Stocks had their worst week since June 2022 on the back of several factors last week. The negativity started after Fed Chair Powell said in testimony on Tuesday that inflation may be higher than expected, the latest economic data is stronger than expected, and the Fed would be ready to accelerate the pace of interest rate hikes if necessary, and asked the market to prepare that the terminal rates may be higher than previously anticipated, leading to a 500-point selloff on the Dow.

The selloff escalated as the week pressed on after the fast unravelling woes at Silicon Valley Bank caused a major selloff on US bank stocks. The troubled bank collapsed on Friday after failing to raise capital to meet its obligations. The shocking news rocked global stock markets, with the main casualty being US financial stocks, with the SPDR S&P Regional Banking ETF losing almost 16% for the week. The three major US averages also lost their most since June 2022. The Dow fell 4.44%, the S&P dropped 4.55%, while the Nasdaq lost 4.71%.

The turmoil among bank stocks overshadowed Friday’s release of February’s employment report, which showed that while payrolls increased more than was expected, the wage-gain was smaller than expected, which traditionally would result in an easing of the rate of inflation in the coming months. This again could signal to the Fed that a continued hawkish stance may not be necessary, especially coming after the implosion of Silicon Valley Bank which could have serious damaging repercussions within the economy as companies that have held deposits at the bank could no longer have access to their money. Market experts are expecting more bank failures to come in the days ahead if the contagion at Silicon Valley Bank is not contained well.

Thus, markets are now repricing the chances of a 50-bps rate hike in light of the new uncertainty in the financial market post Powell’s speech on Tuesday. With new troubles at Silicon Valley Bank, traders are now expecting the Fed to only raise rates by 25-bps on the 22 March meeting. In fact, some traders are even beginning to predict that the Fed would need to start cutting rates by December 2023. This has caused the dollar to slip heavily on Friday and as a result, gold jumped by 2% on Friday and was 0.8% higher for the week.

Interestingly, the fear of contagion spreading in the US banking system has caused investors to start putting money back into the crypto market again, sending crypto prices bouncing higher in the weekend after a series of new crackdowns by the US regulators drove crypto prices lower early in the week.

BTC Broke Below $20,000 Initially as Regulatory Crackdown Intensifies

Even as crypto investors were still digesting news of Silvergate bank’s liquidation news and its impact on the crypto-fiat ecosystem in the USA, regulators from the USA again sent yet another poison pill to the market.

This time, the New York State Attorney General (NYAG) filed a lawsuit suit against crypto exchange KuCoin, alleging the exchange is violating securities laws by offering tokens including ETH, that meet the definition of a security without registering with the attorney general’s office. The fact that ETH had been named as a security in the lawsuit caused sentiment in the crypto market to sour even as investors were still trying to make sense of the impact the collapse of Silvergate would have.

