For the first time in a couple of weeks, the cryptocurrency market has shown somewhat of a correction. What was even more painful for traders is that it came in a week where the stock market took to retracing its own gains somewhat.

Bitcoin was chasing its previous all-time high as the price of the major cryptocurrency topped a high of $53,000 following the Labour Day weekend in the US. However, the much-anticipated correction did finally come and caused the price of Bitcoin to drop rapidly and substantially. This drop also led altcoins to fall some 35%.

It appears that the reason behind the fall was actually off the back of some ground-breaking news for Bitcoin. El Salvador officially welcomed Bitcoin as legal tender in the country last week, but following the announcement the price of Bitcoin collapsed.

Looking at the traditional markets, in the first trading week post-August’s ugly US jobs report, the stock market decided to err on the side of caution as traders widely took profits on a week which saw 5 consecutive days of losses in the US stock market.

August’s PPI released on Friday showed great inflationary pressure as wholesale costs for businesses rose 8.3% yoy, its biggest advance for the past decade. The PPI accelerated 0.7% for the month, above the 0.6% consensus estimate. This has put traders on guard as they await Tuesday’s release of August CPI numbers, which is expected to show similar, if not, worse, inflationary pressure.

With inflation becoming an issue, traders were worried that the FED would be forced to taper even as the rising number of COVID cases continues to plague the economy, as can be seen from the very weak jobs number in August.

For the week, the Dow retreated roughly 2.2% in its second negative week in a row. The S&P 500 was off about 1.7% while the Nasdaq closed 1.6% lower.

The yield on the 10-year Treasury note climbed to 1.339% by the end of Friday, showing some stress in the markets.

In Europe, the ECB announced that it will slow the pace of its asset purchase program during its regular policy meeting last Thursday, while for the US, the FED will be meeting on Sept 21 and 22 in what is expected to be a very important meeting for the markets as traders will be focused on what the FED Chair says about the lousy jobs number with rising inflation and how it may affect the tapering program. If the Fed Chair is dovish, markets could cheer while if he is adamant about tapering, markets might see a selloff. Until the market hears what it wants from the FED, this week could continue to see traders trading under a tantrum in the markets.

With the current uncertainty, risky assets also sold off. Gold broke back below $1,800 and Silver dropped below $24. Oil price, on the other hand, remained in a tight range between $67.50 and $70, seemingly coiling up for a potentially sharper move in the days ahead.

The cryptocurrency was not spared from the risk-off sentiment despite having had a fantastic weekend before US traders returned from the Labour Day long weekend. BTC briefly spiked to $53,000 last Monday as hype around El Salvador’s Sept 7 BTC Day propelled the crypto market higher. However, a derivatives market-led sell down ensued immediately upon the arrival of Sept 7 when the El Salvador BTC wallet met with some technical issues. Even though the issue had been resolved within hours and the system was “all go”, the damage to prices had already been done, with BTC witnessing its biggest one-day drop since May 19, dragging altcoins down by 35% in a huge rout.

BTC Price Plummets on EL Salvador BTC Day

El Salvador bought 400 BTC just one day before Sept 7 where it became the first country in the world to make BTC officially legal tender, creating more excitement in the crypto market, and thus drawing more retail participation in the hype.

The BTC community even organized a worldwide “buy $30 dollars’ worth of BTC” to commemorate the event, driving retail interest even higher as Sept 7 approached, and the price of BTC went to a high of $52,900 on the eve of Sept 7. However, the price of BTC wasn’t spared from what usually happens to over-hyped-up events.

As Sept 7 beckoned, the price of BTC took a quick dive straight down instead of continuing to move higher.

