Bitcoin looked like it was ready to spring back into action when it managed to cross the $50,000 mark briefly in the week, but the coin has struggled to kick on from there and looks to be settling into a range around that price point.

But, it is not all doom and gloom for traders as a major event has happened in the US economy as the Stimulus Bill has been cleared and moves have been seen in the stock markets, giving them some much needed life.

The impact of the Stimulus Bill will be a bolster for certain markets, whereas it has also impacted others in a negative way. The more safe haven-like assets, gold and silver, have felt the pinch while Oil is back on the rise.

Still, even though Bitcoin is not showing much life at the moment, there are a number of promising signs that it could soon be back on track to rally. If this is to happen this week, there will need to be some sort of catalyst. To find out more about the week’s possible market moves, read more in this week’s market report.

Stimulus Bill Passed

Following the passing of the Stimulus Bill by the House, the stock market staged a strong rebound on Monday. However, the selloff continued again by mid-week as better than expected US jobless claims caused Treasury yields to spike again the second time, sending stocks to fall further.

Fed Chair Jerome Powell’s comments on Thursday didn’t manage to salvage the market, as he reiterated that there is no need to support the bond market yet. Friday’s way better than expected Non-farm Payrolls further confirms the start of recovery, with the Labour Department reporting that 379,000 jobs were added in Feb, against expectation of only 210,000.

Yields surged above 1.6% on the report, however, stocks posted gains on Friday to close the week paring losses. For the week, Dow closed up 1.82%, S&P up 1.95%, with only the Nasdaq down 2% as tech selloff continued.

The USD was the beneficiary of the spike in yields, with the DXY posting strong gains to 92.00 level. With the USD strong, Gold and Silver were battered, with Gold closing below $1,700 and Silver down 5% to $25.20.

It is not looking good for Gold as prices have convincingly broken its uptrend since the start of 2019. As the new week begins, prices have rebounded as the USD takes a breather after the big spike last week. Gold has rebounded above $1,700 while Silver is trading near $26 after rebounding 2.5% in Asian trading. However, these look more like technical rebound than reversal.

Oil however, bucked the trend and rose 25% last week to above $66. The reopening of key economies across the globe sent demand for oil higher. Furthermore, an unexpected decision by OPEC+ on Friday to not raise the supply of oil to match the increase in demand sent buyers scrambling to purchase oil. Some experts are now expecting oil to top $100 per barrel by the end of this year.

Short-lived Rebound for BTC As More Traditional Investors Endorse It

Following the stock market recovery on Monday and Citigroup’s positively skewed report on BTC, the price of BTC rebounded strongly to above $50,000 to start the week. Very positive narrations on the benchmark cryptocurrency have also been dished out by many experts throughout the week, with the CEO of a cryptocurrency exchange putting a target price of $1 million for BTC within the next 10 years.

Another long-time crypto critic has also surrendered and joined the BTC club. Shark Tank Investor Kevin O’Leary, who only 2 years ago called BTC garbage, has added BTC to his portfolio.

Meanwhile, BTC die-hard MicroStrategy buys another 530 BTC, or $25m worth in 2 tranches of 328 and 205 BTC. MicroStrategy now owns 91,064 BTC at an average price of $24,119.

