As expected, the Fed hiked interest rates by 50-bps last Wednesday. However, the key issue that markets had trouble with was that the terminal rate had been increased to 5.1% from 4.5% in the September meeting, which is a more hawkish outcome than what market experts had predicted. Fed Chairman Powell also mentioned in his post meeting speech that rates would stay high throughout 2023 and no rate cuts are expected until 2024.

Powell specifically said that while Inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases, it will take substantially more evidence for the Fed to have confidence that inflation is on a sustained downward path. Some experts had expected the Fed to alter language that it sees “ongoing increases in rates” ahead to something less committal, but that phrase remained in the statement, which was read as being very hawkish.

As a result, risky assets sold off, with the US stock indexes notching a second consecutive week of losses. The S&P fell 2.08%, putting its December losses at 5.58% as hopes for a year-end rally fizzle. The Dow and Nasdaq slid 1.7% and 2.7% respectively.

The US dollar rebounded based on the Fed comments, with the dollar regaining some lost ground to close the week higher against its peers. The DXY rose moderately higher after hitting support one at 103 to close the week at 104.4. The yen also rose as a result of the risk-off sentiment and year-end closing of positions, which was exacerbated by fears of a global recession looming in 2023 as central banks continue to commit to hiking rates.

The yield on the benchmark 10-year Treasury note rose around 3-bps to 3.486%, after climbing back above the 3.5% level earlier, while the 2-year Treasury yield closed at 4.191%.

It was not just the Fed that was committed to hiking rates, the ECB also hiked rates by 50-bps on Thursday and said it would need to raise rates “significantly” further to tame inflation. The ECB chief Christine Lagarde further said that from the beginning of March 2022, the ECB would begin to reduce its balance sheet by 15 billion euros ($15.9 billion) per month on average until the end of the second quarter of 2023.

Gold and silver dropped by about 0.5% after falling midweek post the Fed comments in line with the dollar’s rebound, while oil prices managed to regain around 5% as the dust settles around the Russian oil price cap, and as analysts see higher oil prices ahead in 2023 after China relaxes on its zero-COVID policy. The USA also announced on Friday that it would start buying back oil for its strategic reserves which may support prices psychologically going forward. Both precious metals and oil are starting the new week a tad higher as the dollar retraces on the back of a rising yen before the BOJ’s final meeting of the year.

Crypto markets dropped in line with the general risk-off sentiment in the markets initially, however, the selling within the crypto sphere intensified on Friday after two auditors of crypto exchanges decided to end all relationships with crypto firms, sparking widespread confusion and panic.

However, prices are still being supported and have not broken the FTX-induced lows as the nascent sector continues to see dip buyers.

