Following last week’s very strong close on the weekly chart, the price of BTC bolted out of the gates immediately upon the open. A stronger than expected US CPI number didn’t even manage to stop the firepower, with the price of BTC recovering from the initial knee-jerk by the end of Tuesday to put in a new yearly high of $52,500.

With the rise in price, BTC has reclaimed the $1 trillion market cap mark for the first time since December 2021. It now has a bigger market cap than stock giants such as Walmart and Tesla.

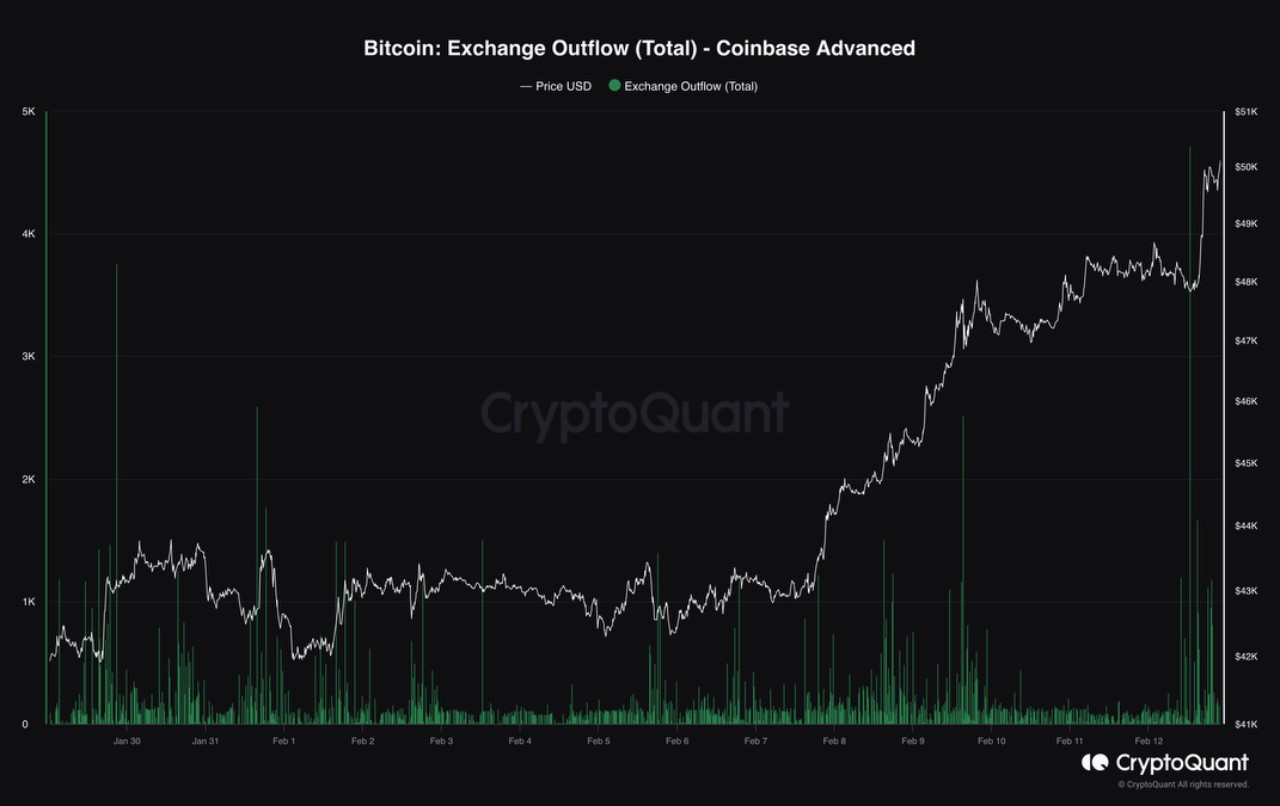

The rise in the price of BTC has primarily been led by spot purchases through the newly launched spot BTC ETFs, with inflows averaging around $500 million, or 12,000 BTC per day, over the past week. In fact, Blackrock’s spot BTC ETF saw its highest inflow last Wednesday, and has acquired more than $5 billion worth of BTC since its inception a month ago.

