There is general uncertainty around the global markets this week as the continued threat of an ebbing and flowing Covid pandemic plays its part, as well as a major collapse in China. China’s second-largest property developer, Evergrande, is in major trouble and this is sparking larger fears for the Chinese economy.

This global uncertainty has not really had an impact on Bitcoin and other cryptocurrencies, as these digital assets once again show their potential to be a hedge against global geopolitical concerns. That being said, there has not been much price action upwards for Bitcoin, and altcoins have suffered more so.

It is primarily stocks indices across the world that have had a lousy week, caused in part by the threat of rising COVID cases, as well as fears of contagion effects from the default of Evergrande.

Evergrande has warned its debt holders that it may fail to repay obligations to $300 billion worth of loans and on Tuesday, also warned that it is at risk of a cross-default, which means such risks could spill into other related sectors like banks, suppliers, property buyers, and investors. This has resulted in an 85% fall in its share price ever since problems started surfacing in March this year, dragging down the already embattled China and Hong Kong stock indices.

There are several reasons why Evergrande’s problems are serious. Firstly, many people bought property from Evergrande even before building work began. They have paid deposits and could potentially lose that money if it goes bust. There are also the companies that do business with Evergrande. Firms including construction and design firms and materials suppliers are at risk of incurring major losses, which could force them into bankruptcy. The third is the potential impact on China’s financial system.

The fear has spread overseas as even in the USA, the 10-year Treasury bond yield had spiked to 1.37% by the close of Friday as investors rushed for safety in USD. As a result, the DXY rose 1% and is now at 93.20. While China is having two-days of public holiday due to the mooncake festival, China stocks trading in Hong Kong has opened the new week down more than 3% today, dragging the Hang Seng Index down by the same magnitude.

With trouble brewing in China, Gold and Silver sold off sharply as investors are starting to worry that the Chinese may have to dump their Gold stash to make up for financial losses, Gold has been down 2.8% since last week at $1,740 while Silver has fallen 10% and is flirting with $22 as worries mount over the demand for Silver with the largest world economies manifesting proof that their economies are fast slowing down.

For last week, the Dow slipped around 0.1% for its third straight week of declines. The S&P 500 fell nearly 0.6% for its second straight week of losses. The Nasdaq Composite dropped almost 0.5%. This week is expected to be worse due to worries about the China Evergrande contagion, as well as temper tantrums starting to hit Wall Street.

The FED meets the middle of this week and on Wednesday is expected to give further clues as to when it may start to slow its $120 billion a month bond purchases that have supported the recovery since COVID. Fed Chief Jerome Powell has said the tapering could occur by the end of this year and investors will be scrutinizing his speech for clues. Many investors fear a fall in the stock market and asset prices as the FED begins to take away its easy policies. Hence, this FED meeting will be very keenly watched.

The only asset that seems unaffected by the potential China crunch is Bitcoin. This could be due to investors looking to BTC as a safe haven away from the financial mess in the highly leveraged traditional markets. However, the altcoins continued to be under slight pressure as retail investors remained side-lined. BTC, with its unique qualities of being a reliable and borderless store of value perhaps served as the best avenue for investors to safeguard their wealth. However, should risk-off sentiment start taking its toll, BTC may not be spared from some negative price impact as well in the short-term, which could be a great buying opportunity.

SALT Conference Helps Put A Bid Under BTC

Crypto was a lot more subdued last week compared with the week before. Early week saw the SALT conference take place, with pro-crypto financial market experts like Cathie Woods and Sam Bankman-Fried taking the stage to promote crypto as an investment to finance and business professionals. This event perhaps managed to put in a bid for BTC in a very quiet week as traders consolidated their positions after the bloodbath last week in preparation for what the FED will say in its policy meeting this Wednesday.

Billionaire investor Ray Dalio, who founded the world’s largest hedge fund, Bridgewater Associates, told attendees at the SALT conference in New York on Wednesday, “I have more crypto than gold.”