Derivatives Deleveraging Caused Huge Margin Liquidations

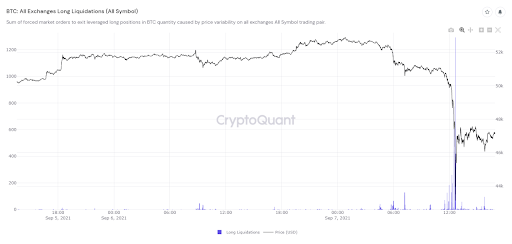

In what appears to be a futures market-led crash, the price of BTC caved back below $50,000, dropping around 12% on Tuesday, dragging the altcoins crashing between 20-50% in a market-wide carnage as bad as the one on May 19. Around $3.7 billion worth of cryptocurrencies were liquidated within the first 12-hours of the fall as exchanges around the world experienced outages with the huge influx of traders trying to access exchanges to buy and sell.

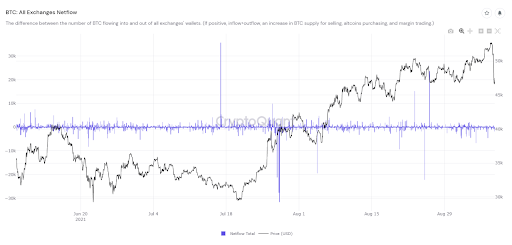

From the exchange net flow diagram above, it can be noted that there was no unusually large inflow of BTC into spot exchanges before and during the correction.

However, there was a huge drop in BTC futures Open Interest as the price of BTC crashed. This could mean that the selloff started at the futures-market, and the price correction subsequently caused margin liquidations on overly leveraged positions in the spot margin positions also, with one feeding on the other, causing a cascade of falling prices within the entire market, making prices crash like dominoes as more positions get liquidated.

The market falling the way it did could have caused some smaller BTC whales to sell some BTC as the number of BTC holders with more than 1,000 BTC is beginning to fall. While it may look negative at first, this may not necessarily mean the market has turned decidedly bearish as the concurrent surge in altcoin prices could be a sign that these BTC holders may have shifted their funds into altcoins instead. Data sources tracked that as much as 90,000 BTC were offloaded by this group of whales in the last 10 days, which nonetheless is still a warning sign that traders should take note of.

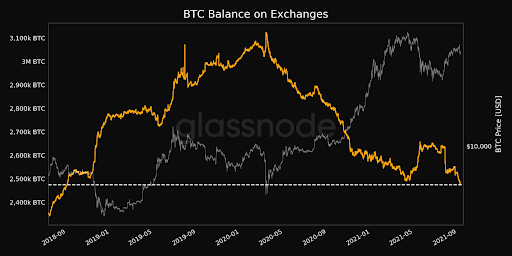

BTC Exchange Balance Remains at 3-year Low

BTC balance on exchanges, however, continues on a falling trend and has reached a 3-year low of 2,472,687 BTC, which means that either no new supply of BTC has entered the market for sale, or that most BTC sales were conducted on an OTC basis which will not reflect on exchanges.

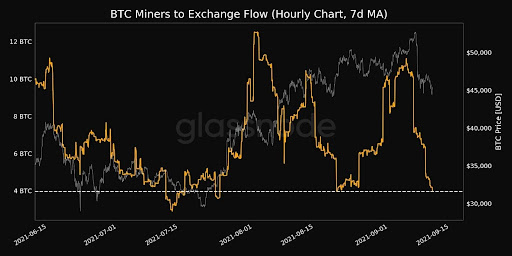

While there was a small increase in the number of BTC sent by miners to exchanges before the dip, that has stopped as miner to exchange flow has fallen back down to a one-month low of 3.96 BTC.

Drop in NFT Sales and TVL Affecting ETH Price

After a blistering August, the majority of top NFT collectibles have seen a considerable decrease in sales volume over the last week. Sales for top NFT collectibles have fallen over the last couple of weeks from highs of $882 million to last week’s total of $129 million.

Not only at the NFT space, with intense competition coming from newer and cheaper blockchains like SOL, FTM and AVAX, coupled with the market-wide correction, the TVL on the ETH network have also taken a sharp 25% dip over the last five days, dragging down the price of ETH down by around 20%.

