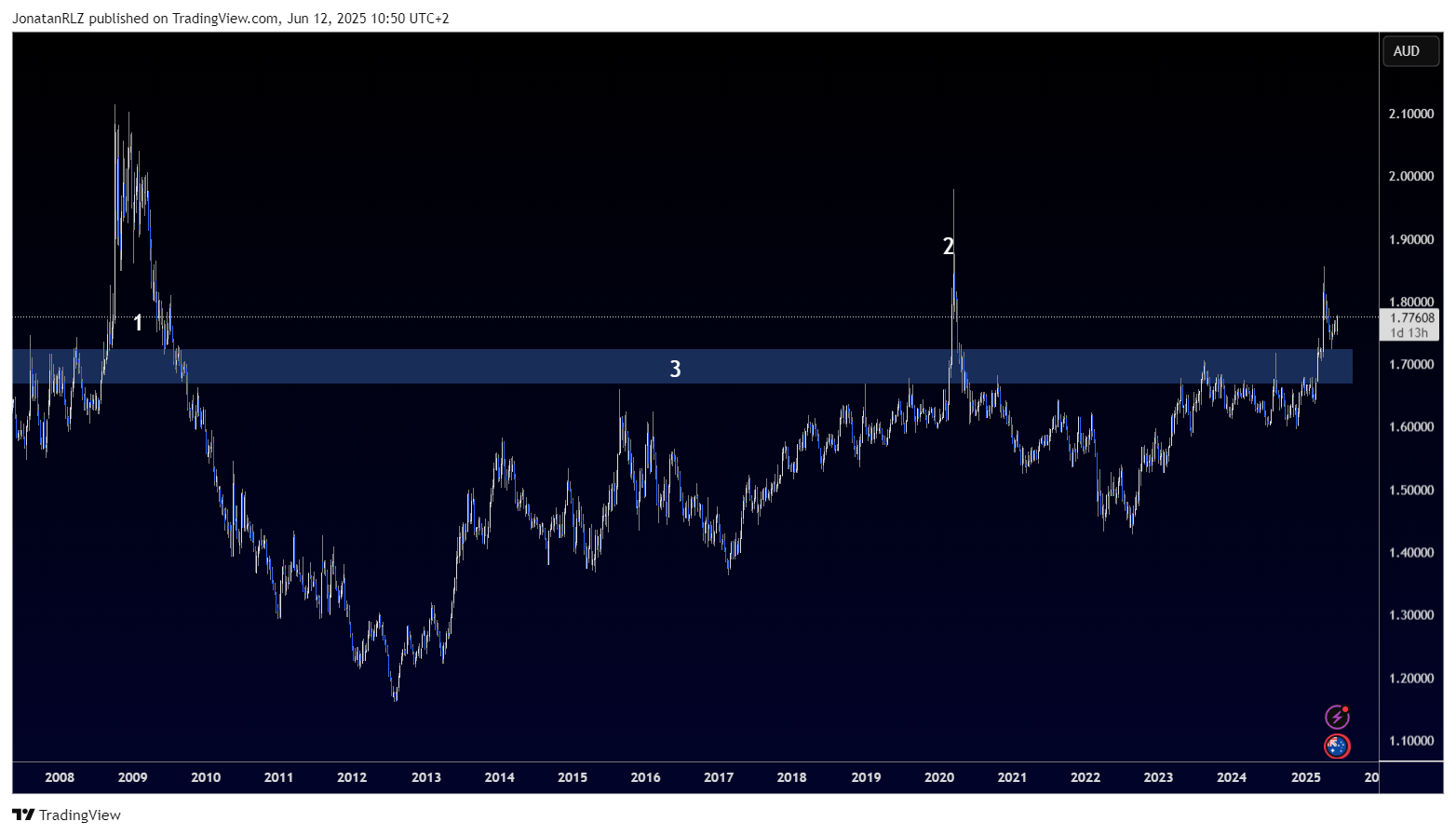

Today’s update on EUR/AUD starts with the weekly chart, where we are seeing the pair trade above a level (3) where it has not printed any significant high time frame structure since 2008 (1). While there was a brief spike above this zone in 2020 (2), that move lacked follow-through and ultimately failed. What we are witnessing now is structurally different.

EUR/AUD has not only broken above this major high time frame level at 1.7000, but has also formed a clean break-and-retest structure. The recent retest held with strength, suggesting the market has accepted this zone as new support. This may signal a major cyclical shift in the behaviour of the pair, with possible long-term implications if this structure continues to hold.

