EUR/USD is back in the spotlight as the pair retests a major technical level while the trade backdrop between the US and Europe remains tense. The EU-US trade deal struck last summer is still frozen after European lawmakers suspended ratification in response to Trump’s Greenland-related tariff threats in January, which saw the president threaten 10% duties on eight European countries with a June 1 escalation to 25% if no deal is reached. At the Munich security conference over the weekend, ECB President Lagarde stressed that Europe must build resilience “even when it is temporarily more expensive,” and announced that EUR repo lines would become a permanent part of the ECB toolkit from the third quarter of 2026. On the US side, benign January CPI data has reinforced Fed rate cut expectations, with a June move now priced at roughly 69 percent.

Daily chart Technical Analysis

EUR/USD is sitting around 1.1865 at the time of writing. The pair broke above its long-term range resistance around 1.1800 in late January and is now retesting that former resistance as potential support. The 50% Fibonacci retracement lines up with this same zone, adding confluence, while the daily 200 SMA climbing at 1.1635 keeps the broader trend bullish. US markets are closed today for Presidents’ Day and China is out through 23 February for Lunar New Year, so volume could be thinner than usual.

The initial retest of 1.1800 produced a strong bullish reaction, something we covered in our previous EUR/USD analysis. But the follow-through looks questionable. The MACD histogram barely responded on the bounce, OBV showed no structural break higher, and no meaningful buying interest stepped in. RSI is still holding above 50, which keeps the bullish structure intact for now, but a break below that level could signal momentum is turning bearish instead of just cooling off.

If 1.1800 fails, the next possible support sits around 1.1635 where the daily 200 SMA aligns with the range equilibrium (middle of the range). On the upside, Fibonacci extensions sit around 1.2100 to 1.2200, a zone that aligns with where several major banks have been forecasting EUR/USD this year and coincides with high time frame resistance. For now, the retest is happening and the indicators suggest patience until stronger confirmation arrives.

4H chart Technical Analysis

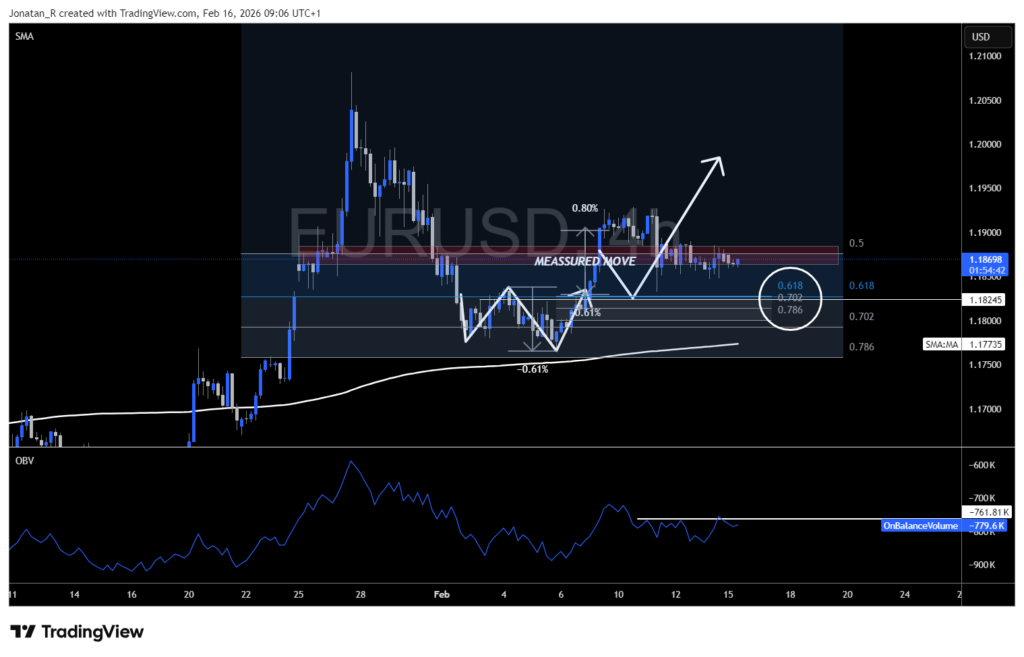

Zooming into the 4-hour, the moves we discussed in our previous analysis have played out. The W pattern that formed during the initial retest has completed, and price is now pulling back toward the neckline of that pattern around 1.1830. This is a level worth paying close attention to because it could tell us who is potentially taking control from here.

What stands out about this zone is how much confluence there is here. The 0.618 Fibonacci retracement on the higher time frame lines up almost perfectly with the 0.618 on the lower time frame, and both land right on the W neckline. That kind of confluence between chart patterns, price levels, and Fibonacci levels adds weight to the area as potential support.

Looking at the OBV, volume did turn bullish on the bounce that built the W bottom, which was a good sign at the time. Since then though, OBV has been fading alongside price as it drifts back toward the neckline. The level to watch on OBV is the white horizontal level marked on the chart. If we can break above that, it could point to fresh buying interest and a potential push back toward 1.1900. If the neckline gives way instead and OBV keeps sliding, the focus shifts back to the daily support levels we covered earlier.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.