However, the week was not without controversy as a fake press release by Walmart managed to cause a massive pump and dump in the crypto market. On Monday morning, Litecoin Foundation posted news that announced Walmart would be accepting LTC as payment, which caused a 30% pump in the price of LTC, and also caused a spike in BTC price. However, within 30 minutes, the news was denied by Walmart and prices came tumbling immediately, with LTC and BTC losing all of its gains, with LTC dropping back to $170 within minutes after spiking to $235.

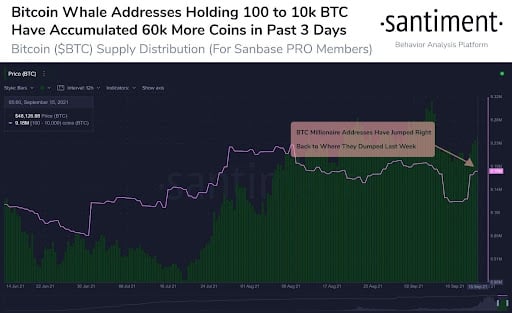

BTC managed to stage a small recovery above $48,000 after falling to a low of $43,500 as dip buyers slowly started buying. One such group of buyers are BTC whales holding 100 to 10,000 BTC, who are reaccumulating after having sold their BTC at above $50,000.

Whales Who Sold BTC Have Reaccumulated

BTC whales holding between 100 to 10,000 BTC dumped around 70,000 BTC between Sep 6 to Sept 9, which saw the price of BTC drop 14%. However, they have since reaccumulated 60,000 BTC to get back to almost the same number of BTC they had before.

From the coin movement of whales, it appears as though they are simply trading their BTC for small gains, rather than an outright sale of their BTC stash. They very quickly repurchase their BTC whenever there is a small dip in the price.

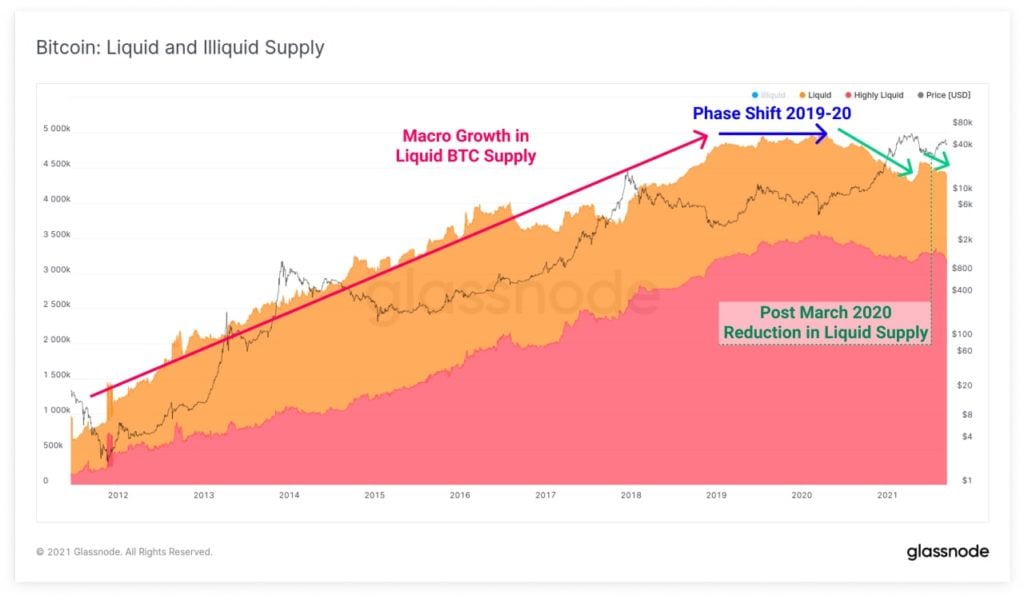

On a long-term structural basis, the supply of BTC has resumed on a declining trend ever since the March 2020 crash. While having gone up in May this year, that supply has reverted to a declining trend, suggesting that reaccumulating is back.

