There has not been too much activity in the cryptocurrency market as the major coins continue to trade mostly sideways. Even news cycles around the cryptocurrency space have failed to spark any sort of upwards or downwards volatility.

In El Salvador, a huge step was taken in the growth and adoption of Bitcoin as the government confirmed that the digital asset now falls under the protection and recognition of being legal tender.

This represents a first for a recognised government and is a major step for the cryptocurrency, but it was still not enough to see the markets budge much.

Meanwhile, stocks had a positive week, with the S&P 500 posting a 0.4% gain, marking its third consecutive positive week to close at yet another ATH. The Nasdaq however, was the outperformer with a rally of nearly 1.9% and posting its fourth winning week in a row. The Dow was the only index faring worse, closing down 0.8% on the week.

The FED’s recent narrative seems to have worked as the markets shrugged off Thursday’s higher-than-expected inflation data as transitory. The CPI jumped 5% in May from a year earlier, rising at its fastest pace since 2008. Despite that number, markets remained calm as the bond market didn’t react badly to the CPI report. The 10-year Treasury yield slid in fact, falling to a three-month low of 1.43%. It was trading above 1.77% earlier in the year.

The USD remained quiet as a result, not moving on the CPI news, with traders not making big bets ahead of the FED meeting this Wednesday. That said, there appears to be some USD repositioning ahead of the FED meeting as the DXY opens the week a tad higher around 90.50.

Last week, the European Council met over in Europe, with the ECB President also sending the message that inflation in Europe is transitory. While the ECB upgraded their inflation and growth projections for 2021 and 2022, it also remained cautious as the lack of improvement in the labour market could threaten any benefit derived from countries re-opening. The EURO thus traded lower against all other currencies, with the EURUSD back down to $1.21 from a high of $1.22 earlier in the week.

Gold and Silver didn’t manage to build on the momentum gained the week before, with Gold falling back below $1,900 and Silver retracing back below $28.00. Despite its slight drop, Silver price still seems rather well supported as talks of a silver shortage in the physical market continues to bring in buyers taking long positions in the hope of a silver-squeeze. Silver is opening the new week at around $27.80, while Gold seems weaker, trading at around $1,865.

Oil continues on its upward trajectory, with price further boosted by the US inflation number since inflation naturally drives up the price of Oil. Crude starts the week closing in on $71.00.

The markets continue to see a strange phenomenon where stocks are more inversely correlated with USD policies, when traditionally, assets like Gold, Silver and cryptocurrencies ought to be the ones inversely correlated to the USD. This has driven newer investor money into the stock market and made traders flock to stock index and option trading since these are apparently the easier trades to do at the moment.

With traders back to trading traditional assets, the cryptocurrency market continues in its zombie state, with neither positive nor negative news being able to generate much volatility in the crypto-verse. Some traders have made the observation that BTC is closing in on a “death cross” on the charts, with the 50-day MA almost ready to cut the 200-day MA from above. However, some chartists also think that this movement could be taken as a contrarian buy-signal for long-term investors as historically, BTC has had a track record of rebounding within 3 months after such a bearish crossover.

False Scare Sent BTC Price Retesting Lows

The first trading day of last week came with a scare, as the US Justice Department and the FBI announced the “recovery” of 63.70 BTC from the funds Colonial Pipeline paid to hackers as ransom. The ambiguous way the report was written led to the crypto market worrying over a suspected “hack” of the BTC network by inexperienced new traders and investors who once again panic sold their coins, leading to yet another selloff in the market. Despite the dip, BTC still managed to remain above $30,000 and didn’t incur more damage. It was later revealed that the law enforcement merely got hold of an old computer which stored the private keys of the hacker’s BTC wallet and seized the BTC in there, as opposed to the FUD about the FBI having successfully hacked the BTC network.

El Salvador First Nation to Make BTC Legal Tender

Several positive news sources have provided some support to the crypto market, especially news about BTC being made legal tender in El Salvador. In a landmark move, El Salvador declared BTC as legal tender as the first country in the world to officially recognise BTC as money. All merchants in the country are decreed to accept BTC as payment and prices can be quoted in BTC terms. The El Salvador President says this move is necessary to protect against the declining value of fiat currencies and that the country is actively pursuing the use of geothermal energy stored in volcanos to mine BTC. The development bank overseeing the BTC adoption will first buy $150 million worth of BTC to facilitate transactions, with the aim of buying more in the future. The country also does not rule out keeping BTC as part of their country’s reserve.

Following this news, other countries like Panama, Paraguay, Mexico, Brazil, and other nations in Latin America have also announced that they are in the planning stages of making BTC legal tender in their own countries.

While this news is significant for the adoption of BTC, the most positive aspect of it from a price point is that it greatly reduces the need for anyone to sell their BTC for fiat in order to make real life transactions. This means that as more countries allow payments to be made directly in BTC, the selling pressure on BTC is gradually removed. Demand may even increase because more people will like to keep their wealth in BTC since it can be spent directly.

