With the FOMC decision looming today, gold remains a critical market to watch as traders assess how U.S. interest rate policy may impact inflation hedges and safe-haven assets. Gold has historically been highly sensitive to central bank policy shifts, and today’s announcement could drive significant volatility.

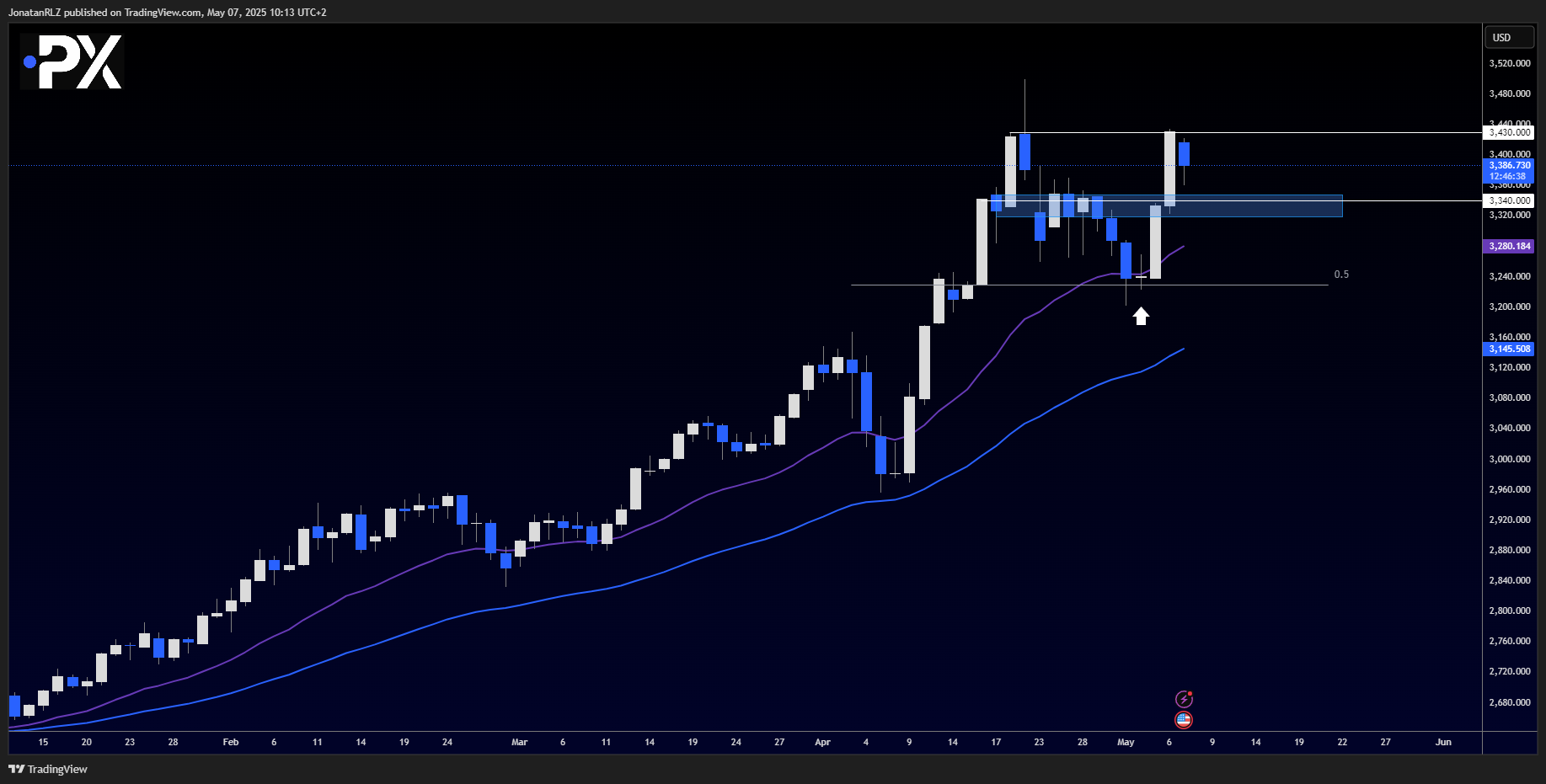

From a technical perspective, gold continues to maintain a very strong high time frame uptrend, consistently printing higher highs and higher lows. After a recent move to the downside, gold found support around the 50% Fibonacci retracement of the latest bullish leg, which also coincided with the daily 20 EMA. At that support level, the market printed a doji-type daily candle, a classic signal of indecision. This is a textbook example of when indecision candles are particularly meaningful — at extreme points or on high time frame support and resistance zones.

Following that indecision candle, the last two daily sessions have shown strong bullish momentum, propelling gold back above the local resistance level at 3,340. On the high time frame, gold is now approaching its final resistance levels. If today’s FOMC decision results in bullish volatility for gold, there is a strong likelihood that the metal could continue its upward journey into price discovery.

To the downside, the area between 3,320 and 3,350 now acts as high time frame support. If the local high around 3,430 is breached, it would likely confirm further upside potential, continuing gold’s powerful uptrend.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.