MicroStrategy Adds More BTC

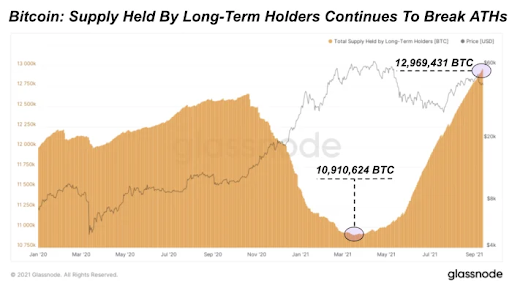

One long-term holder that is constantly accumulating is MicroStrategy, which has taken the dip last week to purchase another 5,050 BTC, spending another $242.9 million on it. This brings the total number of BTC held by MicroStrategy to 114,042 units acquired at an average price of $27,713 per coin.

“Bitcoin is going to subsume the entire gold market cap,” CEO of MicroStrategy told CNBC earlier this year. “Once it gets to $10 trillion, its volatility will be dramatically less. As it marches towards $100 trillion, you’re going to see the growth rates fall, the volatility fall, and it’s going to be a stabilizing influence on the entire financial system of the 21st century.”

With MicroStrategy and other corporates and institutions leading the way, the total number of BTC held by long-term whales continues to increase at a rapid pace, consistently making new ATHs.