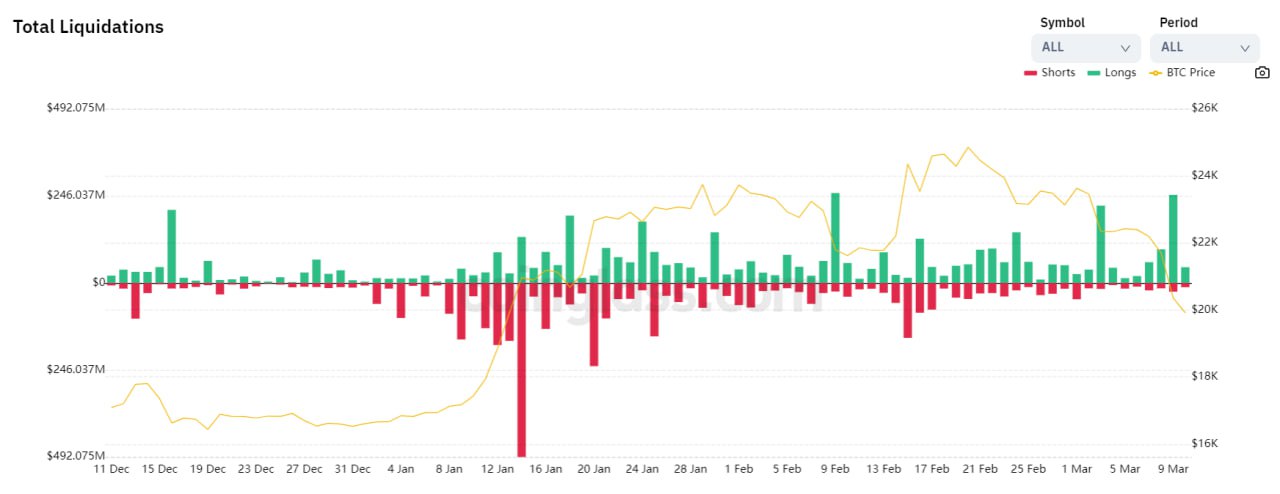

According to the lawsuit, the NYAG’s office believes ETH, LUNA and the UST stablecoin, all traded on the exchange, are securities. The price of ETH plunged 8% within 30 minutes after the suit was revealed, with the broader crypto market similarly plunging, liquidating around $250 million worth of long positions on Thursday.

