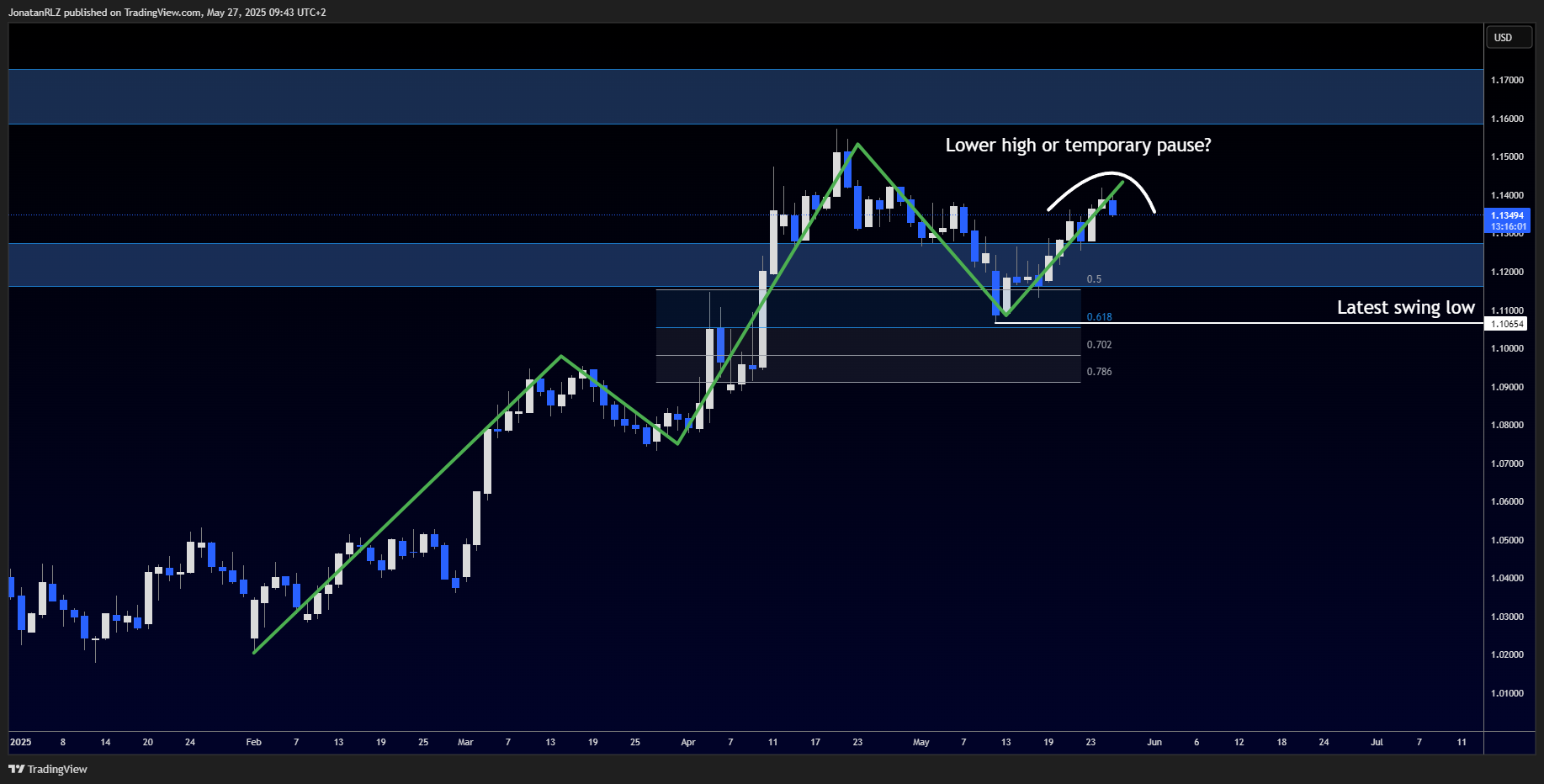

Following weaker than expected French CPI data, EUR/USD faced renewed downside pressure, even as the broader primary trend remains bullish. The daily structure still suggests a sequence of higher highs and higher lows, as seen by the green ascending trend lines on the chart. However, the latest rejection near the previous swing high introduces the possibility of a lower high forming.

If the move continues and EUR/USD breaks below the recent swing low around 1.1065, this would mark a significant shift in structure. Such a move could potentially invalidate the primary uptrend and open the door for a deeper retracement.

On the 4-hour chart, we are now seeing early signs of weakness. The previous swing low in the local trend has broken and momentum appears to be slowing. That said, price is currently approaching a key confluence zone. This includes the rising trendline, the 0.618 Fibonacci retracement, and both the 20 and 50 EMAs on the 4-hour timeframe.

This area, marked by a white circle on the chart, will be crucial in determining the next direction. A bounce from this zone would support the idea that the trend remains intact. However, a clean breakdown below would increase the likelihood of further downside and possibly confirm a shift in the broader market structure.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.