Bitcoin trades at 62,500 after losing 1.5% last week, giving back modest gains from the previous week.

Despite maintaining a strong position above 66k and briefly flirting with 67,000 last Monday, post-halving, Bitcoin faced resistance, leading to a decline. BTC fell over 3% on Wednesday before extending losses to 62,500 over the weekend.

Bitcoin’s weakness came despite a recovery in the US stock market. The Nasdaq rose 4% across the week, ending a 4-week losing streak as tech earnings rolled in. The S&P 500 rose 2.6%, ending a 3-week losing streak.

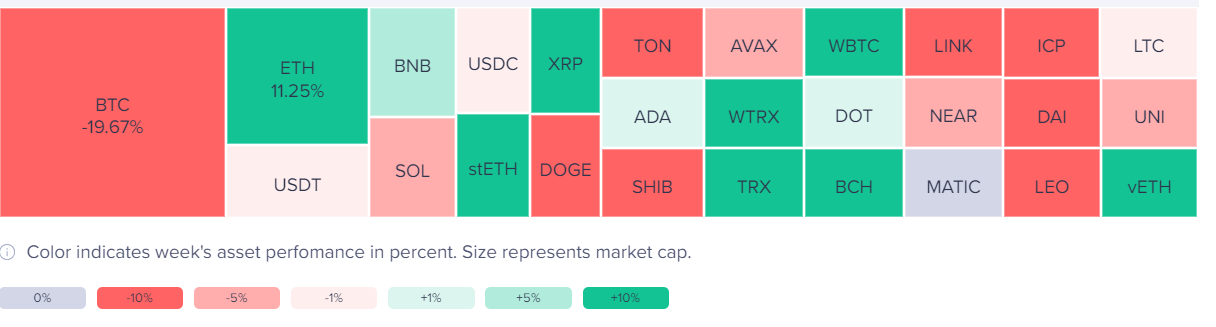

Meanwhile, the broader crypto market saw a mixed performance, with Ethereum and BNB rising around 6%. Other altcoins, such as NEAR and TRX, also saw substantial gains, rising 17% and 9%, respectively.

The Near protocol has outperformed in recent weeks. The protocol has been making moves in the decentralised AI space, which has coincided with outsized gain in NEAR in recent weeks.

However, the vast majority of altcoins lost money across the week. Solana fell 3.7%, and Toncoin dropped over 8% as it continued to pair its recent rally.

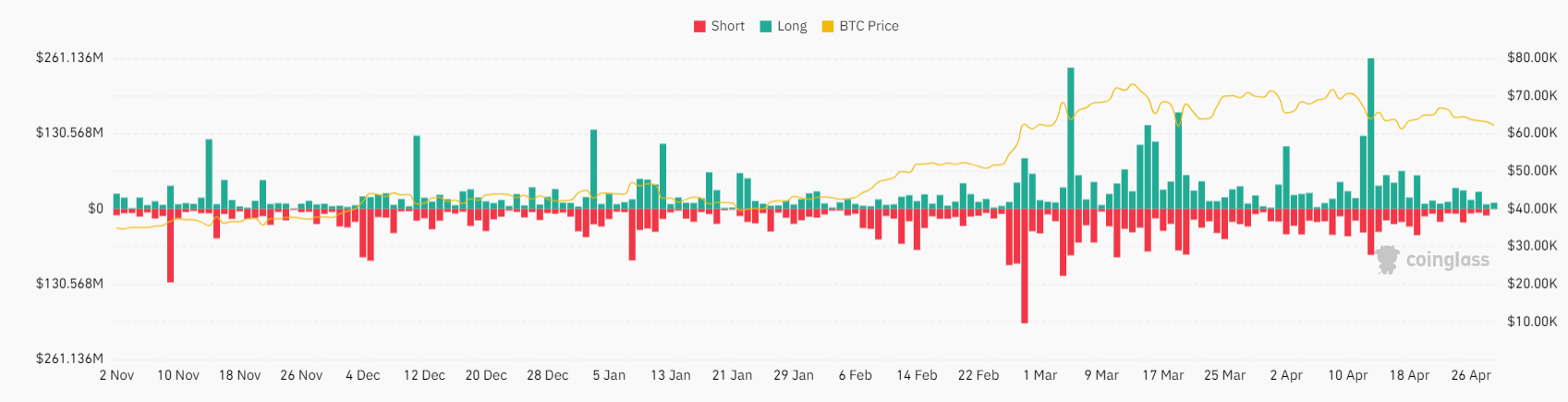

Bitcoin liquidations rise as the price falls

Bitcoins fell from 67k to a low of 62.5k last week. According to Coinglass data, this downturn increased pressure on bullish investors and put pressure on over-leveraged long-position traders. Daily liquidations of long positions were greater than those of short positions. Total liquidations peaked at $55.6 million on April 25.