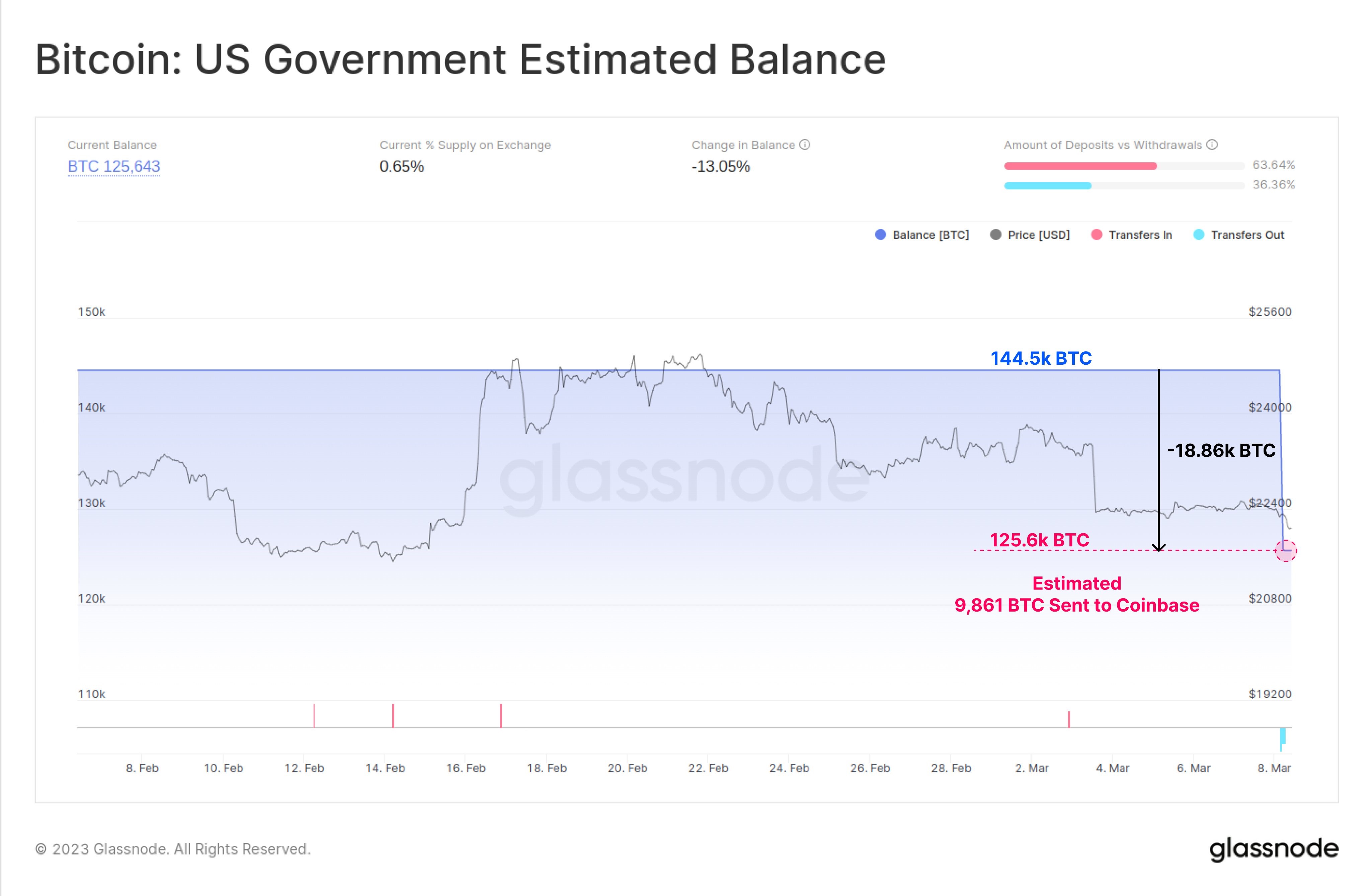

The sharp fall in crypto price was further made worse by the selling of close to 10,000 BTC by the US law enforcement department which had seized these BTC from lawbreakers over many years. While more than 18,000 BTC left the wallet, only 9,861 were proven to have been sold through Coinbase.

