While there has not been much action in the cryptocurrency space of late, with Bitcoin sitting in a range between $32,00 and $38,000, there have been a few news events to take note of. For the promising side of things, a few more nations are looking into Bitcoin following the moves in El Salvador, but China continues to affect the price.

Looking past crypto, there has been a bit of action in the stocks as they managed to hit yet another ATH midweek, and reversed course on Thursday to start to retreat on concerns about the sustainability of global economic comeback from Covid-19.

The losses came as Japan declared a state of emergency in Tokyo for the upcoming Olympics and as countries started to deal with a rebound in Covid-19 cases from the Delta variant. The fear about Covid-19 resurgence on the US economy was further exacerbated when the Labour Department’s latest jobless claims data released on Thursday came in unexpectedly higher at 373,000, signalling a possible slowdown in the labour market.

Economists expected to see 350,000 first-time applicants for unemployment benefits for the week ended July 3 but saw 373,000 instead.

Investors rotated into the safety of Treasuries, pushing the yield on the 10-year Treasury down to 1.25%, the lowest since late February. Despite recent roaring inflation numbers, the 10-year Treasury yield continues to slide. The number started July at 1.58% and has fallen consistently throughout the month. Traders remain confused about the exact reasons for the rollover in yields, with many citing that the best of the economic recovery may be behind us.

However, by Friday, composure returned to the markets as stocks managed to rebound to close at new ATHs again. Friday’s comeback brought all three US majors indices into the green for the week.

The Dow rose 0.2% for the week, the S&P 500 and Nasdaq gained 0.4% and 0.4%, respectively. Big Tech stocks’ gains, however, were subdued in comparison after President Biden signed a new anti-competitive executive order aimed at Big Tech on Friday.

The yield on the 10-year Treasury rebounded 7 basis points to 1.36% by the end of Friday, recovering from the low of 1.25% made on Thursday.

Oil had the most volatile week in months after a quick reversal from above $76. Oil has initially advanced to almost $77 on news that OPEC+ had failed in its latest meeting to organise a supply increase from August, but fell sharply afterwards to a low of $70 as traders began fearing that nations would start over supplying oil in their own accord amid rising Covid-19 cases again.

Last year, oil prices fell below zero for the first time in history on the onset of Covid-19 and many traders still remember this vividly. However, the dip found buyers and oil managed to recoup losses to close the week around $74. It thus can be seen that a risk-on sentiment is still very much in the market despite COVID resurgence fears. Oil starts this week unchanged at $74.00.

In a special Strategy Review meeting on Thursday, the ECB announced that it has shifted to a symmetric inflation target of 2%, contrary to 2% being a ceiling as previously telegraphed. That is a dovish shift, but one that was fully expected by market participants.

The ECB stated it would allow short-term deviations from that goal, including a moderate spell above target, and stressed that interest rates remain the primary monetary policy instrument and that the next review will only be due in 2025. The EURUSD didn’t react to the announcement as traders had already sold the EURUSD a day before in anticipation of this news. The EURUSD closed the week unchanged after a 180 degree move mid-week that reversed all its early week losses.

The RBNZ and Canadian central bank both meet this coming Wednesday, while Fed Chair Powell will be due to give his semi-annual testimony to The House Financial Services Committee on Wednesday night. Traders in these currency pairs please do take note.

Activity in precious metals was tamer, with traders undecided over the direction of both Gold and Silver. While Gold finished the week unchanged at $1,800, Silver slid slightly to end at $26. Both metals are opening the new week flat, with Gold managing to stay above $1,800 and Silver still above $26.00.

Short Traders Front-Running Latest China-FUD Sent Crypto Down 10%

An interesting event occurred on Thursday which had many BTC and crypto traders fuming. At 13:30 Beijing time (UTC+8) on Thursday, the deputy governor of the Central Bank of China released a statement that called BTC and stablecoins speculative tools with potential risks that threaten financial security and social stability. He also commented that cryptocurrencies have become payment tools for money laundering and illegal economic activities and are a danger to global stability.