Whales and Shrimps Accumulate BTC As Price Dips

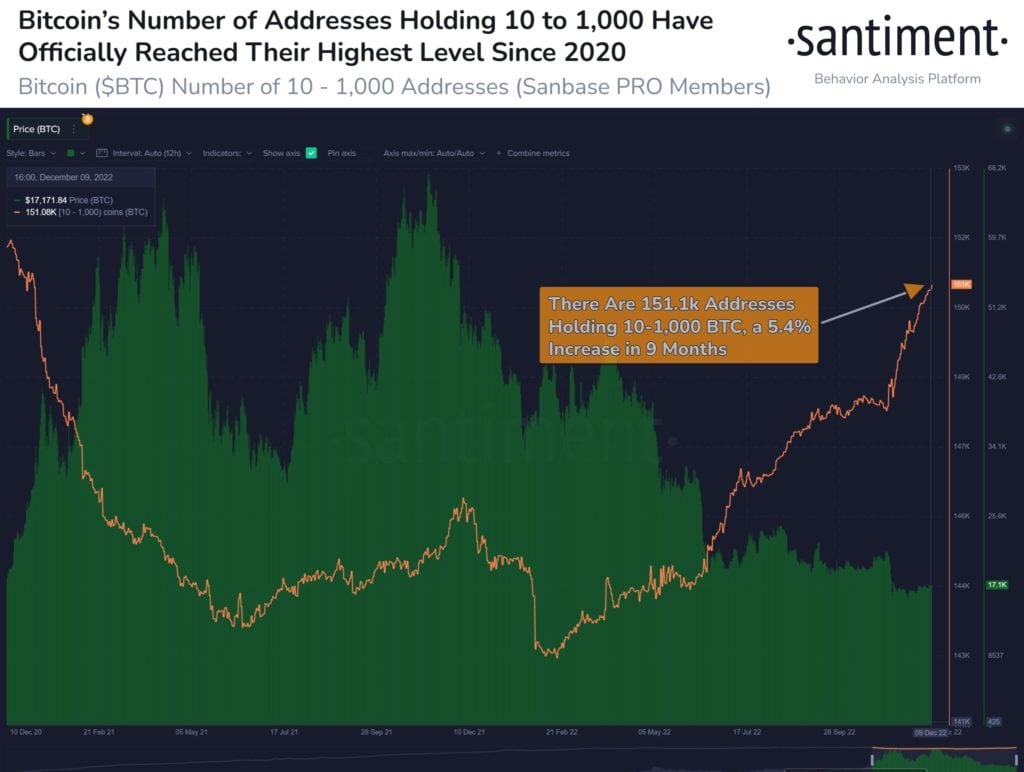

The number of addresses that hold between 10 to 1,000 BTC has increased to 151,080 recently. After a massive decline that began in December 2020, these addresses have increased significantly throughout 2022 as BTC has progressively become more affordable.

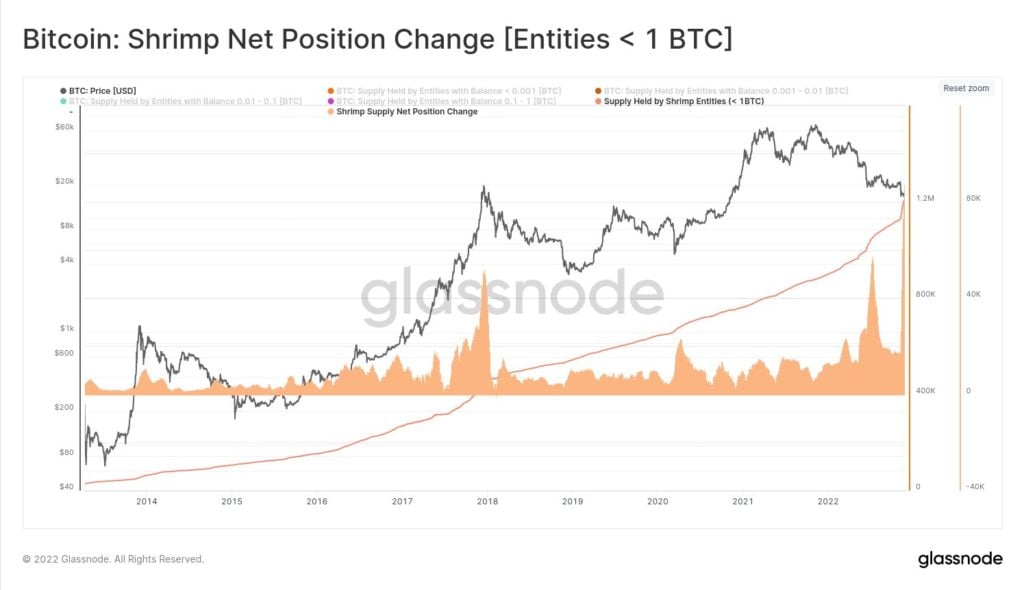

Smaller buyers, usually referred to as shrimps, i.e., holders with less than 1 BTC, have also been adding to their stacks, buying 96,200 more BTC to their holdings since FTX collapsed, which was the biggest increase ever. This cohort of holders now hold around 6.3% of BTC supply, around 1.21 million units of BTC.