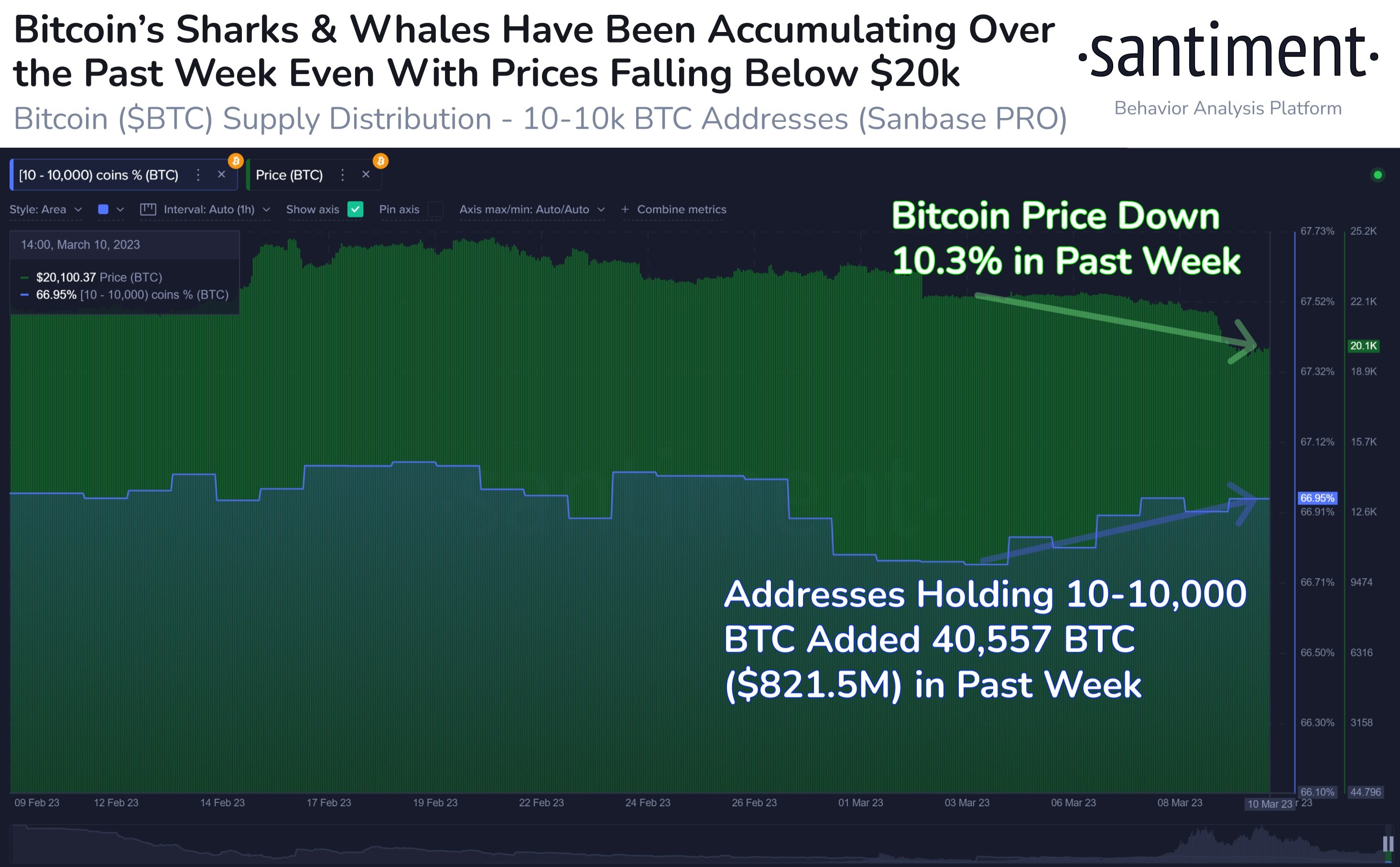

Whales Unfazed and Buys 40,557 BTC During the Dip

However, even as US regulators continued to put pressure on the crypto industry, whales did not appear to be worried and have been taking the dip to accumulate more BTC. Last week, as the price of BTC plunged 10%, whale addresses holding between 10 to 10,000 BTC have collectively added more than 40,000 BTC in the same timeframe.

