The UK100 has surged to fresh all-time highs above 10,550, extending its record-breaking run as the macro backdrop grows increasingly complex.

This morning’s UK inflation data painted a mixed picture:

- Headline CPI fell sharply to 3.0% in January, down from 3.4% in December

- Core CPI edged lower to 3.1%, with core goods cooling notably to 1.6%

- But services inflation barely budged at 4.4%, down from 4.5%, a metric the BoE watches closely as a gauge of domestic price pressures

The headline drop supports the case for a rate cut, but sticky services could complicate the timeline. The Bank of England’s Monetary Policy Committee (MPC) already voted 5-4 to hold at 3.75% in February, and unemployment has climbed to 5.2% with wage growth at multi-year lows.

Let’s dive into the technical analysis to check the key levels to watch today.

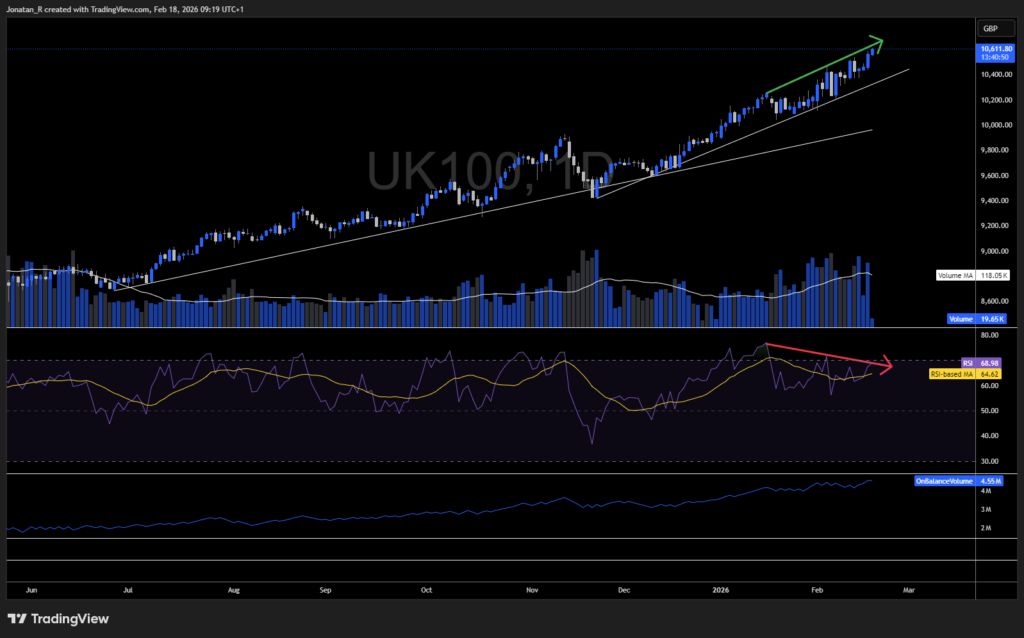

Bulls in control, but RSI flashes warning

On the daily chart, the UK100 is in a clear uptrend, printing higher highs and higher lows with an accelerating trend visible through the steepening trendlines.

The bullish case is well supported:

- Volume is rising alongside the breakout, with recent sessions well above the moving average

- OBV continues to trend higher, confirming participation behind the move

- Trendlines are getting steeper, showing increased momentum

But there’s a warning sign. The RSI is forming a potential bearish divergence, making lower highs while price pushes to new records (see the red arrow on the chart).

This doesn’t guarantee a correction, divergences can persist for weeks in strong trends, but it’s worth watching. A break of structure in price or confirmation from other indicators would be the first signs that the divergence could potentially be playing out.

4-hour chart: breakout into Fibonacci extensions

The UK100 continues to show accelerating momentum on the 4-hour, with trendlines getting progressively steeper. Price has broken above the previous all-time high at 10,535 and is now approaching the -0.382 Fibonacci extension at 10,623.

If that level breaks, the next resistance sits at the -0.618 extension at 10,673.

The indicators support the move:

- OBV is pushing into new highs alongside price, confirming the breakout has volume behind it

- RSI is overbought , which aligns with the daily divergence and suggests the move could need a breather while at the same time confirming strong momentum

On a deep pullback, the 0.5 and 0.618 Fibonacci retracement levels around 10,440-10,430 are the key support zone to watch.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.