Meanwhile, BTC permabull, MicroStrategy, not letting this BTC price dip go to waste, has issued a junk-bond to finance more BTC purchases. The firm initially planned to offer only $400 million worth of notes, but raised the amount to $500 million after overwhelming interest by institutional investors, with them putting in about $1.6 billion in orders. This is the first of its kind BTC-backed junk-bond in the market, and the overwhelming response may encourage other companies to follow suit and in time to come, should demand continue to flourish, could give birth to a BTC-collateralized-debt secondary market.

Fear Amongst Traders Putting BTC in Backwardation

With the excessive fear in the market early week, especially after the FBI FUD, BTC funding rate started to turn negative after being in positive territory the past week, with most retail players now opening short positions.

That same fear is seen amongst institutional traders as well, with the BTC futures market now trading in backwardation as future price becomes lower than spot price, signalling that most traders think the price of BTC will continue to fall lower from its current level.

While seemingly bearish, these two metrics could also be counter-indicative, which may mean that there could be a chance of a short squeeze as the market becomes overly-pessimistic and a shorting trade becomes overcrowded.

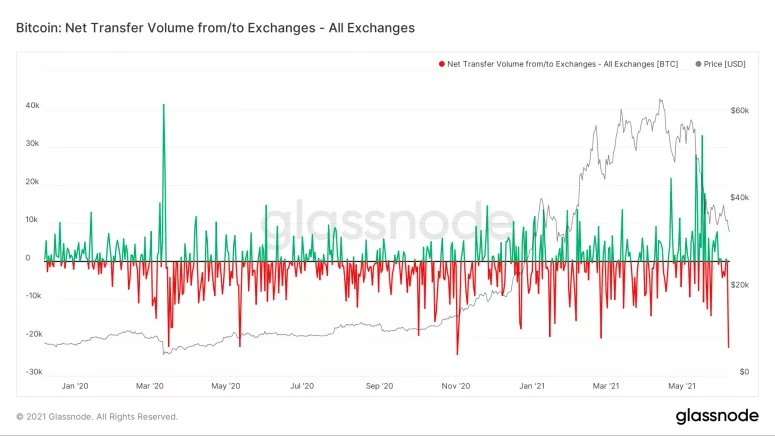

BTC Exchange Outflow Continues to Grow Despite Weak Sentiment

Another metric showing that price could bottom is in BTC exchange outflows. BTC exchanges experienced one of its largest outflows in 7 months last week. Outflow of BTC from exchanges is now at a level last seen in Nov 2020, just before the price of BTC spiked up last year.

Many of the BTC leaving exchanges may be finding their way into DeFi in the form of wrapped BTC, i.e. BTC representation which is run on ETH so that holders of BTC can use their BTC to earn yields at DeFi platforms. Long-term investors may be using this dip in price to buy BTC to put into yield-farming as data shows a doubling of the total BTC locked in smart contracts from 94,000 in April to about 174,000 as of the first week of June.

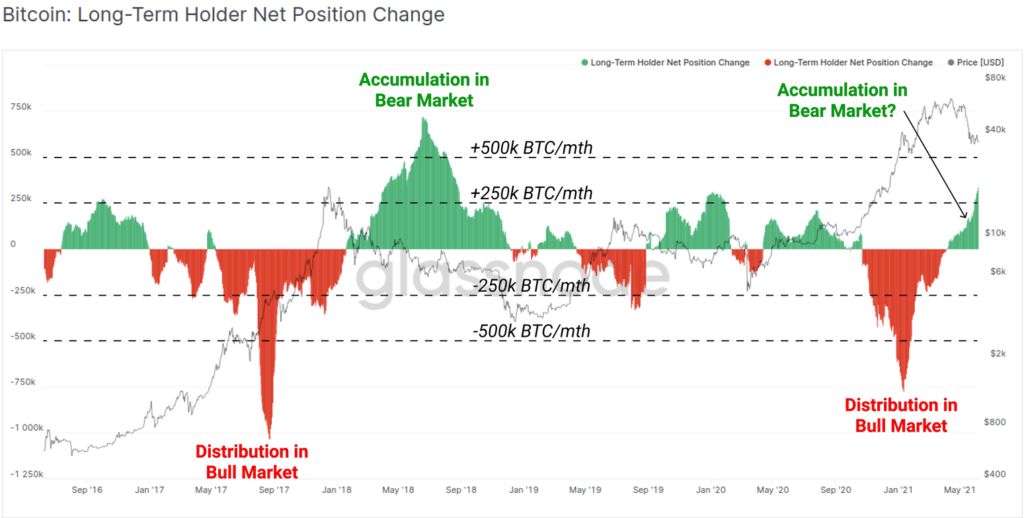

A look at Long-term holder (LTH) net position change also indicates that LTH have reverted back to accumulation mode after a bout of selling, with the change between distribution and accumulation taking place for shorter durations. This could possibly suggest that the BTC peak to trough cycle is getting shorter.