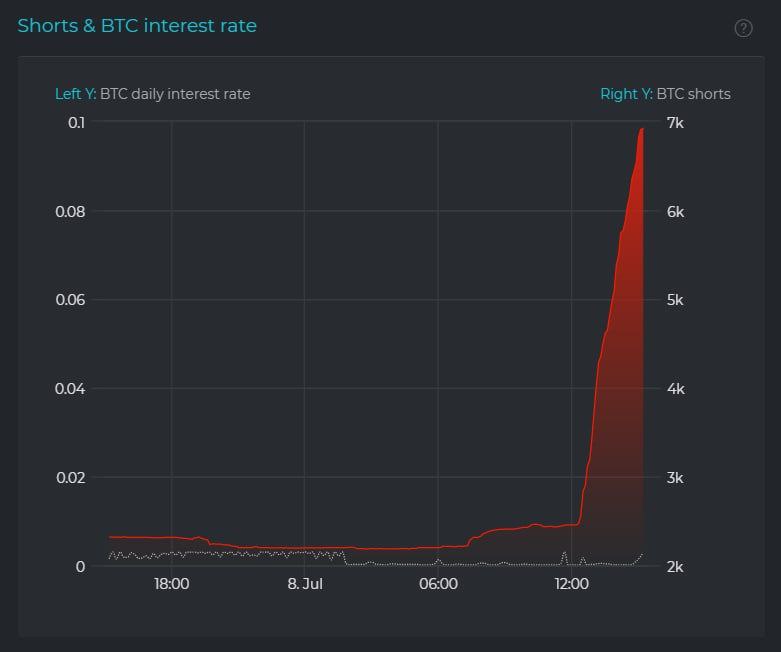

According to onchain whale watchers, between 13:00 and 15:00 Beijing time, a large trader borrowed 5,219 BTC and shorted them on a certain crypto exchange. Most of the short positions were reportedly naked shorts. The impeccable timing of the short trade and the news release has prompted many traders to suspect that the Chinese regulators were generating FUD to profit from taking short positions in the market.

However, the damage had already been done. While not an excessive amount, the selling of 5,219 BTC in a summer lull season at the lowest volume time of the day when USA was asleep and Europe has not yet awakened was enough to send BTC down 7%, dragging other cryptos down around 10% on the day.