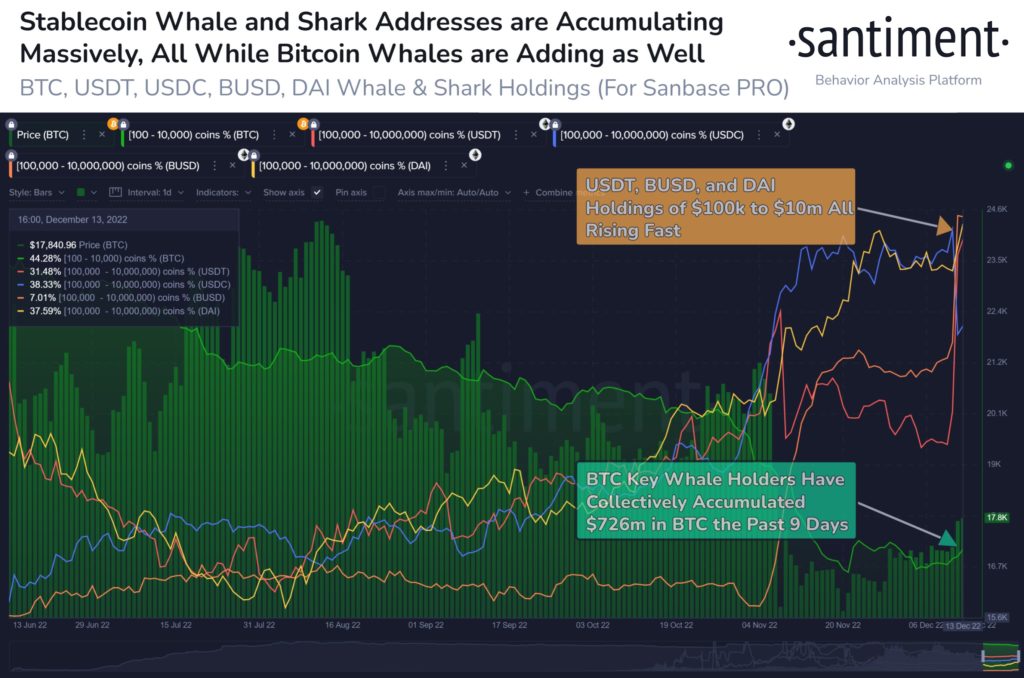

Even larger whales holding between 100 to 10,000 BTC have bought $726m in BTC the past 9 days, in a sign that shows that BTC holders in all categories, big and small, have been accumulating on this dip.

Another positive incident that could provide more crypto buying power ahead is that the purchase of stablecoins are also increasing, with the wallets of USDT between $100,000 to $10 million seeing the sharpest spike in number.