In contrast, the outflow from Grayscale has trickled to around a 2,000 BTC per day average last week. As a result of the strong positive net flow, the price of BTC marched strongly higher without any pullback as the inflows kept going, especially during the hours when the US market was active.

Investor sentiment is getting so bullish that some firms are even calling for BTC to break ATH by the end of March.

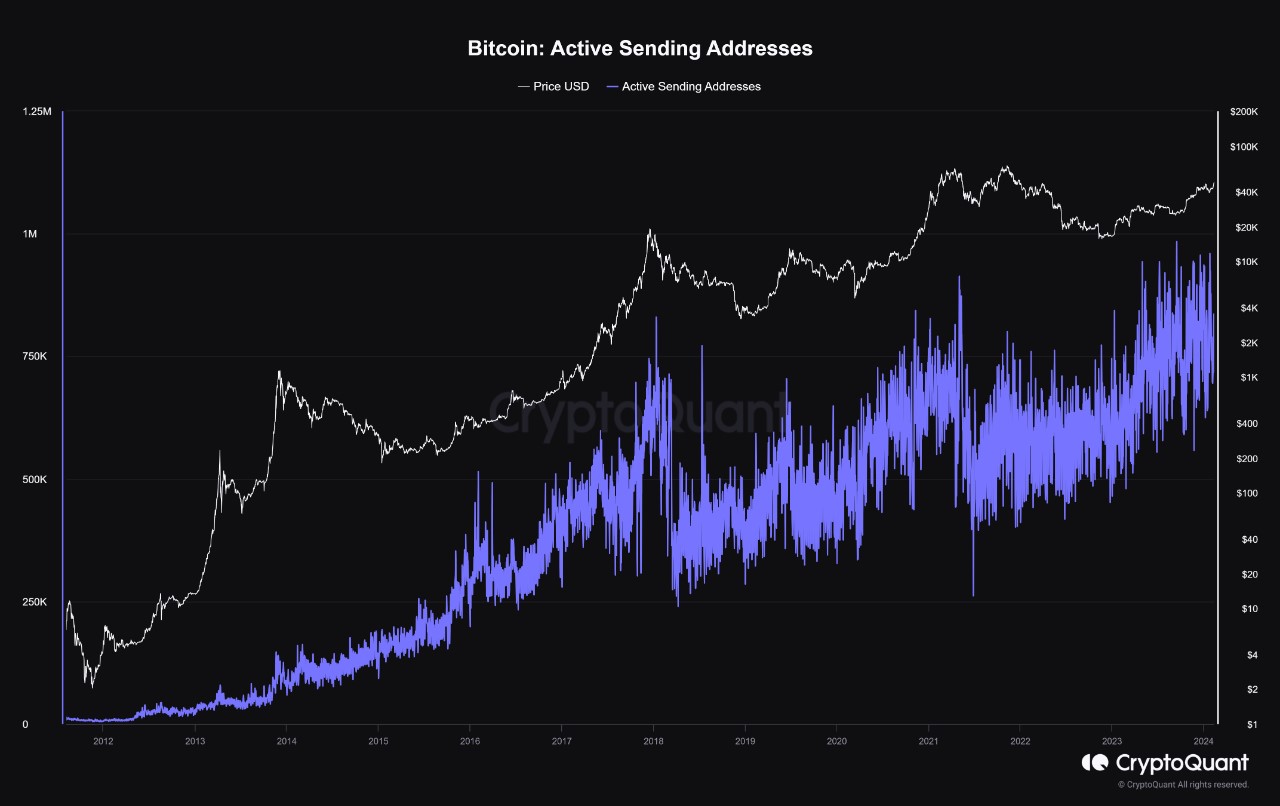

While the number of active BTC wallets used when sending or receiving BTC, which is usually a leading indicator of future price, is indeed showing a very strong trajectory, it may still be a tad soon to think BTC could break $69,000 in a month’s time. Regardless, this particular metric is showing a steep uptrend that has created a new ATH. The increase in active wallets implies a higher demand for BTC as more people are transacting with the coin, which is a sign of increasing adoption in the blockchain. The current number of active addresses has risen past its previous ATH made during the 2021 bull market, which could imply that the price of BTC in the current cycle is on the way to breaking its ATH very soon, even if it does not do so by the end of March.