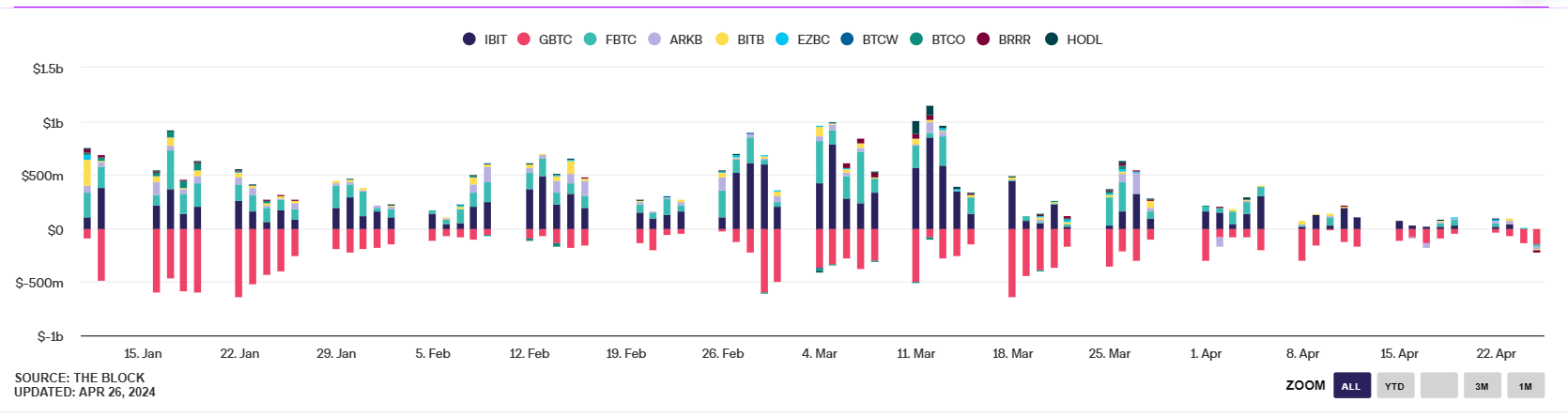

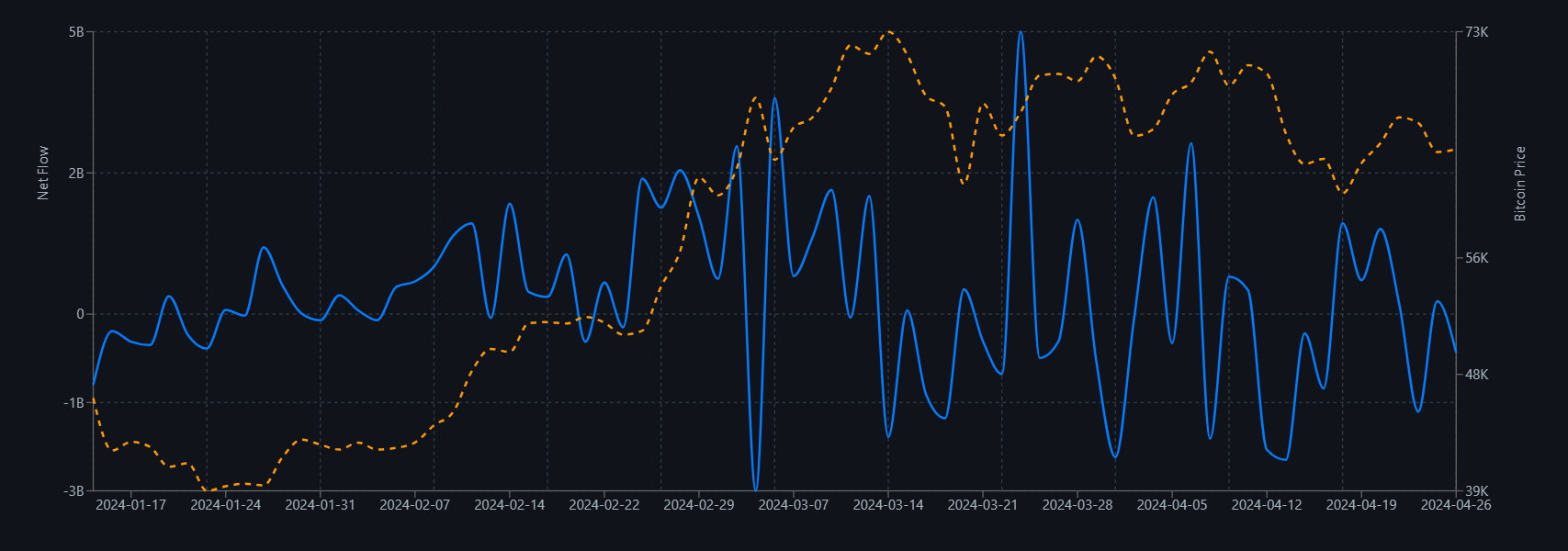

BTC ETF net flows

Since their approval at the start of the year, Bitcoin ETF inflows have been monitored closely. They have provided clues about the demand for Bitcoin exposure and the direction of Bitcoin’s price.

This week’s spot ETF flows were in focus for several reasons. Firstly, the BlackRock BTC ETF, IBIT, joined the top 10 ETF list for the longest streak of inflows after 71 straight days of inflows since its launch on January 11.

However, the monumental inflow streak then halted with $0 inflows on Wednesday, Thursday, and Friday of last week. While $0 inflows into an ETF isn’t a notable event, it could indicate that the excitement surrounding Bitcoin ETFs is starting to cool.

According to Farside Investor data, seven of the 11 approved BTC ETFs saw $0 inflows on Friday, while only the Ark21Shares Bitcoin ETF (ARKB) saw slight inflows. Meanwhile, Grayscale continues to see outflows. Given the size of Grayscale’s converted bitcoin ETF (GBTC), its outflows are of particular interest. Data from Farside Investor showed that GBTC experienced $454 million in outflows.

Looking at net flows across the week, the data shows net outflows of $307 million.

However, according to JP Morgan, the correlation between bitcoin ETF prices and inflows has weakened, falling from a high of 0.84 in January to 0.6 in recent assessments. This suggests a decrease in the alignment between spot BTC inflows and Bitcoin’s price.

The weekly outflows came after US data showed that the US economy grew at a slower pace than expected. Q1 GDP growth was 1.6% annualised, down from 3.4% in Q4 2023 and below forecasts of 2.5%. However, inflation remains a worry. Q1 Core PCE, the Fed’s preferred gauge for inflation, was hotter than expected at 3.7%, up from 2% in Q24 2023. Meanwhile, Core PCE for March was 2.8% YoY, in line with February’s reading, and defied expectations of an easing to 2.6%. Personal spending was also strong at 0.8%.

Sticky inflation raises the prospect of the Fed keeping interest rates high for longer, which could hurt demand for riskier assets such as cryptocurrencies.

US 10 treasury yields rose 0.87% last week, marking the fifth straight weekly rise. Treasury yields hit a five-month peak of 4.75% as inflation worries mount. Bond yields have climbed in recent weeks as signs of persistent inflation see the market scale back Fed rate cut expectations.

