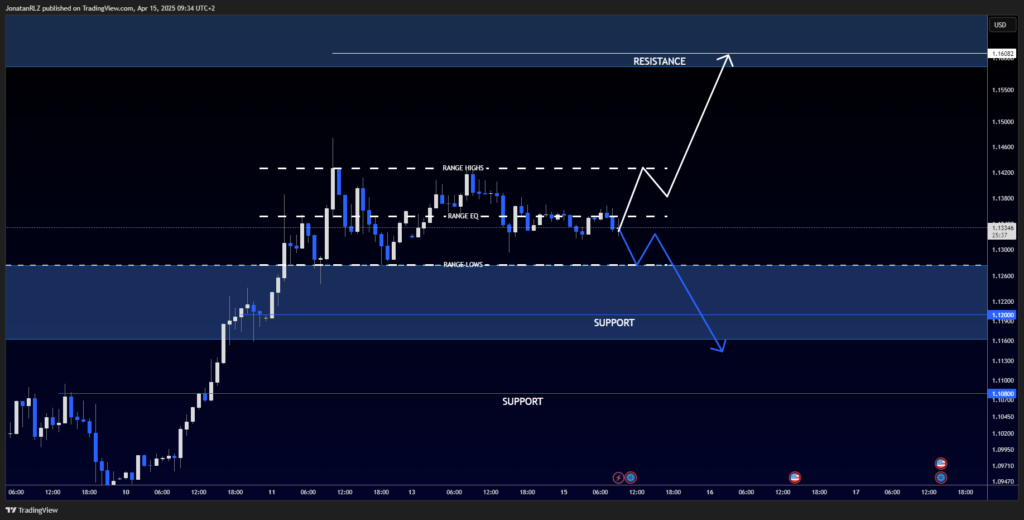

EUR/USD continues to trade within a well-established range, holding comfortably above the previous high timeframe resistance zone, which now appears to be acting as support.

The current intraday range we’re monitoring is defined as follows:

- Range Lows: ~1.12800

- Range EQ (Equilibrium): ~1.13500

- Range Highs: ~1.14300

Structurally, this reminds us of the recent consolidation seen in gold—with a clear breakout already behind us, and the market now deciding whether this zone will act as a base for continuation or give way to deeper retracement.

A break below the range lows with sustained downside momentum could lead to a move toward the previous breakout level at 1.12000, or possibly even further down toward the 1.10800 area—a level of prior interest on the higher timeframes.

On the upside, a clean break above the range highs could shift the focus toward the next major high timeframe resistance, sitting around 1.16000.

This range remains central to near-term directional bias, and traders could perhaps find clear opportunity within the boundaries—or on the next breakout.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.