Starting with the daily timeframe, gold remains in a confirmed bullish primary trend. This is visualised by the blue trendlines on the chart, which continue to guide the larger market structure. Alongside the primary trend, we have also seen a secondary bearish trend, shown in red, with its upper boundary marked as number 1.

That secondary bearish trend has now been broken, and gold has shifted back into a bullish local trend, marked with number 3. This signals a realignment with the larger bullish structure, and sets the foundation for the lower time frames to be evaluated through a bullish lens.

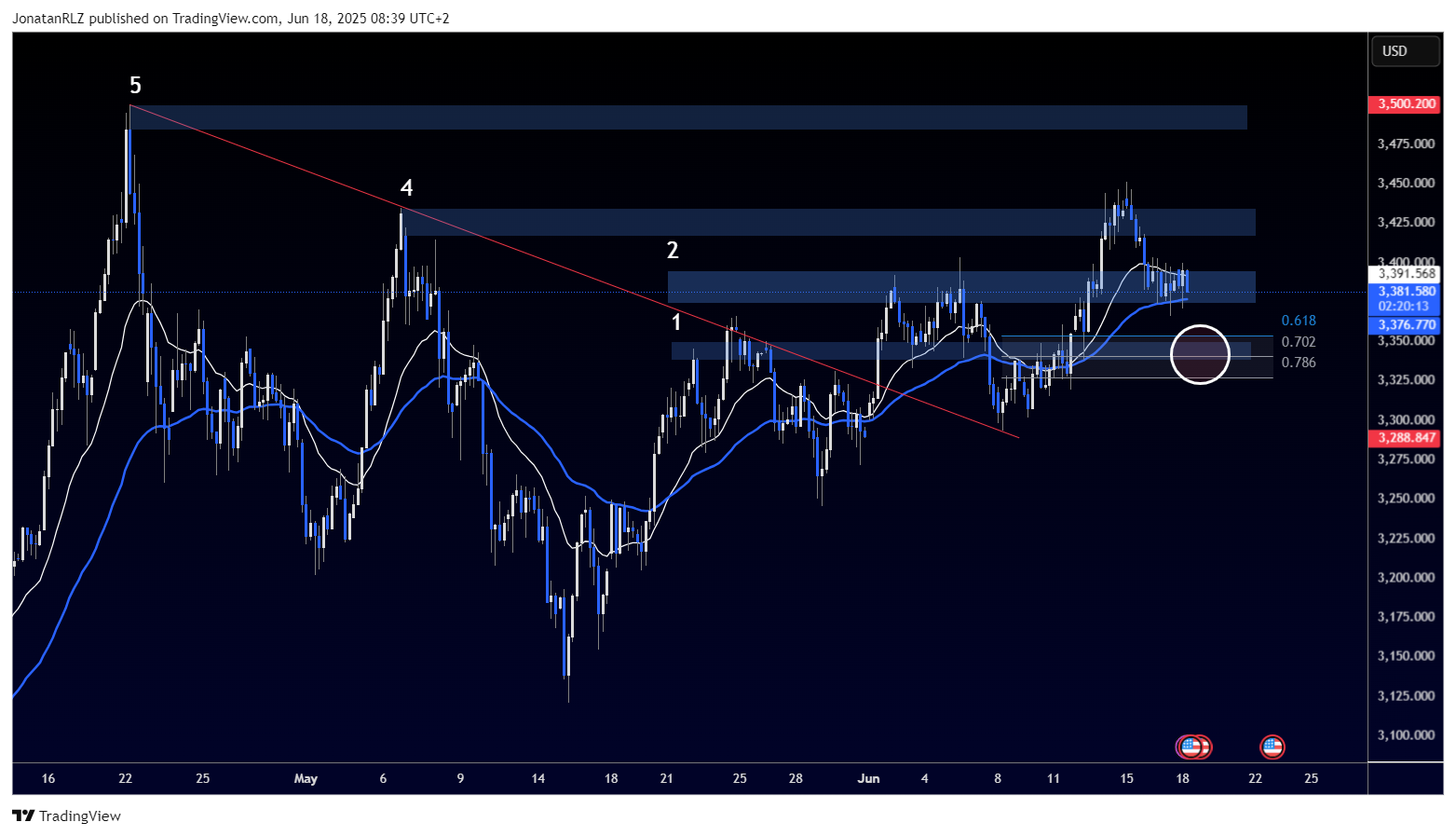

On the 4-hour timeframe, gold maintains a constructive structure, with higher highs and higher lows continuing to form. At the time of writing, price is testing a key support zone around 3,390, marked with number 2. This area also aligns with both the 4-hour 20 and 50 exponential moving averages, providing short-term confluence.

Just below, a more critical support zone is found at 3,350, marked with number 1. This level coincides with the local long reload zone and would likely be a strong area of interest for bulls to step in if price fails to hold the current support. A break below this zone, however, could begin to shift the structure and bring the bullish scenario into question.

To the upside, the first trouble area stands around 3,430, marked as number 4. If bulls can hold current support and regain momentum, this would be the next resistance to watch. A break above that level sets the stage for a possible move to the final resistance zone at 3,500, marked as number 5, which coincides with the all-time highs.

Gold remains in a favourable position structurally, but price action over the coming sessions will depend on whether buyers can continue to defend support and reclaim short-term upside targets. A loss of the 3,350 level would shift the outlook and raise the possibility of a deeper retracement or structural shift.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.