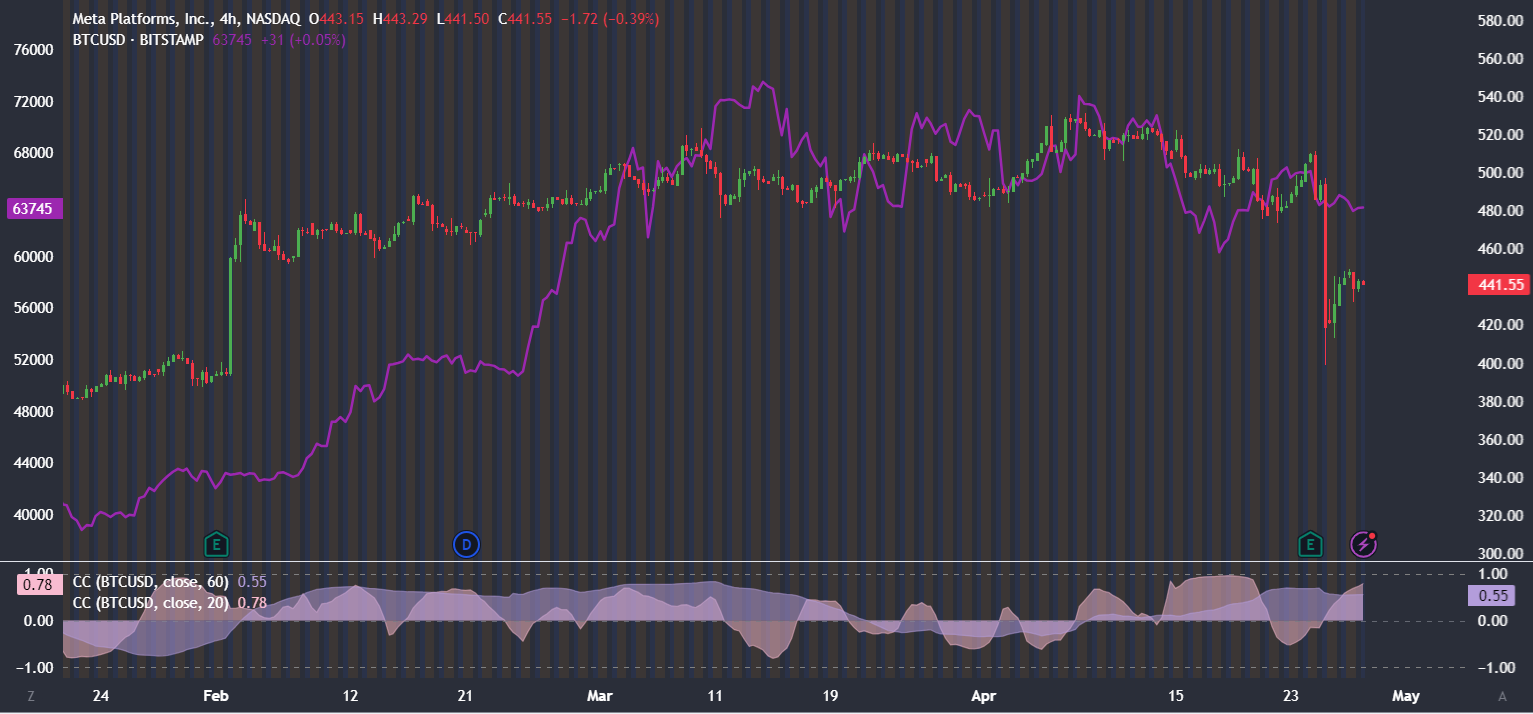

Bitcoin & tech stocks

Bitcoin booked its largest daily loss on the day that Meta’s share price dropped 10% as investors reacted to Meta’s earnings. While Q1 figures were better than analysts’ forecast, the social media giant posted a weaker revenue outlook and continued losses in its metaverse division, Reality Labs. The company also warned that expenses would surge to $96-$99 billion while capital expenditure of $40 billion would be raised to fund AI research and development.

Meta, which has outperformed the broader market, fell sharply, and Bitcoin dropped sharply.

Tech earnings remained in focus at the end of the week, with Alphabet and Microsoft beating forecasts, lifting share prices and the broader market. While the S&P 500 rose 1% following the earnings releases, Bitcoin fell 1%, with crypto trades paying more attention to the hotter inflation data.

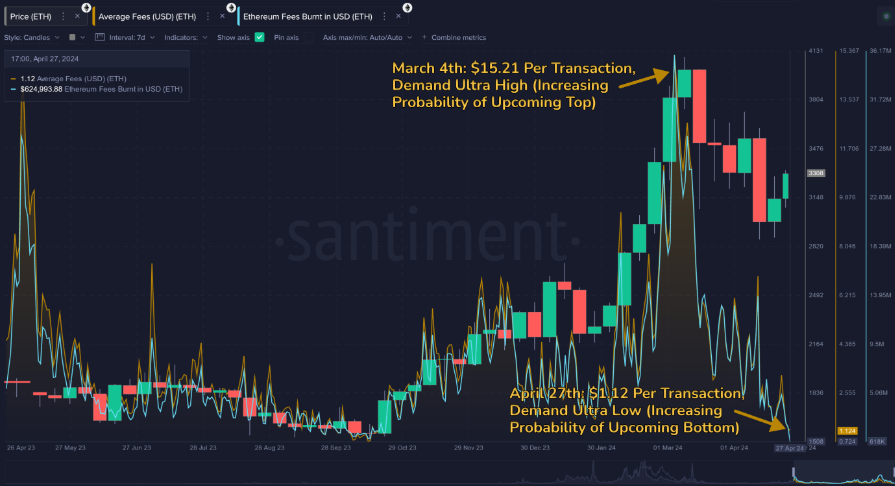

Ethereum fees fall could this point to ETH price gains

Ethereum rose almost 6%, outperforming Bitcoin and many of its altcoin peers. According to Santiment data, ETH experienced a surge in social media volume in the week, up 11.25%, and the price rose above 3.3k.

