After the excitement of last week in the markets, across stocks and even Bitcoin, there has been a little cooling off this time around. The stock markets have taken onboard the good news surrounding the potential new Covid-19 vaccine and not changed much while Bitcoin has also settled well around the impressive $16,000. However, altcoins are worth watching this week as they start to pop off.

The US election has of course had its impact globally, and especially in the US, but the next steps from here will be the looming COVID stimulus package which will play its part in shaping the market. Further abroad, in Europe, there are similar considerations as the European Central Bank gears up for its own rounds of December stimulus programs aimed at fixing an weak European economy.

The big news in the cryptocurrency space was the fact that Bitcoin managed to cross over to $16,000 for only the second time in its history. The coin rallied hard to get there but has since consolidated around that mark.

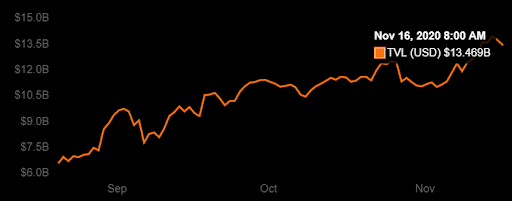

Meanwhile, altcoins are showing some life in the wake of the Bitcoin rally, and for a few other reasons including PayPal offering BTC, LTC, BCH and ETH to all its eligible USA users. This has also been bolstered in the DeFi space as one metric, Total Value Locked (TVL), in DeFi platforms started climbing up again in Nov and surpassed ATH last week.

Bitcoin’s own metrics also look good. Both Option and Futures volume maintain at all time highs, while the spot market continues to be supported by institutions. Interestingly though, a look at the Google searches suggests that this rally is not being driven by retail investors as there is very little rise in interest across the search engine.

Will monetary policies and further economic stimulus drive the stock markets and commodities markets, or will Bitcoin be the beneficiary of this additional money printing? Read the rest of our weekly market research report to find out.

Stock Markets Muted After Covid-19 Vaccine Announcement, Potentially Preparing For Stimulus Bill

After a strong showing in the markets early last week, when news of a viable COVID vaccine led a growth in the stock market causing a rally that pushed them past their ATH, the rest of the week was more muted.

The US Presidential Election is still being contested with Donald Trump attempting to go through the courts to challenge the outcome. This has certainly had the stock market on stand by.

Meanwhile a COVID stimulus bill is on the cards. Fed Chairman Jerome Powell also mentioned on Thursday in an ECB virtual forum that more action from both the Fed as well as from Congress in the form of fiscal stimulus, will be needed soon as the coming few months could be challenging.

Any vaccine will not be able to be deployed near-term as cases continue to soar in the US. These talks led traders to believe that the stimulus bill may be just around the corner and markets merely consolidated around their ATH, seeming to be waiting for news.

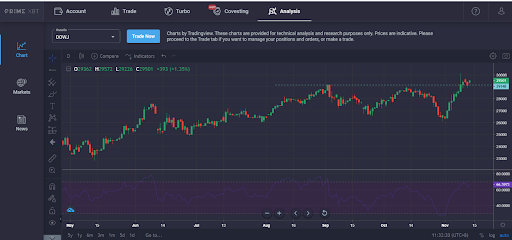

https://www.tradingview.com/x/zux0ZGEt

The Dow seems to be consolidating around its ATH to build a base for its next move. With US indices entering price discovery stage with no historical price to serve as a guide, some traders may consider trading the other indices. Other than US stocks, European stocks also appear poised to be seeing better days ahead.

European Markets Consolidating In Anticipation Of December Stimulus

https://www.tradingview.com/x/vmhLksvk

The European Stock Index has also broken higher and is looking interesting to trade as long as it consolidates around its previous high of 3400.

There are less than four weeks left to the ECB’s December 10 interest rate meeting, where the ECB promised to unleash a policy bazooka to support the ailing European economies. The European markets may likely push higher if the polices are deemed sufficient to the market participants.

Altcoin Popping Off While Google Suggests Bitcoin Interest Is Not Coming From Retail Investors

With a quieter stock market, the crypto market was the mover last week, with the broad crypto market posting decent gains, and BTC finally managing to break above the psychological resistance at $16,000.

