Crypto prices continued to plunge last week after a small bounce on Martin Luther King’s holiday when the large institutions were not at work. However, as soon as the fund houses returned, the price of BTC started breaking down further, as loads of BTC were observed to have been sent out from GBTC for sale as its customers went on a redemption spree.

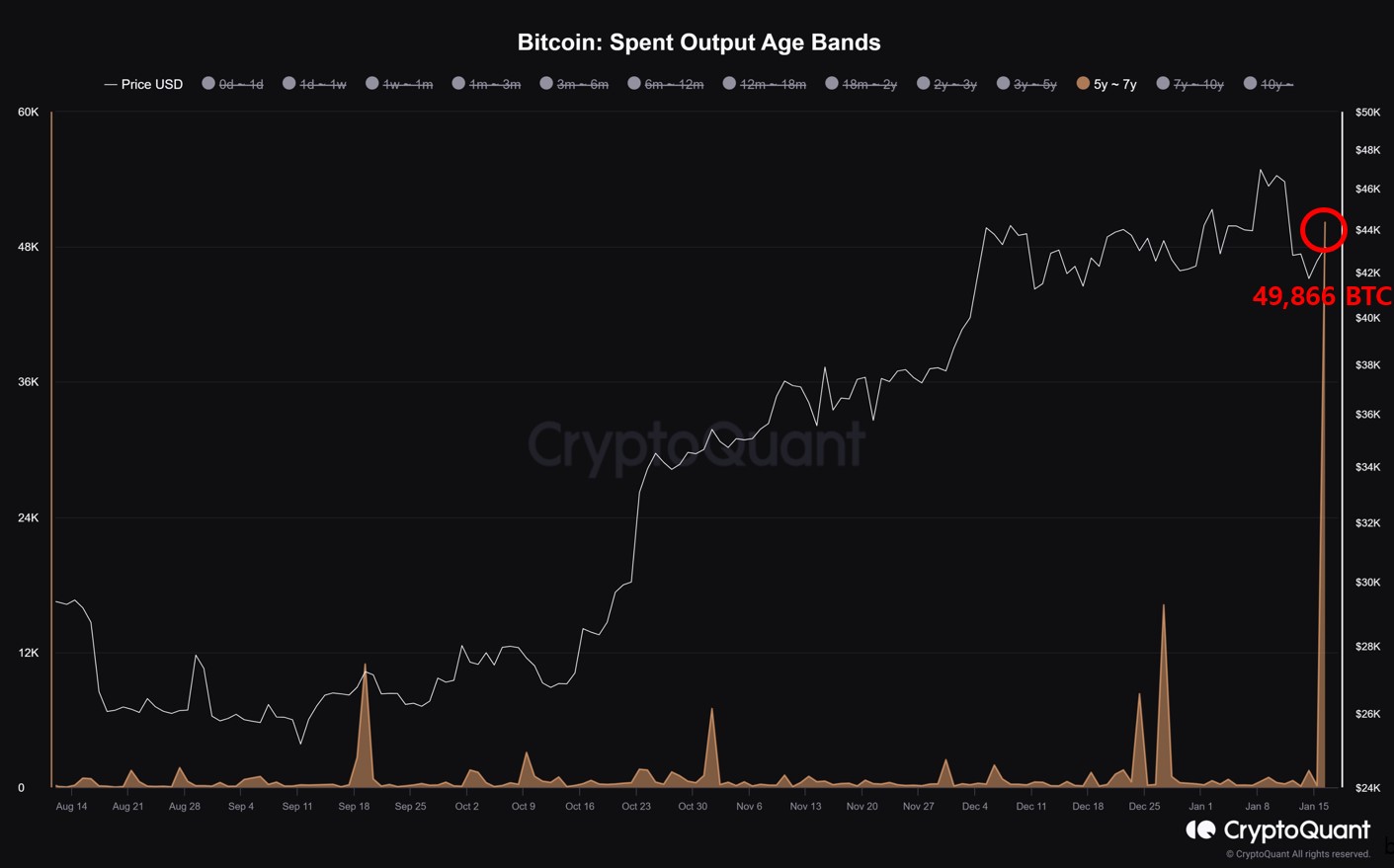

Furthermore, GBTC appeared to not be the only big seller, as a batch of 49,866 BTC that had been held for around 6 years was released into the market at around the same time. Such intense selling pressure, needless to say, put a heavy hand on the price of BTC, which could not even manage to put on any small technical rebound as its price crashed almost 10% from $43,500 to $40,200 even after a big 15% fall the week before.

Spot ETF buyers could not absorb BTC sales

The large fall was not due to a lack of buyers, in fact, the newly listed spot ETFs saw a net inflow of more than $1 billion, amongst which Blackrock and Fidelity had the highest inflows. Simply put, the size of the buying was barely enough to contain the amount of selling pressure as clients of Grayscale sold out of the GBTC to take profits after not being able to redeem them for 3 years. The much higher fee charged by Grayscale could have also prompted its clients to sell out from Grayscale in order to rotate into other lower fee spot ETFs, which added to the amount of selling.