Historical Trend Suggests a Weak End to the Year

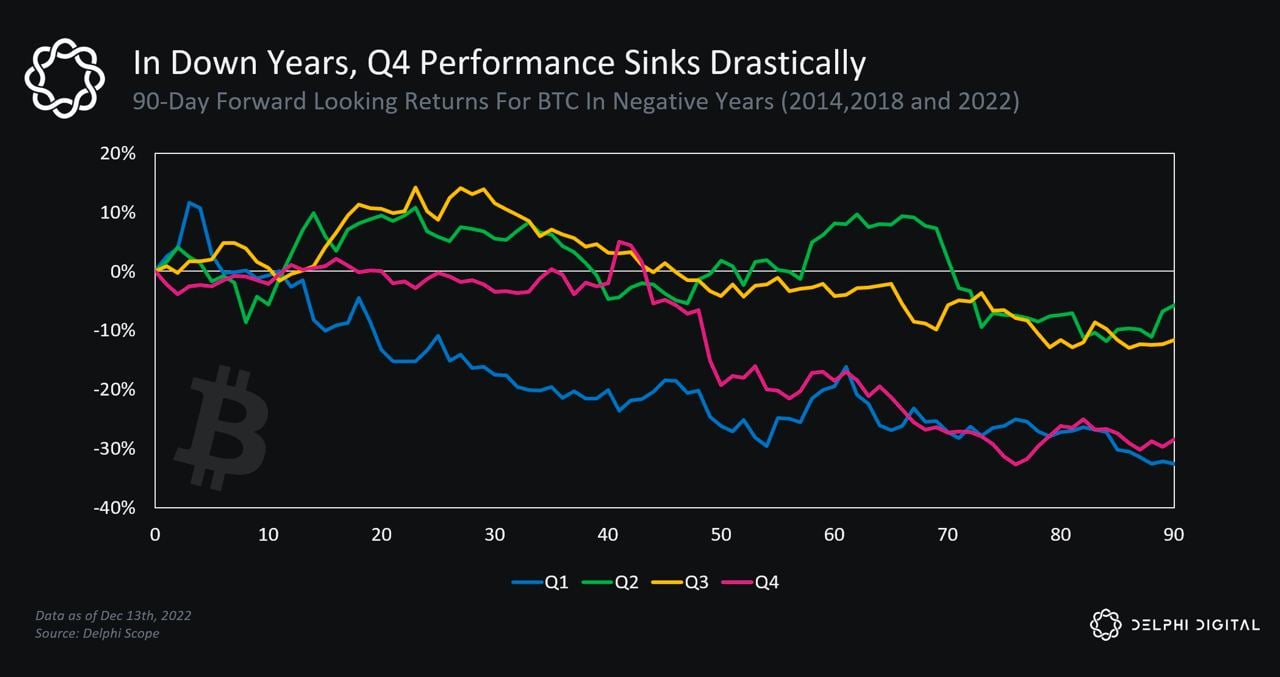

However, despite the accumulations, the price of BTC and other cryptos are not expected to do very well for the rest of December. This is because based on historical experiences, the price of crypto assets do not perform well in the final quarter of any year which coincides with a bear market.

Auditors Abandonment Sent Crypto Prices Tumbling

Another factor that caused the dump in crypto prices on Friday was the resignation of Mazars, an audit firm that has been working with crypto exchanges to publish “proof-of-reserves” in the aftermath of the FTX collapse. Mazars had recently issued a proof-of-reserves for Binance that has been heavily criticised for lacking in transparency, while also simultaneously working on the same report for other crypto exchanges like Kucoin, OKX, and Crypto.com. Other than Mazars, another accounting firm used by many crypto exchanges, Armanino, also announced that it would end all audit services to crypto firms with immediate effect. Both firms did not reveal the grounds by which they made this decision, which has escalated the fear amongst the crypto community. Coming on the back of the stronger USD post a more hawkish Fed and the selloff in the stock market, crypto prices dropped heavily by an average 10% as Friday came to a close. As more traders start closing off their positions ahead of the year end break, volatilities like this cannot be ruled out in the coming weeks, albeit possibly on light trading volumes.

Another rumor causing the market to sell off is that Digital Currency Group (DCG) is liquidating its altcoin portfolio in a bid to save the company from bankruptcy. While the rumor cannot be confirmed, it has caused the prices of altcoins to drop heavily by as much as 20% on Friday when the rumor broke, taking trader sentiments to a recent low.

Other than the abovementioned bad news, the start of the FTX trial, and a major FUD campaign by mainstream media on Binance, are giving crypto traders a lot more reasons to be fearful, and bearishness has spiked to the highest levels since June as the price of ETH dips below $1,200. Note the typo in the Santiment diagram, BTC did not dip below $1,200, ETH did, this error just shows how feelings are in the crypto space right now – no one is in a proper state of mind. However, historically, extreme levels of pessimism also give rise to the best investment opportunities and we shall know in a couple of weeks if this contrarian indicator has worked again this time.

For the traditional market, this week sees the final central bank meeting by the Bank of Japan on Tuesday, while the markets head off for the Christmas weekend after the release of the US PCE price index on Friday.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.