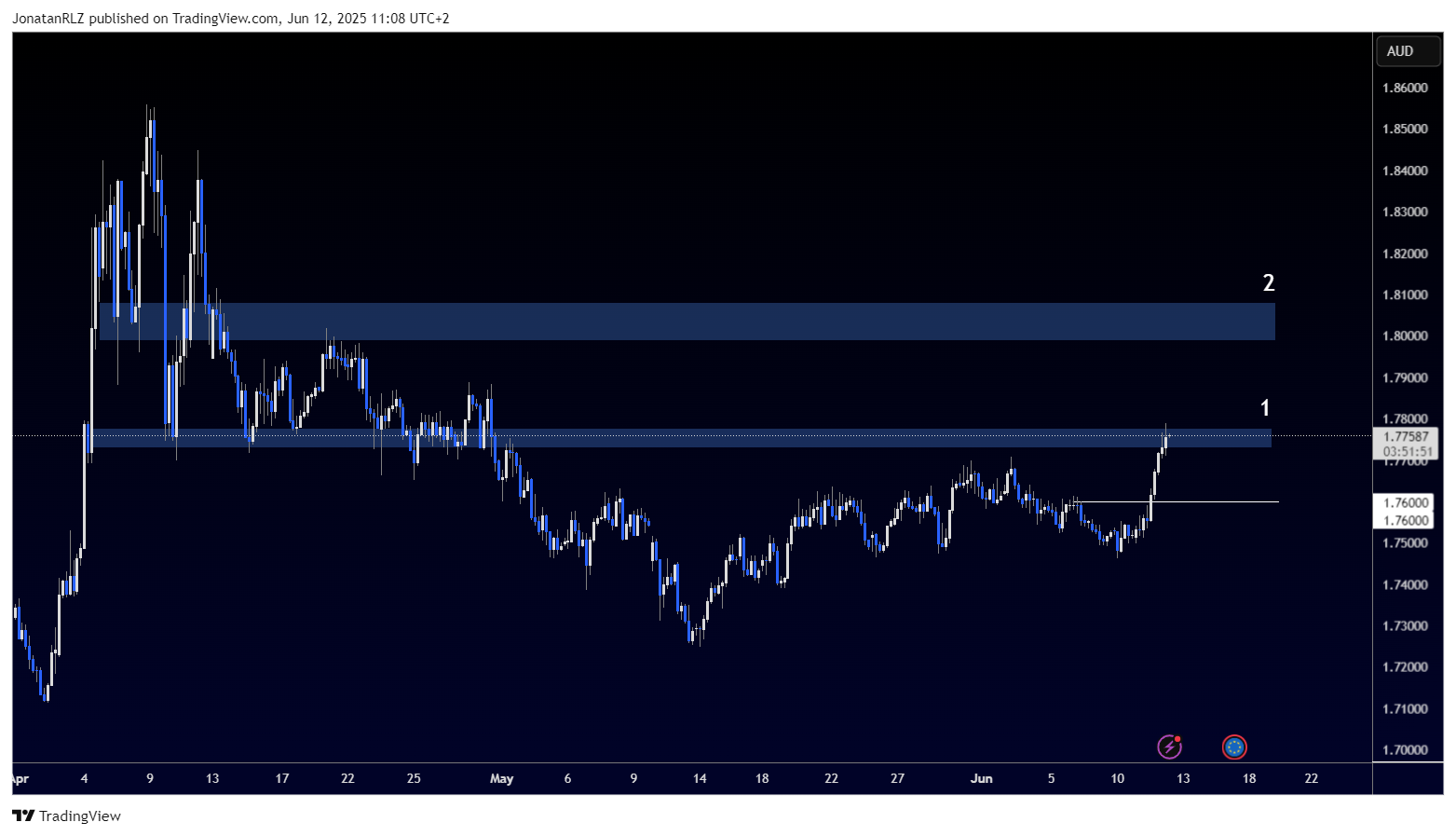

Moving into the daily chart, we see two important zones in play. First is the horizontal support marked as number 1 around 1.7350, which acted as the initial breakout level and produced a clear bullish confirmation when retested. The second is the 1.7600 region, marked as number 2,which is currently being broken through.

Right now, EUR/AUD is testing a short-term resistance zone around 1.7788. A successful move through this area would be a clear sign of continued strength, potentially opening up room to move higher toward the 1.8200 level, where we find the Local Short RLZ (reload zone).

On the 4-hour chart, price is currently testing the short-term resistance zone marked as number 1. If this area is reclaimed, we could see a move toward the resistance zone marked as number 2, starting at 1.8000. This would mark the entry into the upper short reload zone and could act as the next key trouble area for bulls.

However, if we see rejection at current levels, price could fall back toward the 1.7600 region for another test. That level would be important to watch for a potential bullish reaction, particularly if the high time frame bullish structure remains intact.

EUR/AUD continues to show strong structure across all major time frames, and the recent acceptance above multi-decade resistance puts the focus on potential continuation toward higher levels, with well-defined invalidation zones below.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.