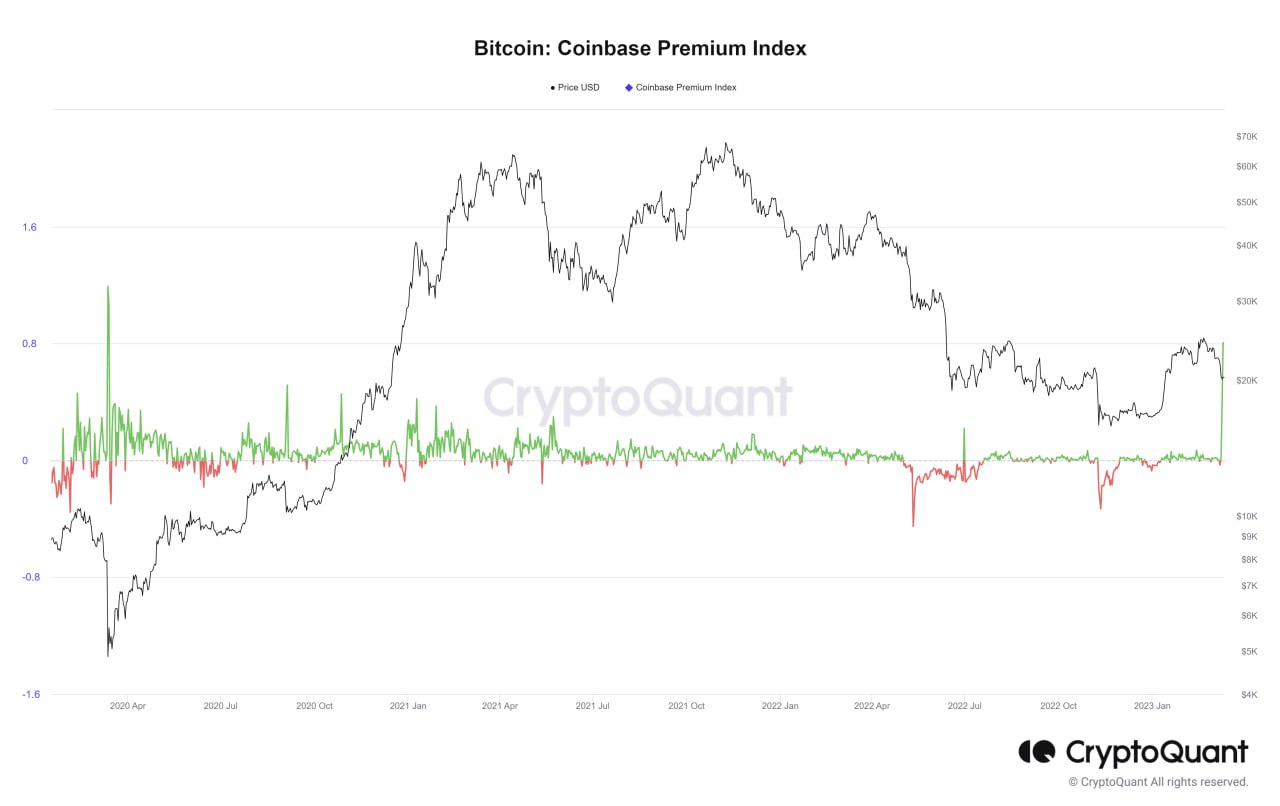

Coinbase Premium Spikes To Historically Key Levels

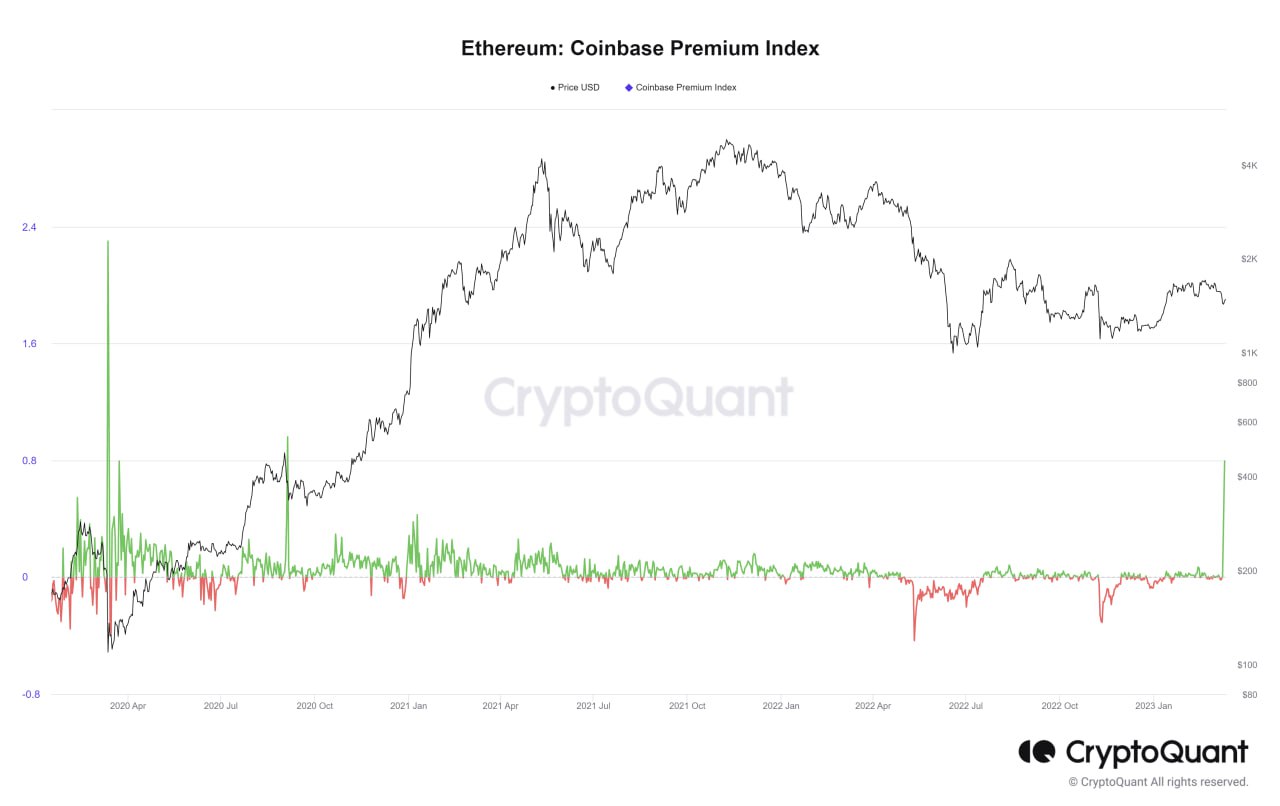

The most intriguing part of the whale purchases are that they appear to be out of the USA, as the Coinbase premium spiked significantly higher in the after-hours on Friday night from a negative value, and continued through Sunday to its highest premium since the COVID crash of 2020. The key point to note is that the price of BTC started recovering and began its bull run immediately after the huge spike in the Coinbase premium of that time. Could a similar situation play out this time? Only time will time.

Similarly, the same thing happened to the Coinbase premium on ETH. While not as large a spike as that seen on BTC, the Coinbase premium on ETH rose to its highest level since October 2020 on Sunday, which could be a sign that huge buyers from America are also moving into the number 2 crypto.

The spike in the Coinbase premium on important crypto assets could imply that American money is making its way back into the crypto market even as US regulators try to relentlessly clampdown on the sector, possibly due to the current fallout in the traditional banking sector led by the collapse of Silicon Valley Bank.