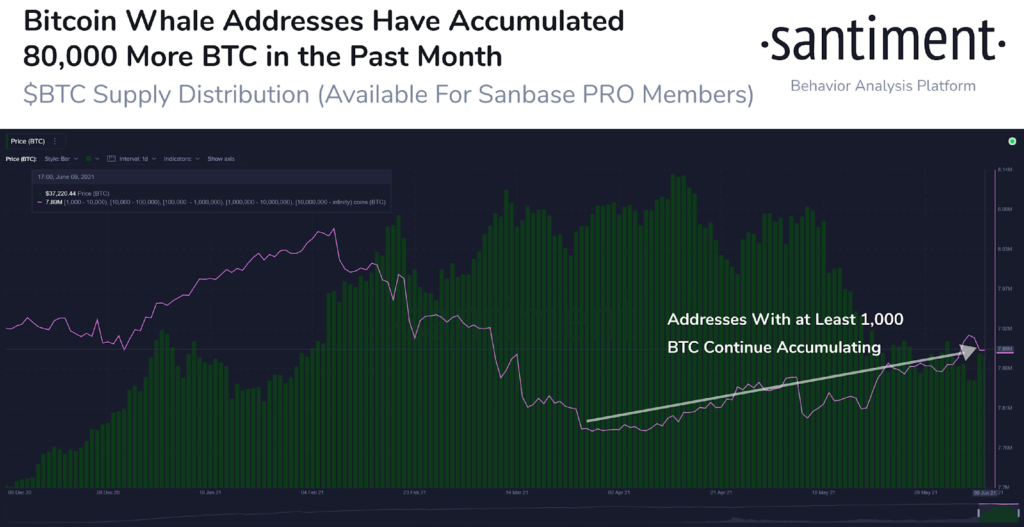

Long-term whales with more than 1,000 BTC are also back accumulating rather aggressively, adding around 80,000 BTC in less than a month. This BTC accumulation trend will likely continue with MicroStrategy on the way to buy $500 million worth and El Salvador needing to buy at least $150 million, which may lead to more whales accumulating BTC due to FOMO in time to come.

ETH Left In The Cold As Attention Shifts To BTC

With most attention centred on BTC last week, altcoins suffered from a lack of interest, with the largest altcoin ETH underperforming BTC in every way.

Active ETH address is still reeling from the selloff, not picking up despite a 90% fall in ETH gas fees, a sign that investors are not showing interest in interacting with the blockchain. This does not look particularly bullish for the price of ETH in the near-term, with a general decline in trading volume across all crypto exchanges witnessed as well.

Other altcoin movements were largely news driven, with KSM moving up 40% from $340 to $540 after KSM fixed the date for its first parachain slot auction on 15 June. This good news also led DOT higher, as the parachain slot auction for DOT is stipulated to launch after KSM completes its fifth parachain slot auction, leading investors to accumulate DOT ahead of its own parachain slot auction launch. However, both tokens didn’t manage to hold on to their gains as the general market weakness took prices of both tokens back lower.

Another development which didn’t manage to excite the market was about XRP. Ripple proposed a major upgrade for XRPL which went unnoticed by the market. To put it briefly, the CTO of Ripple revealed a plan to upgrade the XRPL to allow for a feature known as the federated sidechains, which works in a similar manner as parachains in DOT. The addition of the sidechain will enable the XRPL to support smart contracts which will put it in the league to compete with the likes of ETH in the DeFi, NFT, or CBDC issuance space. While this is significant news, the market seems to have not picked up on it, possibly due to the lawsuit with the SEC, as well as a general lack of interest in the market as crypto prices continue to look sluggish.

Other than price, trading volume on crypto exchanges have also fallen sharply compared with two months ago, with traders moving to speculate more on the stock market than in the crypto market at the moment, as can be seen with the recent resurgence of meme “reddit” stocks. Stocks have also been trading more in-tune with the inflation theme, with the FED dovishness having a more direct positive impact on stocks than on crypto as the latter continues to be plagued by rumours of more regulatory crackdown in China.

As traders remain divided over the outlook for cryptocurrencies in the near-term, a spark came from Elon Musk on Sunday afternoon when he was replying to a tweet by a media which was lashing out at him. In the tweet, Musk was seen replying that Tesla would accept BTC again when 50% of the hashing power comes from clean energy. This revelation created a rather large spike in BTC price from around $36,000 to a high of $39,900 where BTC met with fierce selling in early Asian trading hours which took its price back down to $39,000 within minutes.

Despite the fierce selling, the move was enough to let BTC carve out a positive close on the weekly chart, and more importantly, bring BTC price away from the “death cross” that was imminent had its price not jumped. Where BTC and the crypto market is headed this week depends on whether BTC manages to clear its overhead resistance zone between $40,000 and $42,000.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.