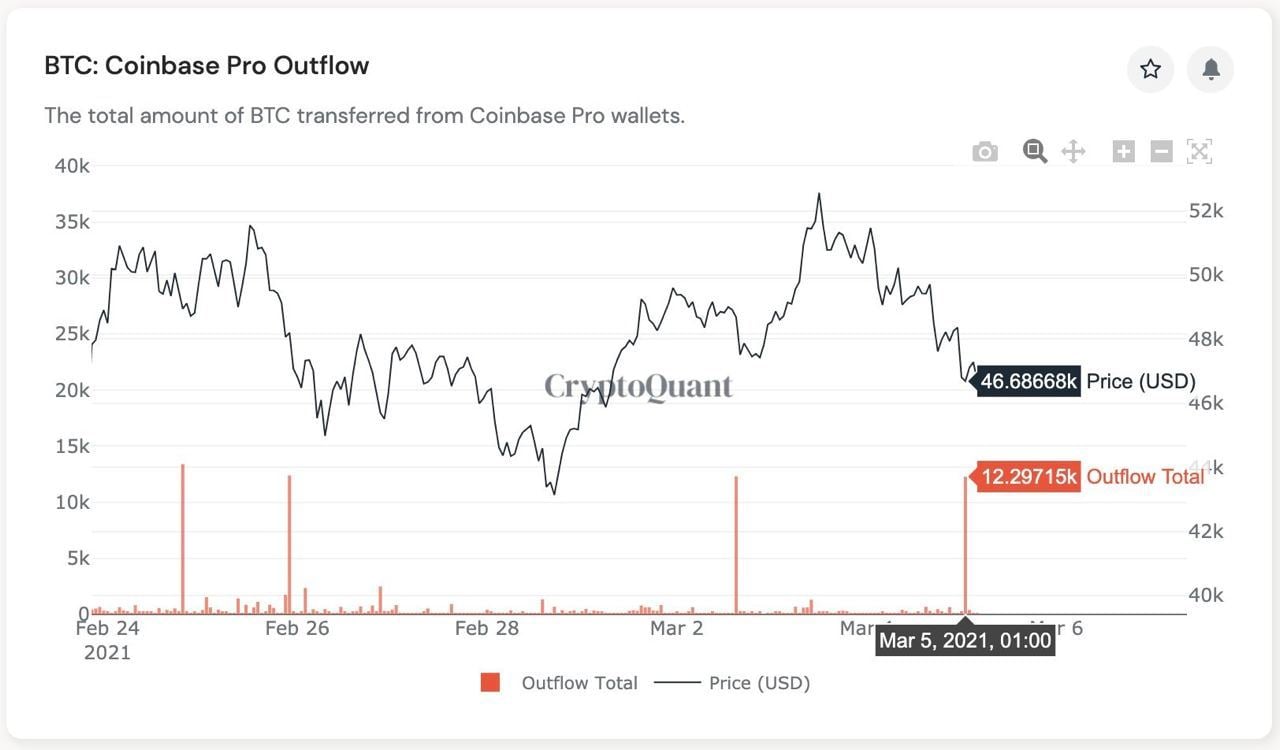

Other than MicroStrategy, some other large buyers also bought the dip, with large quantities of BTC spotted to be removed from Coinbase Pro which only serves institutional or large corporates. The average price of the purchases was around $48,000.

One such investor is Chinese Selfie-app maker, Meitu, which is listed in Hong Kong. Meitu just revealed that it has snapped up 380 BTC and 15,000 ETH, worth around $40m, on Friday, March 5, during the dip.