Altcoins Back in Buy Zone After Heavy Losses

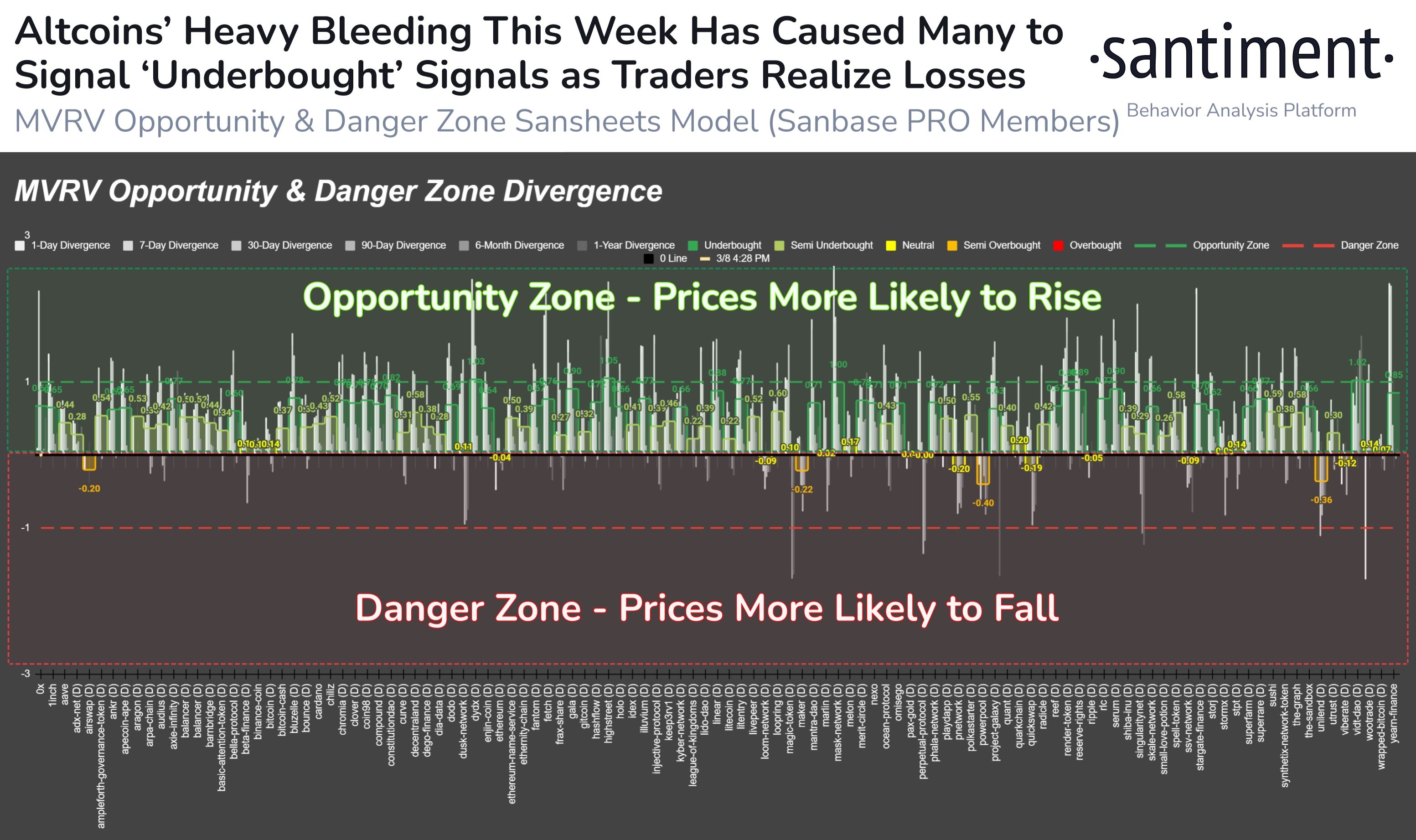

It is not only BTC and ETH which are looking attractive to whales. According to the MVRV metric which we often use to look for value buys within the crypto market, most altcoins have fallen back into the “opportunity zone” since the selloff, which implies that the current rout may present itself as a good dip buying opportunity as on a historical average, when the MVRV hits the current level, the chances for prices to rise is much higher than for prices to continue falling.

