In our previous EUR/USD analysis, we highlighted that the pair was retesting its breakout zone around 1.1800. That retest is now under significantly more pressure.

The FOMC minutes from the January meeting revealed a divided Fed, with several officials openly discussing potential rate hikes if inflation stays above target. The dollar surged in response, with the DXY hitting a one-week high near 97.70.

Adding to the pressure on the euro, reports suggest ECB President Lagarde may step down before her term ends in 2027, though nothing has been confirmed.

Today’s calendar brings US jobless claims, Q4 GDP, and multiple Fed speakers, all of which could add further direction.

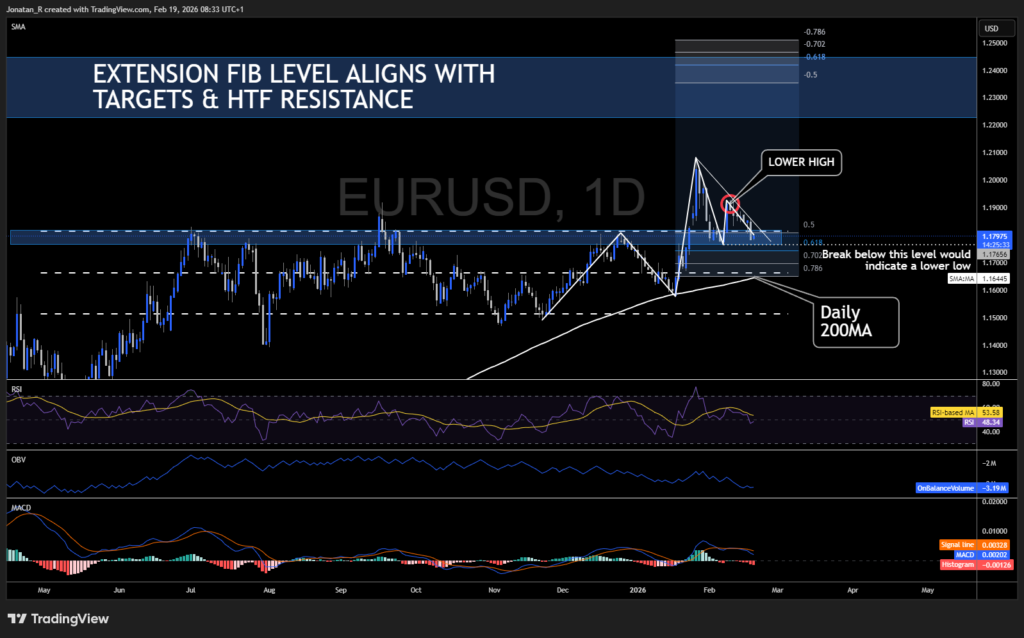

Daily chart

EUR/USD is trading around 1.17950 at the time of writing this article, right on the 1.1800 breakout zone that capped price for most of 2025. The breakout in late January pushed price close to 1.2100, and the local bullish structure is still technically intact.

However, price has now printed a lower high. A break below 1.1770 would create a daily lower low, breaking the local bull structure and putting price back inside the previous range.

The indicators are leaning bearish:

- RSI at 48.07, below the 50 midline, potentially enter its bearish range

- OBV still declining through this whole range and breakout showing bull participation fading throughout this move

- MACD crossed bearish with clear downside pressure

That said, support is support until proven otherwise. Price is still holding the breakout zone and a lower low hasn’t been confirmed yet.

If this level does break, the daily 200 SMA at 1.16445 lines up with the range equilibrium below, creating strong confluence as the potential next major area of interest.

4-hour chart

Zooming into the 4-hour, price is testing the 200 SMA and sitting within a solid support zone between the 50% and 0.618 Fibonacci retracement levels of the breakout move.

RSI has shifted clearly bearish and is approaching oversold territory. This is where bulls would want to see a bullish divergence form, with RSI printing higher lows while price ranges or makes lower lows, signalling that selling pressure could be fading.

OBV confirms the move lower, with buying participation declining alongside price. A breakout on OBV while price holds this support zone could offer an early clue on directional probabilities.

For now, this is a wait-and-watch area. The confluence of the Fibonacci levels and the 4-hour 200 SMA makes it significant, but the indicators haven’t given a reason to turn bullish yet.

Trade Now

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.