Market not overheated, retail participants absent

However, despite many bullish calls, the crypto market is surprisingly not overheated yet, especially for BTC, as most of the BTC inflows were spot demand from the ETFs, which means this rally could possibly have some sustainability.

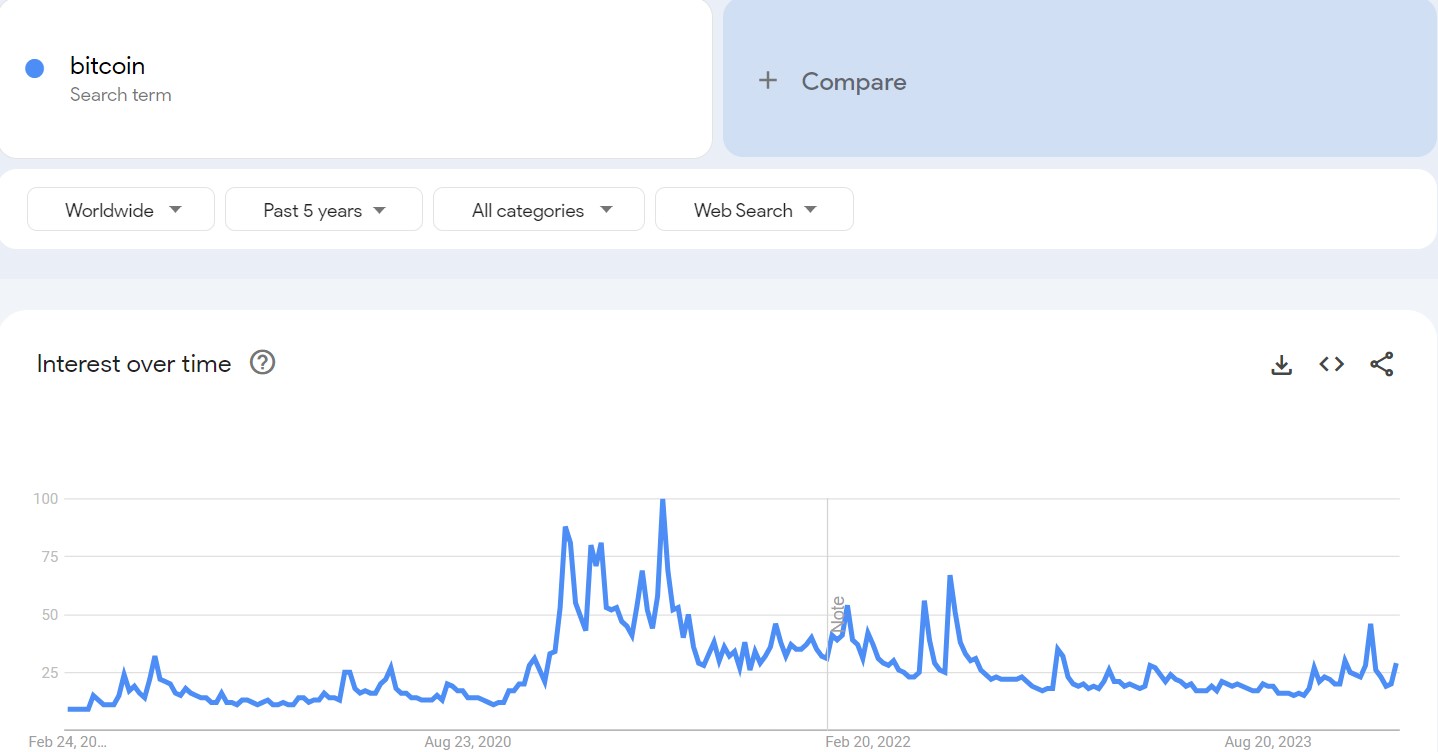

To know the extent of retail market participants’ interests however, a google keyword search may be a good indication. As we can see from the results below, despite the roaring demand from the spot BTC ETF, retail searches for “Bitcoin” is still at a bear market territory, suggesting that retail participants are barely entering the space.