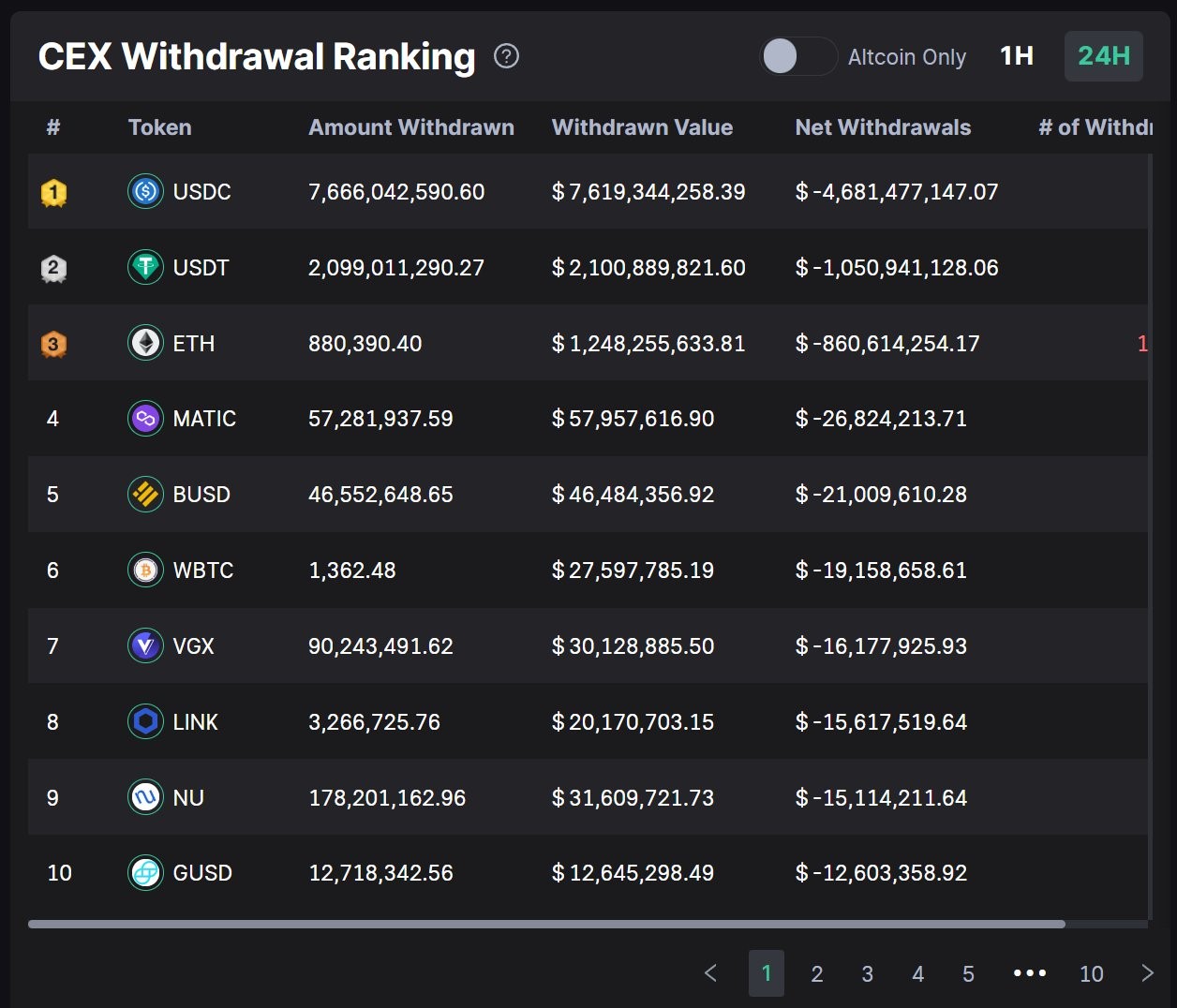

Run on USDC Causes Stablecoin to Depeg

After stablecoin issuer Circle, who issues USDC, revealed that it had around 25% of its cash balance (around $3.3 billion) stuck with the beleaguered bank late Friday night, panicked holders of the USDC stablecoin sped to withdraw, redeem and convert whatever USDC they had into a safer stablecoin, the USDT, which was the only stablecoin that managed to keep its $1 peg over the weekend. Many even resorted to converting their USDC into BTC and other cryptos. This caused the pricing of cryptocurrencies in USDC to be almost 10% higher than with other stablecoins. At one point, the value of USDC even went as low as $0.87. On Friday, USDC saw its largest withdrawal in history, with more than $7.6 billion withdrawn from crypto exchanges and $2.4 billion burned (redeemed) within mere hours of Circle’s revelation. However, after some assurances by the management of Circle on Saturday, the value of the USDC stablecoin has slowly recovered towards $1.

Crypto Sees Huge Bounce on Sunday After US Regulators Assure Deposits

On Sunday, after the whole weekend of meetings, US regulators finally announced that they would honour all the deposits at Silicon Valley Bank and Signature Bank, which allowed everyone involved to breathe a big sigh of relief. Along with that move, the Fed also said it is creating a new Bank Term Funding Program (BTFB) aimed at safeguarding institutions affected by the market instability of the SVB failure. The Fed facility will offer loans of up to one year to banks, saving associations, credit unions and other institutions. Those taking advantage of the facility will be asked to pledge high-quality collateral such as Treasurys, agency debt and mortgage-backed securities.

The program reminded crypto investors of TARP, which was the preincarnate version of QE invented in the aftermath of the Lehman crisis in 2008, in which the Fed printed money to support the financial markets to prevent it from crumbling. The news was welcomed by crypto investors as they expect the Fed to have to start becoming more dovish to prevent the current banking system stress from spreading. BTC and ETH jumped 10% immediately, liquidating around $160 million of short positions. Altcoins also jumped, with many battered coins like FTM, DYDX, OP, GALA jumping 20% overnight.

US stock futures are trading higher as Asian traders await the action to start on Wall Street, while the latest rescue plan is causing the dollar to bleed by 1% while at the same time, sending the price of gold and silver higher by 1.5%.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.