Erthereum’s average fee level dropped to $1.12 per network transaction, marking the lowest average cost in a day on October 18.

Transaction fees can reflect traders’ sentiment, which typically moves from feelings that crypto will soar to feelings that crypto is dead. Fees often peak around the price tops and return to a resting state around the price bottoms.

With markets retracing over the past six weeks, weaker demand and lower transaction fees could point to a turnaround.

Looking ahead: FOMC & more tech earnings

Last week, stocks booked gains across the week, snapping a multi-week losing run. The move higher came after volatile reactions to US tech stock earnings and despite hotter-than-expected US inflation data.

Interestingly, the gains in stock came even though US 10 treasury yields rose (these usually trade inversely), and the USD also booked modest gains.

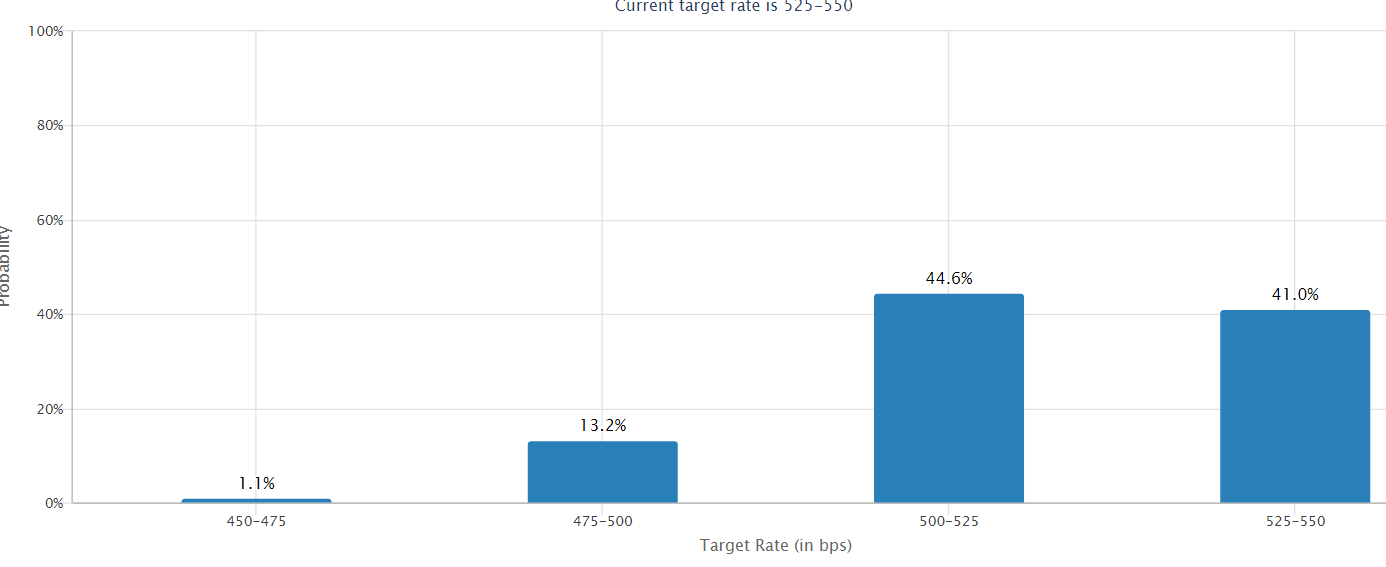

This week, the main focus will be the Fed rate decision on Wednesday, May 1st. Given that this is also a public holiday, it could lead to higher volatility surrounding the event, given potentially lower market liquidity. The Fed is expected to leave rates on hold at 5.25% – 5.5%. However, the market will be watching closely for clues over when the Fed could cut rates and the scale of those cuts. Signs of sticky inflation have caused the market to rein in Fed rate cut expectations.

According to the CME Fed watch tool, the market is pricing in just one full 25 basis point rate cut this year. The market is pricing in a 59% probability that the Fed will cut rates in September. Should Fed chair Powell adopt a more hawkish stance, supporting the view that rates will stay high for longer, the USD could rise, and riskier assets, including Bitcoin, could struggle.

Tech earnings will also remain under the spotlight, with figures from Apple and Amazon in focus. While Apple is expected to see weakness in iPhone sales, particularly in China, Amazon is poised to get a boost from its Amazon Web Services (AWS) business unit. How these tech giants fare could have an outsized impact on risk sentiment and the direction that stocks go.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.