Welcome to today’s daily technical update on Gold.

What a market we’re in—Gold continues to rally with force, showing relentless bullish momentum. With breakouts stacked on top of breakouts, we’re frequently readjusting key levels to stay aligned with the latest price structure.

In today’s update, we revisit the intraday structure based on last week’s levels and the recent breakout activity. Our last update was on Thursday, following the major breakout on Wednesday, where we noted a potential short-term top pattern forming.

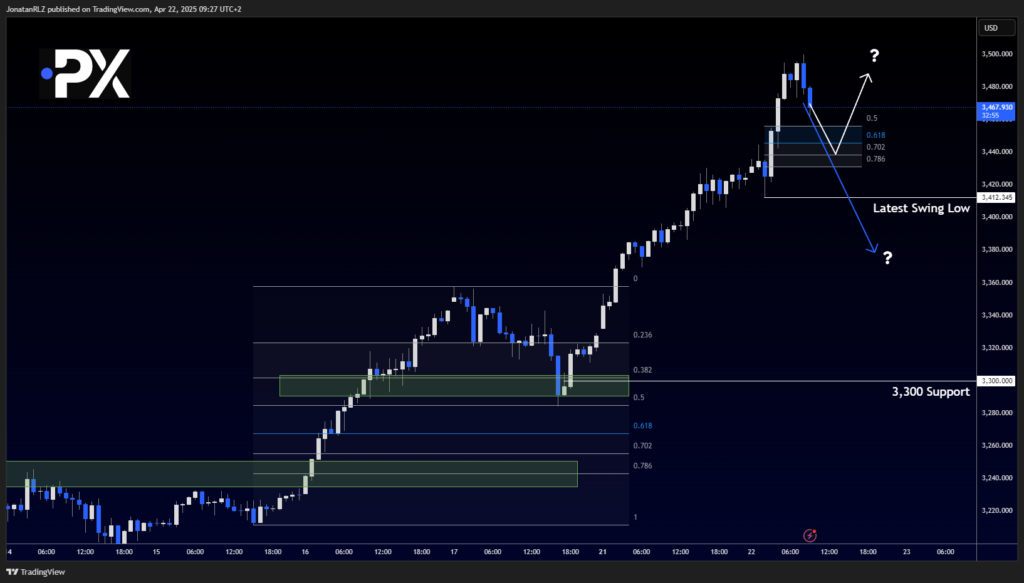

In that update, we identified the $3,300 area as an important short-term support. That level was respected and held prior to Monday’s breakout, which pushed price significantly higher once again.

We’re now seeing new short-term structure forming, and price is aligning well with local Fibonacci retracement levels. Two areas of interest stand out for today:

- $3,445 , which aligns with the 0.618 retracement level of the most recent local up move

- $3,412 , the most recent swing low

If $3,445 holds, it could support another wave of bullish continuation. But if $3,412 breaks, it might signal the start of another short-term top formation—something we’ve seen develop during previous rally phases.

These are the key levels to monitor throughout today and the rest of the week. With volatility running high, it’s crucial to stay alert, respect risk, and avoid emotional decision-making in a market that is trending aggressively.

As always, proper risk management and capital preservation should remain the top priority—especially in an environment where gold is pushing into parabolic territory.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.