More BTC Removed from Circulation Suggests Long-term Buyers

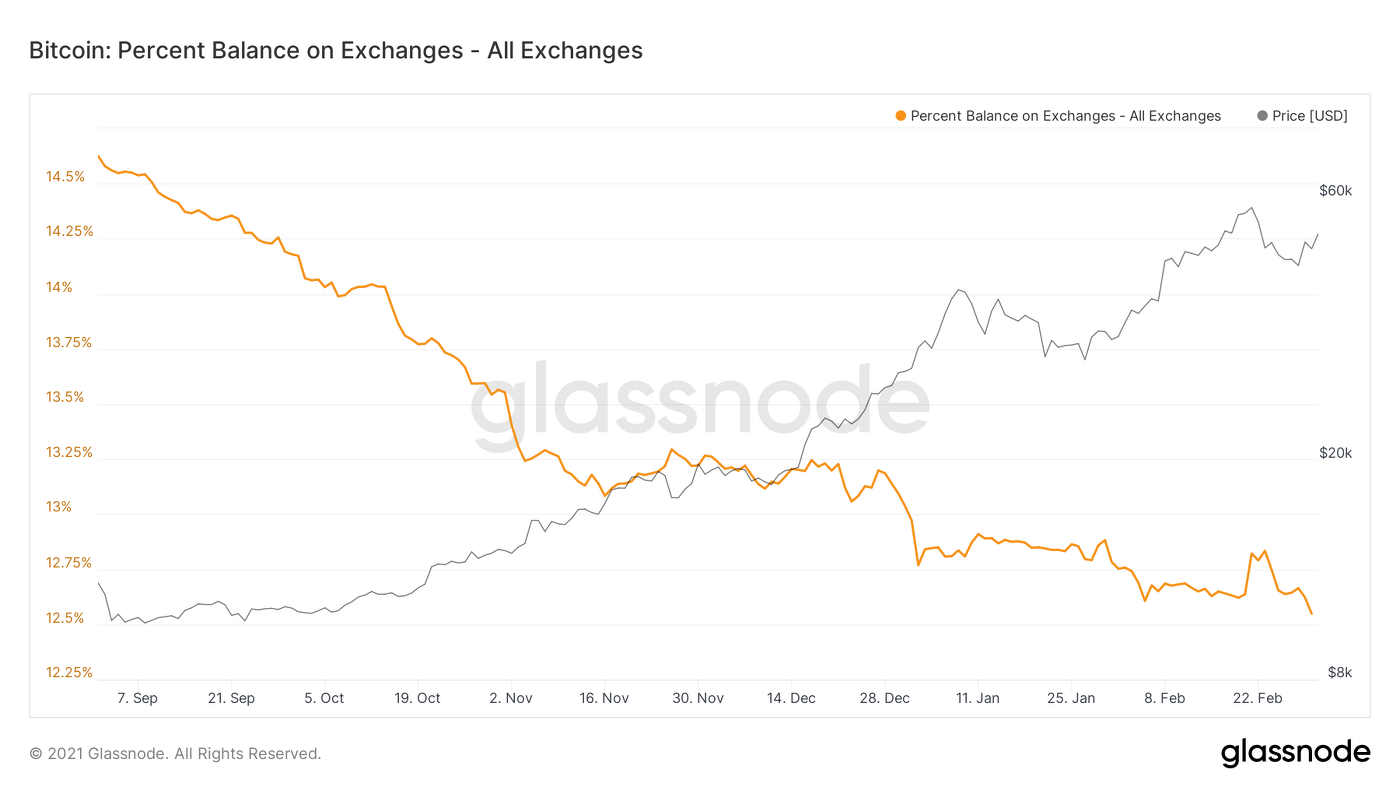

BTC balances on exchanges have shown a sharp decrease after the Feb 22 selloff, suggesting that buyers who bought on the corresponding dip have been removing these BTC from exchanges for storage.

Between Feb 23 and March 2, there was a 2% decline in BTC held on exchanges. This corresponds to 52,900 Bitcoin ($2.7 billion) being removed from exchanges, intensifying a yearlong downward trend as more BTC continues to get removed from exchanges into long-term storage.

There is now only around 2.3 million BTC remaining on exchanges, the lowest amount since July 2018, when Bitcoin was worth about $7,400. BTC then went on to post 180% gain to $19,500 within the next 5 months.

According to data, Bitcoin held on exchanges generally increased between August 2014 all the way up to March of 2020. But in March 2020, this historical trend changed course, and BTC has mostly been flowing off of exchanges ever since.

This suggests a change in sentiment of buyers of BTC from speculative trading to long term investment, as can be evidenced by large corporate buyers like Square and MicroStrategy who purchase BTC as their reserve currency. These buyers are not likely to sell their stash of BTC at all.