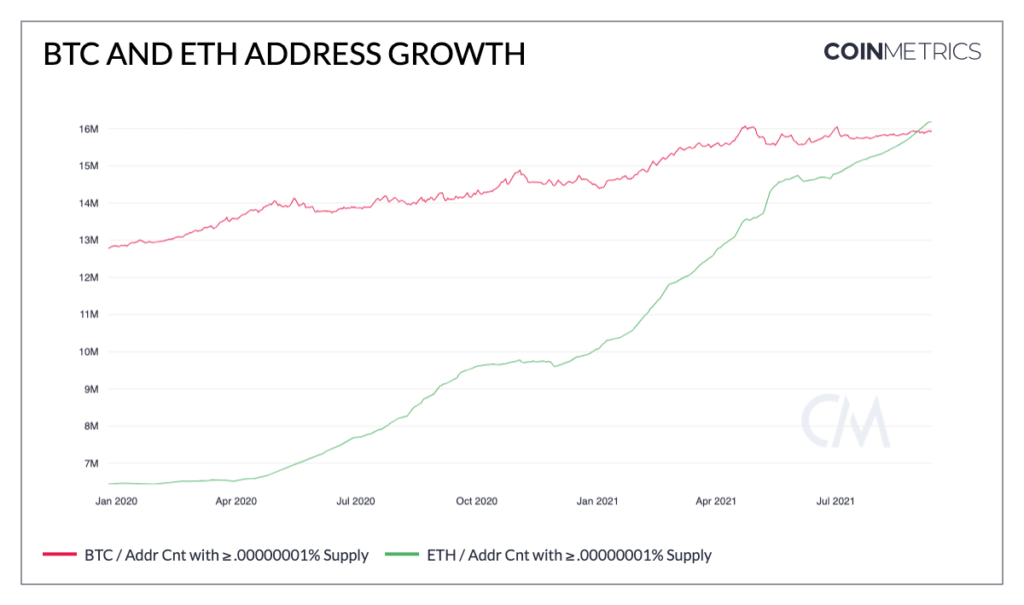

ETH Adoption Strongest As New Address Growth Leads

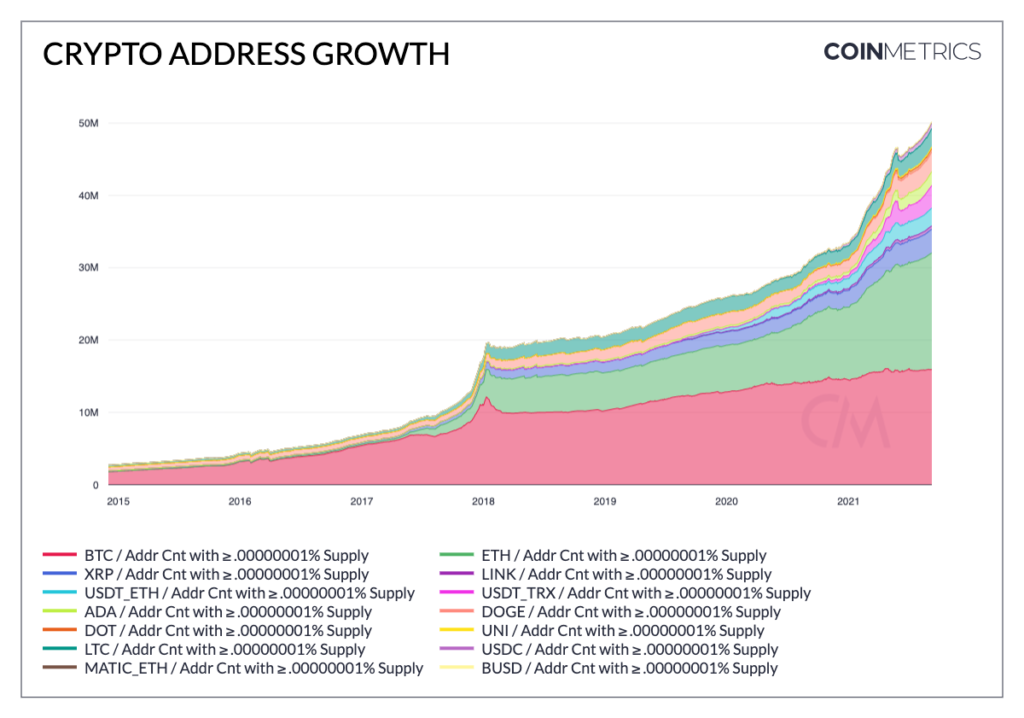

ETH addresses have been growing a lot stronger than BTC addresses since this year, and unsurprisingly, the number of ETH addresses has surpassed that of BTC effective this month, growing to around 16.5 million addresses. BTC isn’t that far behind, however, with around 16 million addresses.

However, the pace that ETH addresses are increasing is worth noting, as it is also the fastest-growing blockchain address amongst all, with XRP following at a distant second, and DOGE being third.

ETH 2.0 Staking Continues Steady Increase

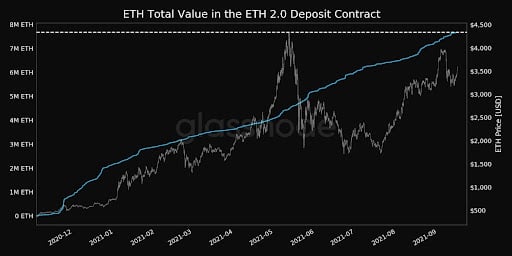

Total Value in the ETH 2.0 Deposit Contract continues to increase at the same pace regardless of what happens in the market, and has just reached an ATH of 7,674,370 ETH. This bodes well for the price of ETH long-term as ETH 2.0 validators will not be able to withdraw from the contract for at least the next one year to sell. This also shows that there is a growing number of long-term holders for ETH.

While consolidation continues to be the name of the game, some noteworthy news on individual projects still managed to help the price of their respective tokens. One such token last week was Avalanche (AVAX), which saw its token rise 20% after it received a $230 million investment led by Polychain Capital and Three Arrows Capital.

Even though there are signs of life within the crypto space, activity remains sporadic as traders are very quick to take profits, unlike the boom in August where rallies could be sustained. One reason could be that traders are afraid to take committed positions ahead of the FED meeting this Wednesday, which could greatly influence the direction of the market depending on the central bank’s narrative with regards to tapering. Tapering would be positive for the USD and negative for crypto in general.

While the FED meeting remains the key event for the week, traders may also want to take note of options expiry this Friday, which may also increase volatility in the markets. Around $4 billion worth of BTC and ETH options will be expiring this Friday.

Also, developments around the Evergrande situation should be keenly followed in case the contagion spreads to other markets outside of China. The size of the default is as big as Lehman’s in 2008, which is why financial market experts are calling this China’s Lehman moment. If the situation goes out of control and the China government decides to not bail them out, the repercussions would be felt mostly in banks as well as other real estate exposed companies throughout the world.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.