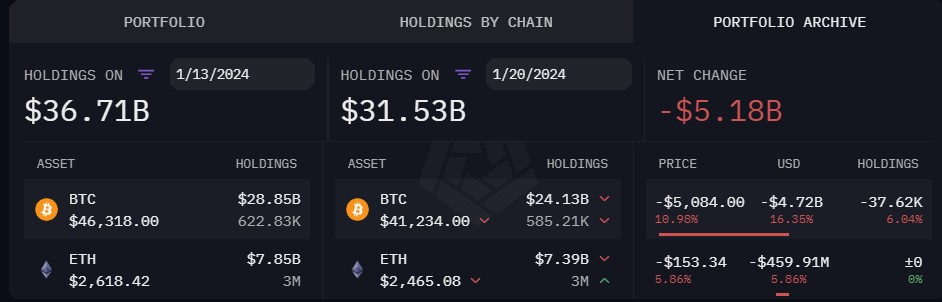

By the close of Friday, GBTC had offloaded around 37,600 units of BTC. As the weekend beckoned and the trust went on its weekend break, the price of BTC saw a reprieve, rebounding from Friday’s low of $40,200 to trade above $41,500. However, whether this was only a weekend breather or a more sustained rebound remains to be seen, as Grayscale still has around 585,000 units of BTC that its customers may very likely choose to sell in the days and weeks ahead.

With the potential redemption of Mt Gox and Celsius’ ongoing sale of crypto assets to return to investors, the possibility of more or even all clients of GBTC selling is high, especially after the price of BTC has risen by more than 250% over the past year and is currently looking to have over-extended its run in the short-term since the hype of the spot ETFs is now over. The crypto market had been getting too frothy due to the hype of the BTC spot ETFs and this overheatedness could take some time to cool off.

One interesting way of determining the level of froth in the market could be by looking at the Korean Premium, which often disappears during bear markets and re-emerges during bull markets.

Korean premium suggests BTC overheated

The historical chart below shows that when the Korea Premium surges by more than 3% relative to the Coinbase Premium, US investors are selling and South Korean (mostly retail) investors are buying BTC. Usually an increase in the Korean relative price of BTC, commonly known as the Kimchi Premium, is a sign of overheatedness, which indicates that BTC’s price may need to cool off in the short-term.

As can be seen from the diagram, typically, the price of BTC may undergo a period of consolidation for several months even after the Kimchi Premium reverts to its mean, which could imply that the market may remain lacklustre for another few weeks even after the price of BTC manages to find its new floor.

However, a consolidation in the price of BTC could bode well for altcoins as hot money moves to seek higher returns elsewhere. Thus, while the going looks bleak now, the altcoin market may present us with several good trading opportunities in the days ahead. This is especially after a big wall of worry has been lifted off altcoin investors in the latest Coinbase vs SEC lawsuit.

Judge sided crypto in SEC lawsuit, long-term bullish

Despite the current bloodbath in the market, the crypto space is not without good news. During an important hearing in the Coinbase vs SEC lawsuit mid last week where the SEC allegedly claimed that many cryptocurrencies were securities, the judge leaned on the side of crypto and commented that the methods that the SEC used to justify their classification of assets is out of date and that new rules ought to be created for the crypto asset class instead on relying on the old standard. While there was no summary judgement as yet which means that the lawsuit will still continue on, it nonetheless is very good news that even the law is beginning to take the side of the nascent industry and allow space for it to grow. This is good news for crypto and especially for altcoins and the burgeoning DeFi space. Hence, with this piece of news, the DeFi coins could come back to life once the price of BTC settles down.

Furthermore, long-term BTC metrics clearly proves that we are in the early stages of a larger bull market ahead, which means that dips will be for buying.