Surge in New Users This Year

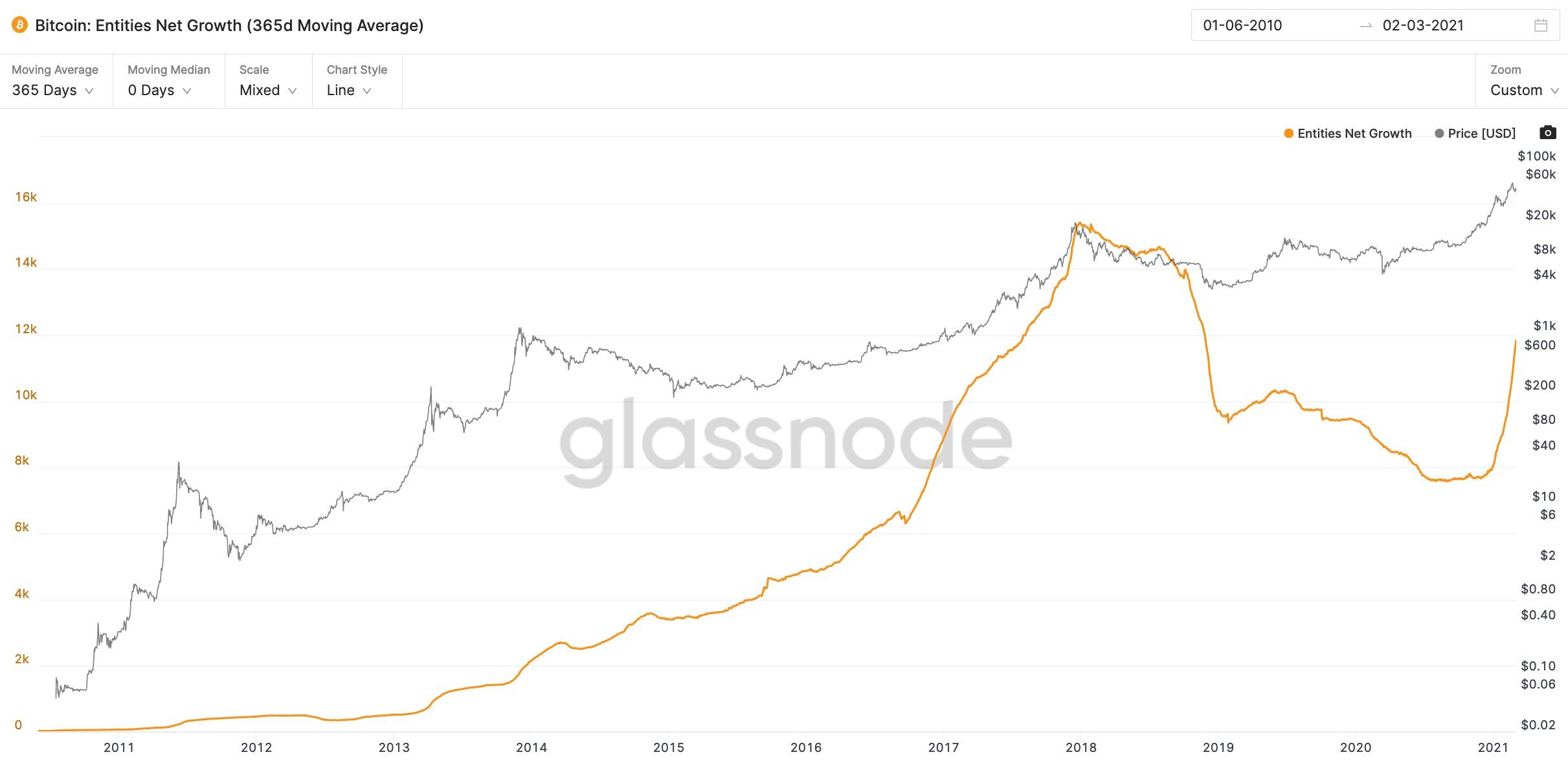

With the surge in price and interest in cryptocurrency since the pandemic, more and more new users are getting into the crypto space, with more new individual users spotted on the blockchain.

New entities of the BTC blockchain increased sharply since the beginning of this year, with entities net growth showing a sharp growth since mid-Jan.

Short-term Price Consolidation Expected as Tug of War Ensues

Short-term, the price of BTC may see some pressure above $50,000 as evidenced last week. When the price of BTC broke past $52,000 again after Monday’s rally, whales again were spotted to deposit BTC to exchanges, which brought the price back down again to below $50,000, suggesting that these whales have sold BTC after prices hit $52,000.

Hence, we can conclude that older generation whales are selling BTC at around $52,000, while the new generation whales are buying at $48,000 and below. This tug of war may cause the price of BTC to consolidate until the yield situation causes risk assets to sell off and calms down. On-chain data still points towards a price appreciation for the mid to long term. Hence, should $53,000 be taken out, it bodes well for the price of BTC.