This could imply that most of the current price trajectory could be institutional led, which traditionally have more staying power than the retail demand.

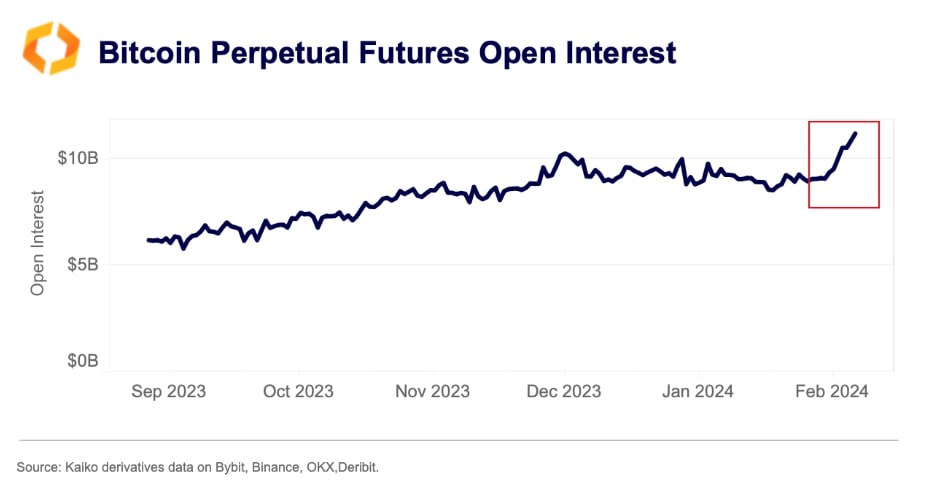

Other than spot demand, institutional investors are also bidding up BTC in the futures market, as can be seen in the below diagram which shows the BTC futures open interest (OI) rising steadily to a new ATH of beyond $11 billion after the spot ETFs were launched.

While BTC OI has hit a new ATH, funding rates are still at a historically low region, which suggests that the market is not yet too overheated.

In other words, the current situation playing out is suggesting that BTC is becoming a mainstream investment asset for “serious” investors. Even Fidelity Investments is said to be allocating between 1-3% of its long-term conservative fund to BTC, cementing BTC’s status as a safe asset.

This acceptance of BTC by traditional heavyweight investment firms could pave the way for the acceptance of other crypto assets like altcoins by the mainstream “serious” investors, which could usher in a large inflow of funds into them.

High profit ratio may cause prices to pullback

However, despite the good fundamentals, in the short-term, there may be some profit-taking pressure coming from investors as the percentage of BTC in profit has risen to a level that historically would be tempting to profit-take.

Currently, 97.3% of Unspent Transaction Output is in profit, which is historically a level that may see profit-taking from short-term and mid-term investors.

Furthermore, the immediately forthcoming macroeconomic picture may not be as favourable as before for crypto since data released last week showed that inflation could be rising again, which may postpone the chance of a FED rate cut.