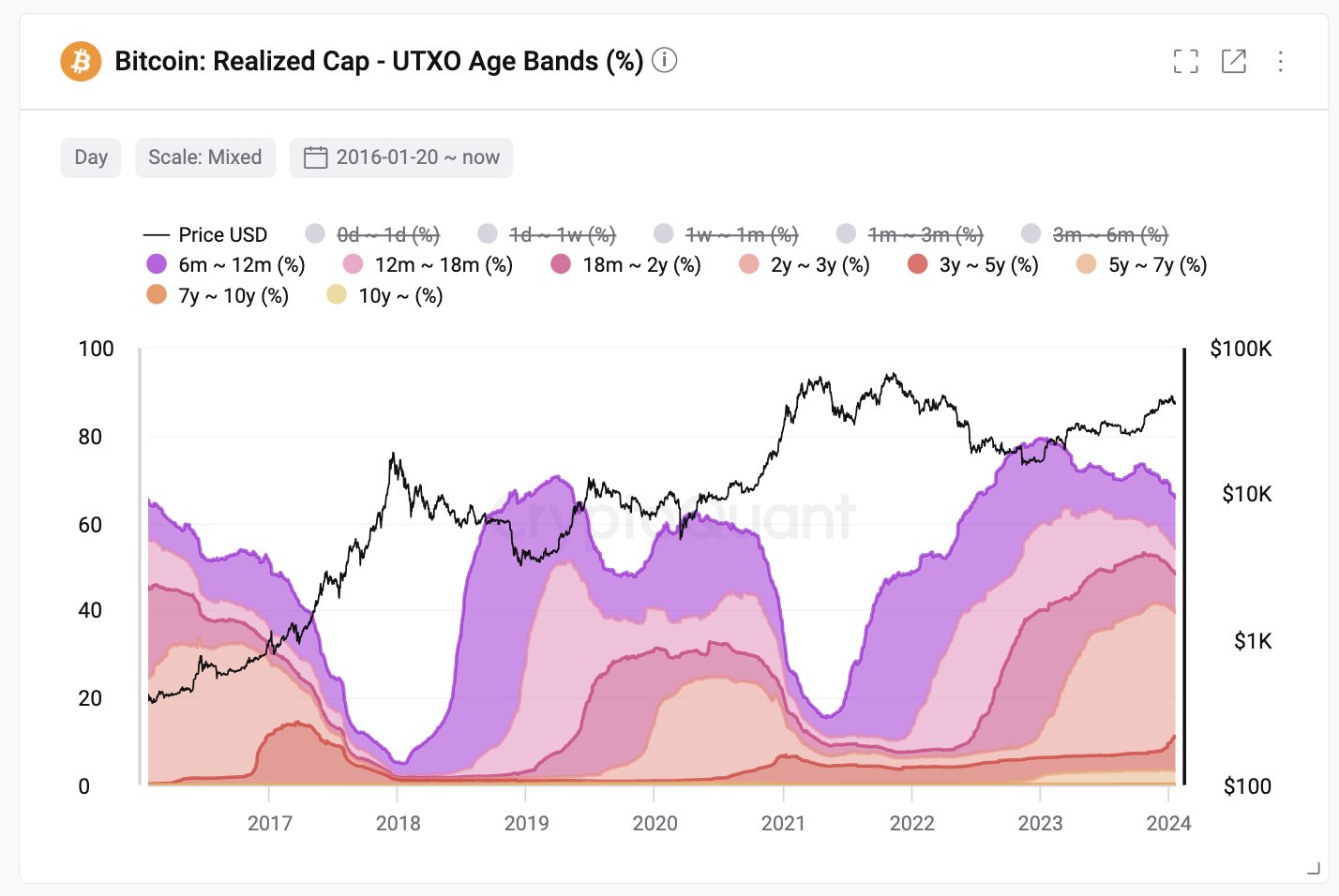

As can be seen by the UTXO Age Bands diagram below, typically, BTC price moves into a strong uptrend as the BTC long-term supply held by whales start to dispose of their BTC bought during the depths of the bear market, and this sale would happen throughout the bull market until all the supply has been let go.

For the current situation, this new cycle disposal has only just begun, indicating that there is a lot more room for the price of BTC to climb much higher in the same cycle.

Benign US economic numbers boost both stocks and dollar

US stocks closed modestly higher again after a mixed week which initially saw some selling pressure after Fed Governor Christopher Waller told a virtual conference that he sees no reason to cut rates as quickly as he had previously expected given the healthy state of the economy. His comments caused US yields to increase again and led the dollar to a 1% rise over the week against its peers.

Expectations for rate cuts this year also fell sharply after Waller’s comments, with the futures markets pricing only a 13.1% chance of seven or more rate cuts in 2024 as of the close of trading on Friday versus 61.5% the week before. Chances of a rate cut in March fell from 81.0% to 47.4%.

However, the stock market recovered after better-than-expected economic numbers were released. Wednesday’s December retail sales numbers exceeded expectations, suggesting that the consumption side of the economy is still in pristine shape. On Friday, the University of Michigan issued a preliminary report that its index of consumer sentiment jumped in January to its highest level in nearly three years and by the most since 2005, a sign that consumers are feeling confident in the economy.

Tech and growth stocks were the leaders as the Nasdaq rose by 3.1%, the S&P gained 1.3% and the Dow edged higher by 0.8%. Gold slipped by 0.87% as the dollar rose, while Silver lost around 2.3%, while oil traded around 1% higher due to the persistent hostility between the US and the Houthis fighters in the middle east.

This week, Monday night will see the BoJ holding its first meeting for the year, the BoC will meet on Wednesday, while the ECB will be meeting on Thursday. On Friday, the PCE price index which the FED usually looks at to measure inflation will be released. This will be the last important economic release before the FED meets next week.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.