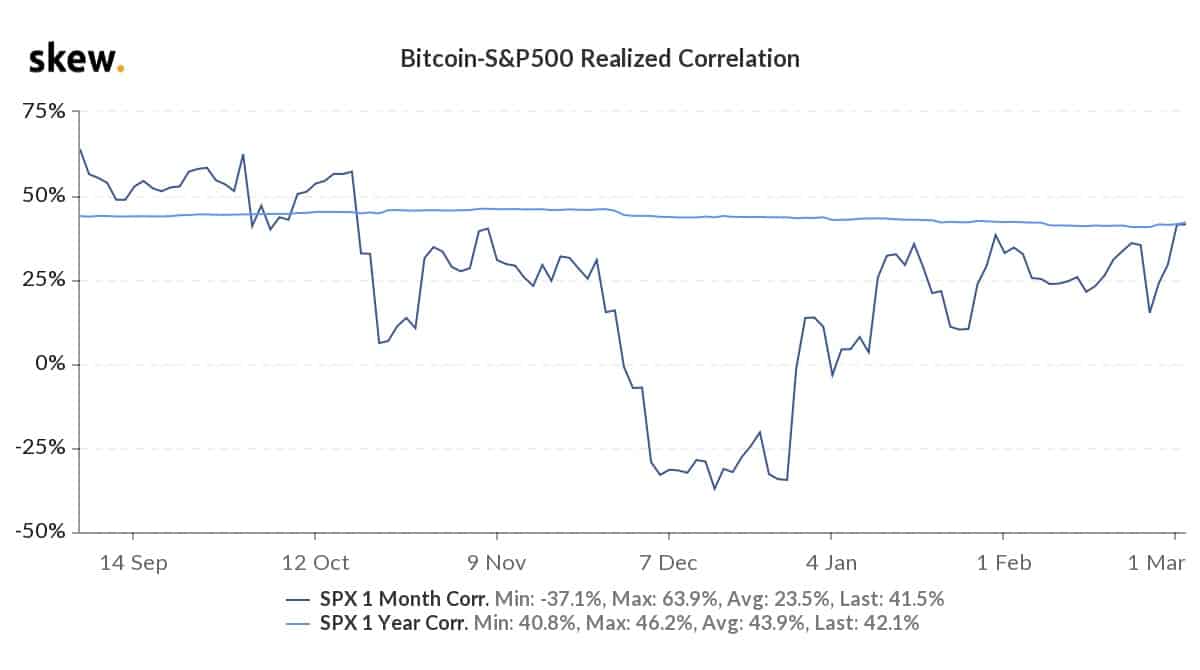

Correlation of BTC price and the US stock market is also at a 5-month high, which means any selloff in the overvalued stock market will directly drag down the price of BTC, which then impacts the price of all other cryptocurrencies. Hence, do keep watch on the stock market movement to determine the direction of cryptocurrencies until the correlation decreases to zero or negative. It currently sits at 40% which is a high figure.

ETH Gas Fees Lower After Drop in DeFi Usage

With prices cooling off, ETH fees have also fallen back towards its normal range. Since Feb 23, fees have declined by 65% with the average cost dropping to 131 Gwei on March 3 and data shows that at certain times of the day, fees can drop to below 70 Gwei.

The drop in fee can be attributed to the fact that DeFi demand has fallen ever since the market correction. Data shows that trading volume on DEXs has been on the decline since peaking at $4.35 billion on Feb. 23 and the DEX daily 24-hour growth metric is down by 50% in March.

However, do not expect the fee on ETH network to fall drastically as the rise in popularity of Non-fungible Tokens (NFTs) has created fresh demand for using the ETH blockchain which may prevent fees from falling further.

Meanwhile, some good news for ETH has come in the form of a date for the implementation of EIP1559 upgrade. This upgrade will incorporate the BASEFEE burn mechanism which aims to burn the transaction fees which otherwise will be paid to miners.

