- Gold rises above 2930 towards 2956

- US CPI cooled to 2.8% from 3%

- Trade war and recession fears drive safe haven demand

- Gold Bitcoin cross appears to have peaked

- Where next for Gold prices?

Gold is rising for a third straight day, bringing its all-time high back into focus. XAU/USD has risen above 2930 as it positions itself to test 2956, the record high established in February, and fresh record levels.

Uncertainty over Trump trade tariffs and rising US recession worries are strengthening safe-haven demand. Cooler-than-expected US inflation data yesterday also support the precious metal by lifting Federal Reserve rate cut expectations.

Yesterday, U.S. data showed that inflation rose by less than expected last month to 2.8%, down from 3% in January. Underlying inflation was also cooler than expected at 3.1%. The data gives the Federal Reserve some flexibility around cutting interest rates. The market is pricing in three rate cuts to see it by the Fed. Gold is non-yielding, so it performs better in a low-interest-rate environment.

However, it’s worth noting that the inflation data is likely a temporary improvement, given the backdrop of progressive trade tariffs on imports, which will likely add inflationary pressures within the US economy.

At the beginning of the month, Trump triggered a trade war by raising tariffs on goods from China to 20% and imposing a 25% duty on Canadian and Mexican imports in ports. This was then followed by a slew of delays and exemptions, creating further uncertainty among businesses and households.

Forward-looking data shows that confidence has deteriorated rapidly, and US recession worries are rising, sparking a sell-off in US stocks and the USD as investors seek refuge elsewhere. Safe-haven Gold, along with the Japanese yen, has benefited from safe-haven flows and the weaker USD.

Today, attention will turn to US PPI inflation and jobless claims data for further clues over the outlook for inflation and Federal Reserve rate cuts.

Gold vs Bitcoin

While Gold could be on track to test its record high, Bitcoin continues to struggle below the key 100k psychological level, which is around 82k at the time of writing.

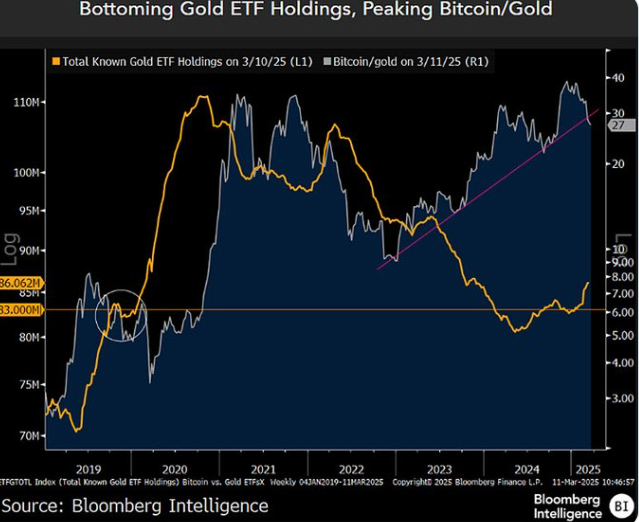

The Gold Bitcoin cross may have peaked and appears to be testing a trendline support dating back to 2022.

At the same time, Gold ETF inflows, seen as the yellow curve on the chart, have started to rise after a long-term decline since 2022. This could suggest that sentiment is turning away from Bitcoin in favour of gold, a store of value, and away from riskier assets.

Where next for Gold prices?

After a period of consolidation above 2880, XAU/USD is climbing towards 2956, its record high established in February. A rise above here could boost momentum, which has shown signs of fading amid a bearish divergence in the RSI, bringing 3000 into focus. Immediate support is seen at 2880. A break below here and 2850 could see sellers extend losses towards 2790.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.