Resurgence of inflation rattles stocks

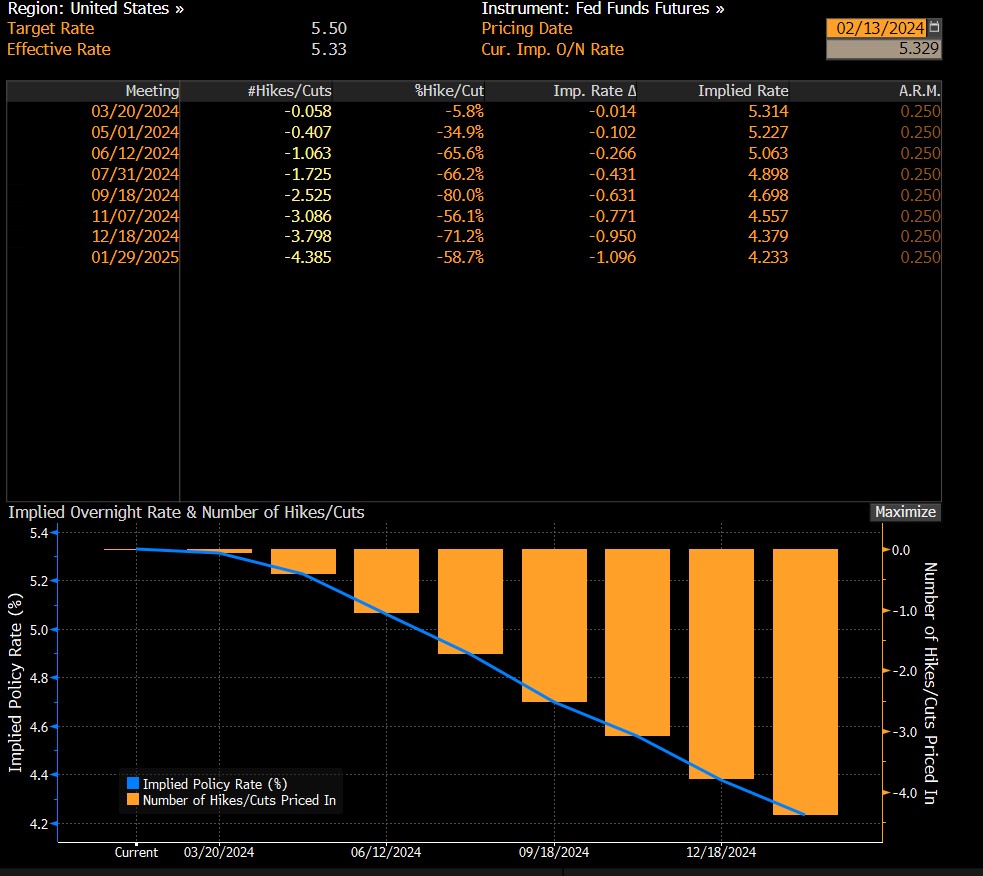

On the topic of inflation, US CPI numbers released last week came in stronger than anticipated, causing a temporary blip in stock prices on Tuesday as traders began to fully price out the possibility of a rate cut in March.

The CPI index increased 0.3% in January, and on a year-over-year basis, it came out to 3.1%, down from 3.4% in December. However, as the market was only expecting a monthly increase of 0.2% and an annual gain of 2.9%, the number was much hotter than expected.

Treasury yields surged higher immediately as even the odds of a May cut were reduced to about 35%, and stocks had their worst rout since March 2023, with the Dow losing more than 500 points on Tuesday alone.

While stocks managed to regain some lost ground mid-week, the three major US averages still ended in the red after a huge miss in the retail sales number. The hotter than expected PPI readings that came out on Friday also did not help sentiment. Economists expected the core PPI to rise by only 0.1%, however, the figure came out to be 0.5%, which was much higher. This caused yet another spike in Treasury yields and erased all hopes of a March rate cut.

As a result, all three major US indexes broke their five-week winning streaks to end in the negative last week. The S&P lost 0.42%, while the Dow slipped 0.11%. The Nasdaq tumbled 1.34%.

The higher US yields sent the dollar modestly higher, rising by 0.2%, while Gold slipped 0.6%. Silver on the other hand, rose 3.5%, as chatter of short covering hit the market after Tuesday’s CPI numbers. Oil gained for the second week, as Brent edged 1.5% higher, while the WTI rose 2.4%.

This week, the China market comes back into full swing, while the US market will be closed on Monday for the President’s Day holiday. On the data front, the key event risk may be the manufacturing PMIs due out on Thursday, while Wednesday will bring about the FED meeting minutes of the last FOMC meeting.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.