With BTC momentum slowly down and consolidating around $16,000, the altcoin market sprang to life, adding to their gains at the end of October when Paypal announced that it was opening the crypto market to its 350 million users.

Paypal has started offering BTC, LTC, BCH and ETH to all its eligible USA users, and has increased its weekly purchase limit to $20,000 per customer based on overwhelming customer demand. Paypal mentioned that it will start to offer the service to its European customers soon.

As a good gauge to the altcoin market, Total Value Locked (TVL) in DeFi platforms started climbing up again in Nov and surpassed ATH last week to hit $13.8 billion. This lent strength to ETH as well as other DeFi related tokens like UNI and YFI. ETH, even though its staking participation rate of ETH 2.0 is still low at around 10%, the pickup in DeFi activity has pushed the price of ETH to $477 at one point before retracing to $450.

BTC metrics continued to improve, with both Option and Futures volume maintaining at ATH, while spot market continues to be supported by institutions every time the price retraces.

To illustrate, on Saturday, when the price of BTC fell below $16,000, Grayscale swooped in to buy another 7,000 units, causing the price of BTC to return to $16,000 again. This consistent demand from institutions has reduced downside volatility for BTC throughout this rally.

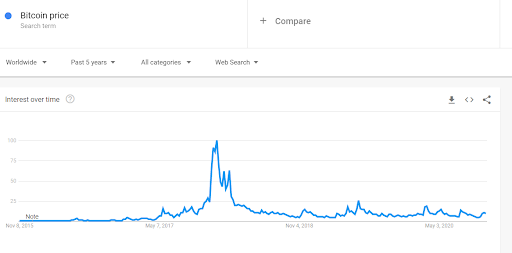

Retail market participation though, remains soft, with google search trends for BTC still at a low 10, implying that retail interest in BTC remains low. The google trend indicator ranges from 0 as no interest to 100 as highest interest.

As can be seen in the graph below, despite BTC’s very strong showing this year, retail search on it is still very low compared to early 2018’s reading of 100, before the price of BTC crashed. Retail FOMO can be a good counter indication of price movement since the retail market segment is always the last to observe and react to any changes in trend.

This low value suggests that the retail market has not yet entered the market and as such, this rally may still have plenty of room to grow.

https://static.coindesk.com/media/2020/11/no-retail-fomo.png

Other strength showing metrics include the Miners Rolling Inventory Index (MRI). According to the MRI, which shows the year on year percentage change in inventories held by miners, miners have started selling BTC again in the last 3 months.

The index now stands at 140%, which means miners are selling 40% more BTC than they have mined. A reading of below 100 suggests miners are selling less than they have mined and are hoarding. This metric is significant because despite miners’ selling activity for 3 months, the price of BTC has continued to rise, implying that all that selling has been more than well absorbed.

Ripple Buys Back Bulk XRP And Patents A New Payments System

Meanwhile, Ripple, the company behind the XRP token, revealed on Tuesday that it has been buying back its XRP token in the open market since 3Q this year, with more purchases expected to come as it builds up various financial products to aid in the institutional adoption of its XRP token.

On Friday, it was further revealed that Ripple has filed a patent for a new payment service called Paystring. The filing describes Paystring under the classification of “electronic financial services, namely monetary services for receiving and disbursing remittances and monetary gifts in fiat currencies and virtual currencies over a computer network and for exchanging fiat currencies and virtual currencies over a computer network.”

All these developments tie in with Ripple’s objective of popularising XRP as a value transfer tool and may likely increase adoption of XRP in time to come.

https://www.tradingview.com/x/9RMYMG4M

On the back of this positive news, the price of XRP rose above the consolidation range of $0.225 to $0.26 towards $0.28 where it met with some selling pressure.

Should $0.28 be breached with the broad cryptocurrency market continuing to remain buoyant, $0.30 and beyond should not be far away. On any pullback, the area highlighted in blue should provide good support.

Information provided in PrimeXBT’s market report includes information provided by Kim Chua, Lead Market Analyst for PrimeXBT, in addition to charts from various data sources.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.