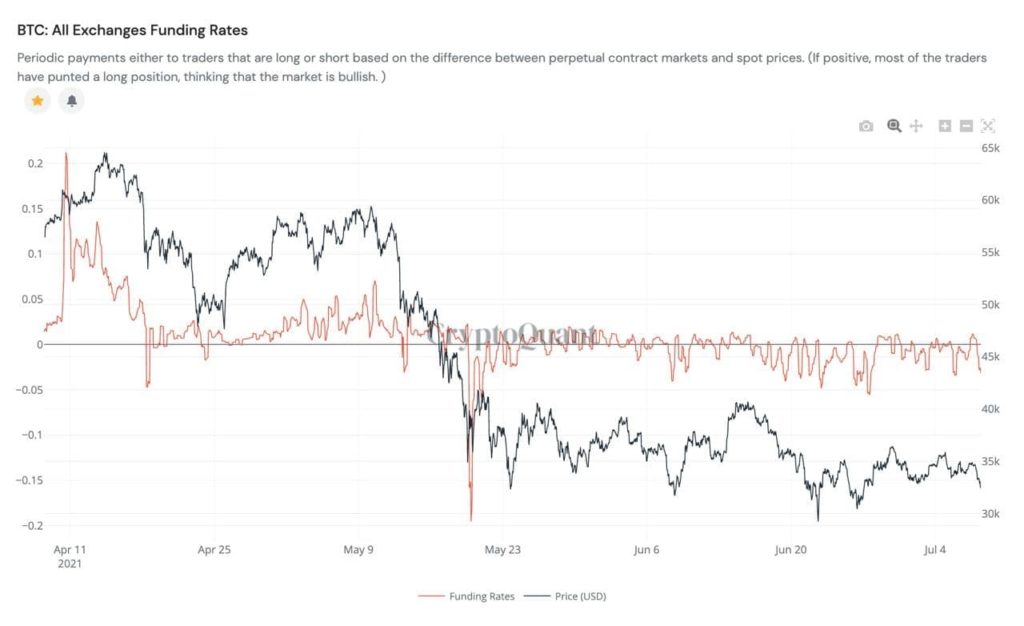

With the fall in price and a general lack of volume and interest in trading, the funding rate for BTC has gone further negative to come near levels where a rebound to clear shorts historically has occurred. It will not be surprising to see a sudden uptick in the price of BTC in the days ahead should the funding rate continue to drop.

Rapid Growth in New BTC Buyers In July

Even though short positions are on the rise, new entrants into the crypto space have also been observed. A large spike in the number of new entities have been recorded on the BTC network over the past 2 weeks as the price of BTC consolidated near $30,000, a sign that many new players are using the dip to start accumulating BTC. After plateauing at around 45,000 new users in June, the number has shot up above 50,000 in the first 2 weeks of July.

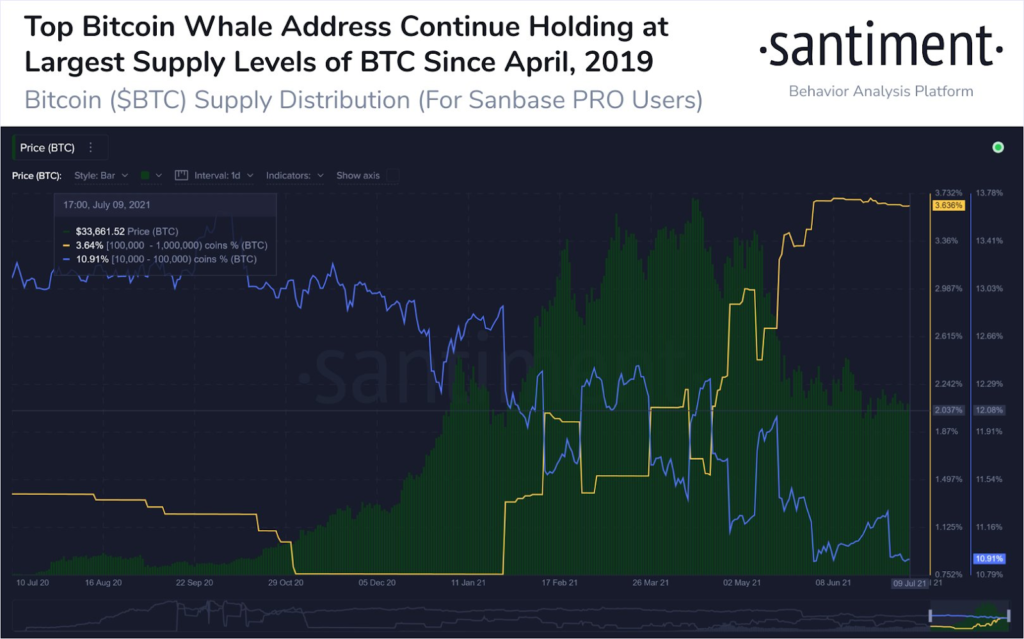

Other than new market entrants, 17 new whales were also birthed on the BTC network last week, while the old whales who have very little history of having sold BTC continues to accumulate more BTC, bringing the overall holdings of whales up by 65,429 BTC in a week in a sure sign of serious accumulation.

This accumulation has led to an increase in BTC holdings at large wallets containing more than 100,000 BTC to 3.64% of the total supply, up from 2.6% in June, and is at its highest level since April 2019. However, the concentration of BTC held at wallets with less than 100,000 BTC remains at the same level as June. This shows that BTC is being accumulated by very large whales in this dip.