This reduces the supply of ETH which experts think will raise the price of ETH over time because it reduces supply. This upgrade has been scheduled to go live in July this year.

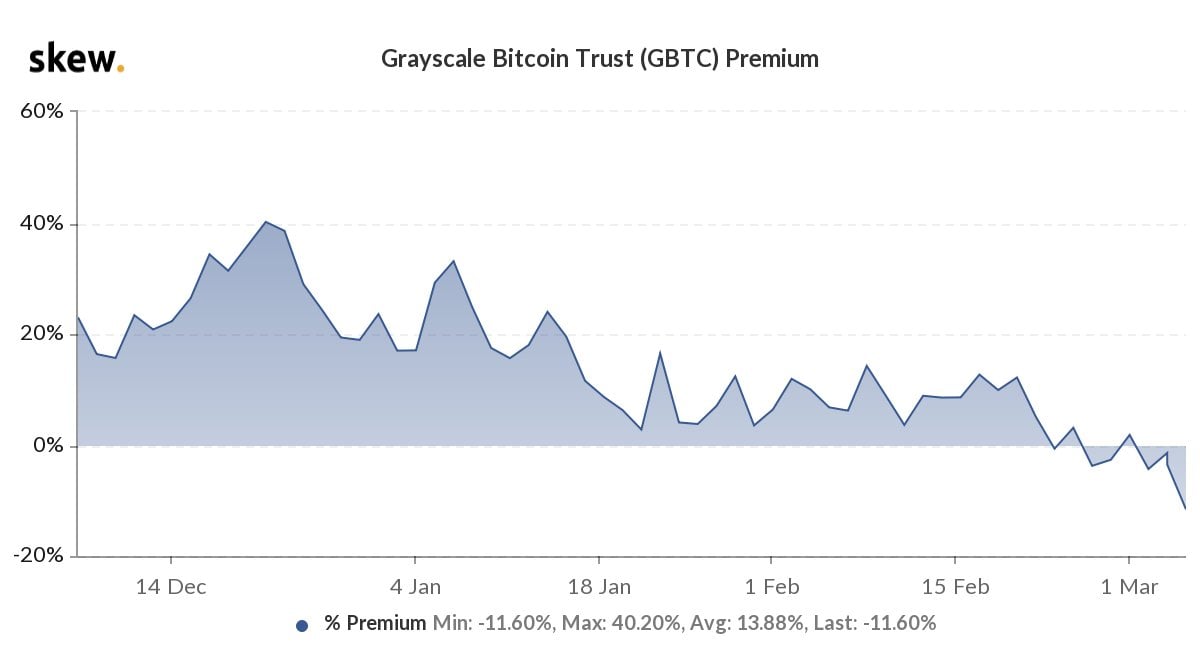

Grayscale Premiums Turning to Discount

According to reports, Grayscale added 174,000 tokens to its LTC holdings in the past month. This haul pushed its total holdings of the altcoin to 1.44 million. Following this acquisition, which represents 80% of all LTC that were mined in Feb, the total value of Grayscale’s holdings of the altcoin is now just over $248 million.

However, ever since Grayscale’s ETH Trust traded negative to its NAV end of Feb, its BTC Trust has also started trading at a discount, suggesting that clients of Grayscale have sold their GBTC shares. This may not necessarily mean they are bearish on BTC or ETH, but could be shifting to a more reasonably priced offering to hold BTC as Grayscale is extremely expensive, and there are more choices for the investor since a lot more BTC and ETH related products have entered the market this year.

With the Senate passing the Stimulus Bill on Saturday, the $1.9 trillion stimulus is 95% confirmed and will make its way to President Biden’s desk by 14 March, for aid to be distributed out mid-March.

This may lend some positivity to start the week but as the stimulus bill has been largely priced in by the markets, the effect may not be long-lasting and all eyes will still be on the benchmark 10-year Treasury Yield movement to determine the direction for all markets.

Opinion remains divided as to whether this is a dip to buy or more correction is ahead, with some experts saying that the Fed will act soon to calm markets down, while on the other hand, other experts are very bearish and calling for a big stock market correction.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.