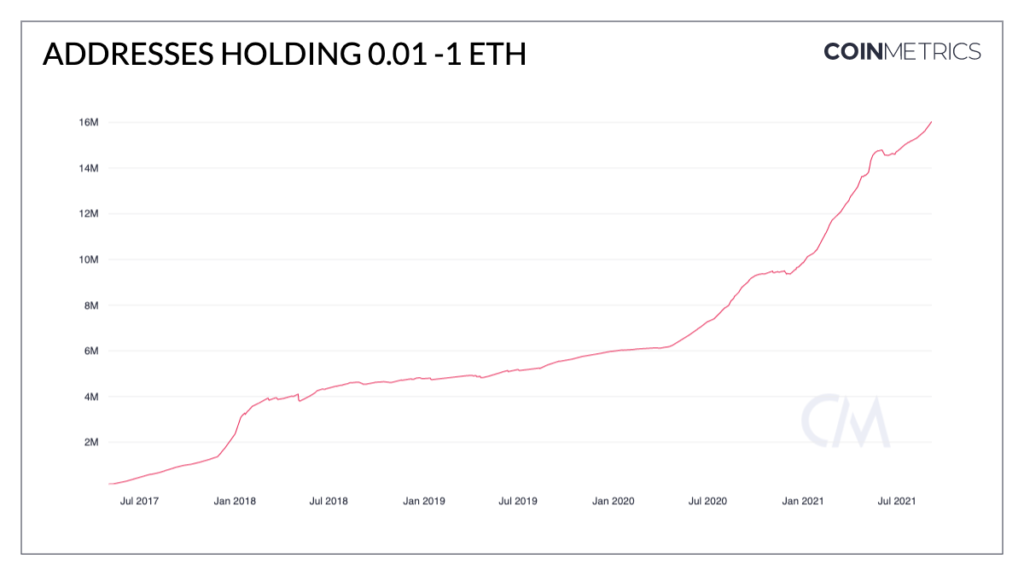

While ETH price took a dive, small investors could have taken the opportunity to buy the dip, with the number of ETH holders with less than 1 ETH continuing on its sharp upward trajectory, unaffected by the drop in price.

Crypto Legalisation By Countries Pick Up Pace

While the market-wide sell-off took the limelight, there were some notable developments with regards to the adoption of cryptocurrencies which will have a longer-term positive impact.

On Sept 8, Ukraine passed a bill to legalize BTC to enable crypto legal protections for its citizens. Banks would be able to take on digital asset firm accounts, while citizens would have their crypto assets legally protected.

Other than Ukraine, Panama has also sent a bill to parliament to recognize BTC and ETH as legal payment methods in the country on the same day that BTC is being made legal tender in El Salvador. Despite the short-term volatility, adoption of crypto is picking up pace and bodes well for the crypto market long-term.

Some Altcoins Defied Market Drop To Post Record Gains

While most coins continued to wallow in the doldrums, some other newer crowd favorites were able to recover from the selloff very quickly, the most notable being SOL and EGLD. Both coins defied the market selloff to post even higher ATHs when the rest of the market was under heavy correction. SOL even managed to propel from Tuesday’s low of $135 to an ATH of $216 within just 36 hours. EGLD managed to climb more than 100% from a low of $130 during the selloff to $296 by Sunday. However, most altcoins are retracing as the new week begins.

Other interesting events last week included XRP making a small jump of around 10% on Thursday night when the old rumor of a Coinbase relisting resurfaced again. Even though Coinbase has once again denied it, there was a significant rise in network activity on the XRPL just before the rumor started making its rounds. Even though the rumor has been denied, a surge in network activity has historically been a consistent leading indicator of future price increase for the token, and hence, it may be fruitful for traders to keep a lookout for a possible upward movement in the price in the not-too-distant future.

Despite the neutral on-chain data for crypto as a whole, it may be important for traders to watch what happens in the stock market as taper tantrums may start to hit, especially if Tuesday’s CPI numbers come out on the upside. While long-term metrics for BTC and the crypto market look healthy, contagion effects from the stock market could impact crypto prices in the short-term.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.