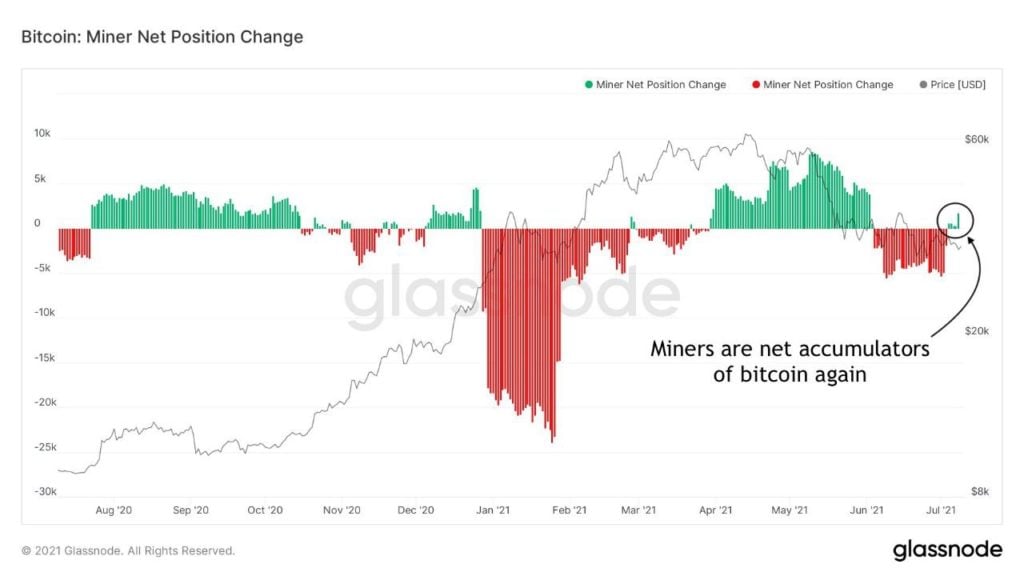

Miners Reaccumulating BTC After Selling in June

Miners are also back accumulating BTC in July after a spate of selling in June. The Miners’ NPI has reverted back into positive territory as more BTC has been bought by miners than sold.

Various on-chain metrics seem to suggest a potential seller’s exhaustion in the works, which could bring a sudden upswing in BTC price should anticipated risk events like the GBTC unlock on July 18 pass with no substantial sale of BTC. Current sellers of BTC appear to be short-term speculators who enter short positions, rather than long-term holders.

Improvement in Institutional Flows As XRP Sees First Inflow in 6 Months

A survey conducted with 100 wealth managers shows that 82% of them plan to increase their crypto exposure between now and 2023, with 58% of them having long-term views.

Investment bank Goldman Sachs has issued a report on ETH, calling it the blockchain with the highest “real use potential” and predicted that the market cap of ETH could flippen that of BTC soon. Other than Goldman, Bank of America also announced that they have set up a cryptocurrency research team, while major UK investment fund Marshall Wace with $55 billion AUM revealed plans to invest into the blockchain space.

For the first time in 9 weeks, inflows were seen across all individual crypto assets implying a turnaround in sentiment amongst investors. BTC took the lead, with total inflows of $38.9 million. ETH, the second-largest cryptocurrency by market value, broke its three-week streak of outflows with inflows of $18 million. Altcoins with the most inflow were DOT, XRP and ADA, which saw inflows of $2.1 million, $1.2 million and $0.7 million respectively. It is interesting to see that XRP is beginning to see inflow after being outcast since January after the SEC lawsuit caused institutional funds to abandon the asset.

Other than buying into crypto funds, institutional investors and politicians are getting into the crypto fray in other interesting ways. Capital International, one of the investment arms of The Capital Group, one of the oldest and largest investment management organisations in the world with over $2.2 trillion in AUM, said last week that it has bought more than half a billion dollars’ worth of MicroStrategy’s stock, or around 12.2% of the company. This makes Capital International the second largest shareholder of MicroStrategy.

Equally important but in less USD amounts, last week also saw a few US politicians declaring holdings in cryptocurrencies like BTC, ETH, DOGE, as well as ownership in GBTC and ETHE shares. While there has been limited price action, activity on the ground for crypto adoption has been picking up in the Americas.

ETH’s London Hardfork Scheduled For August 4

ETH’s upcoming London Hardfork has its date set on August 4, bringing slight positivity to the crypto market, sending the price of ETH up around 10% to $2,400 before retracing back down near $2,000. ETH currently trades at around $2,150.

ETH has added over 5.37 million more unique addresses in just 30 days as it continues to gain momentum ahead of its scheduled EIP-1559 upgrade in the London Fork. This means that on average, the ETH network added 173,235 new unique addresses daily, taking the total number of unique users to 162,231,196. This is a great improvement after ETH experienced massive capital outflows last month.

Paraguay To Vote On BTC Bill, Israel Buys $2.3 Billion Worth Of BTC

After El Salvador made history with its watershed decision, two Paraguayan legislators had come out to say they would push for a BTC bill in Paraguay. The parliament of Paraguay is scheduled to vote on this bill this Wednesday, July 14, and a pass could bring some much welcome cheer to the lull crypto market.

The weekend also brought another very bullish BTC-related news from another sovereign state. The Israel Investment Fund Group (IIFG), which manages the sovereign wealth fund of Israel, announced on Sunday that it has invested a massive $2.3 billion in BTC. IIFG notes that the latest BTC investment comes as part of their portfolio diversification strategy and this global strategic plan will help Israel lead to the future.

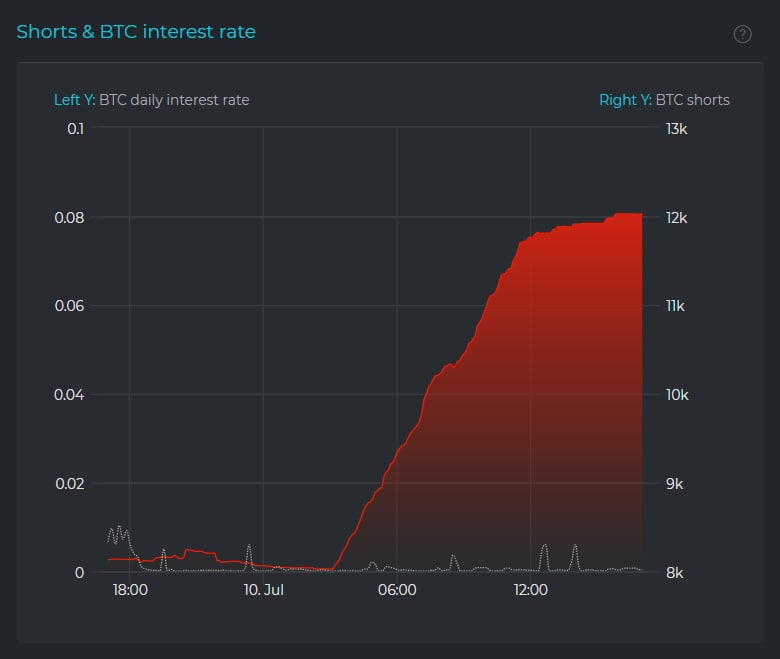

Despite the positive news, the price of BTC hasn’t moved a great deal due to an increase of short positions in the market. As the weekend comes to an end, shorts are continuing to pile up on the same crypto exchange used by the “Chinese-FUD shorter”, which has sent funding rates further south. Despite short positions having climbed above 12,000 BTC, the price of BTC has refused to crack lower, maintaining above $33,000, showing conviction by holders. This tug-of-war between shorts and long-term holders could set up for an interesting start of the week to see if the shorts manage to bring the market lower. Should shorts fail to force down the market, however, a subsequent short squeeze may occur and could potentially bring BTC’s price rallying upwards as the shorts will need to buy back their naked short BTC position.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.