US Treasury yields began to shoot higher on Tuesday after the release of the August CPI numbers which was higher-than-expected. The CPI for August increased 0.1% vs expectations of a 0.1% drop, while on a year-over-year basis, prices rose 8.3% against market expectation for 8%. This prompted a huge selloff in risky assets like stocks as traders are beginning to price in a 100-bps point hike next week against a 75-bps hike expectation earlier on. Experts are now worried that the Fed will need to hike a lot more to contain inflation. The 1-year US Treasury yield has already hit 4%, signalling that traders expect another 150-bps at least for this year.

On Tuesday alone, the Dow plunged more than 1,200 points or 3.94%, the S&P 500 sank by 4.32%, and the Nasdaq tanked 5.16%, wiping out all their recent gains in September.

The yield on the 2-year Treasury, the part of the curve most sensitive to Fed policy, soared to 3.9%, its highest level since 2007, before retreating a tad to 3.87% by the close of Friday, while the yield on the benchmark 10-year Treasury note surged to 3.453%. This is the steepest yield curve inversion for the US Treasuries in 40 years, as traders prepare for short-term interest rates to spike a lot more for the next couple of months.

Investor sentiment at the close of the week was made much worse after profit warning from FedEx, a bell weather logistic and transport sector stock that was a benchmark for the state of the global economy.

By the close of Friday, the Dow had lost 4.1% for the week, the S&P declined 4.8%, while the Nasdaq sank about 5.5%. This was the fourth losing week in five for all three major indices, making the summer comeback rally look increasingly like a bear market bounce.

Over in Europe however, inflation looked a little better in the UK after fuel prices pulled back. The UK CPI for August surprisingly eased to 9.9% instead of 10.2% as expected. The inflation number for July was 10.1%. This caused the pound to slide as investors weighed the possibility of a less aggressive rate hike this week in UK as a new Prime Minister has just taken office.

After an initial bounce at the beginning of the week, the GBP/USD is back lower, at one point even breaking the $1.14 level to clock a 37-year low against the USD. Against the Euro, the pound was also weaker, with the EUR/GBP closing at the highest point of the week at 0.877 pounds.

The EUR/USD also weakened after the US CPI numbers, giving back its early week magnificent bounce to $1.02 in a hurry. The EUR/USD is back at parity again after a roundabout trip.

With the dollar’s strength comes weakness in precious metals prices, albeit not by a notable amount. Gold broke below $1,700 to close at $1,675 while Silver only lost a tad and maintains at $19.60 for a stronger showing, possibly due to economic figures out of China that were better-than-expected over last week.

China is also reopening some regions that had been shut down due to COVID cases in the last couple of weeks, lending some support to oil prices even as the dollar surged. Both Brent and the WTI closed the week around the same level as where they started and are about 1% higher in the fresh week.

Meanwhile, the week in cryptocurrency was focused on the Merge, where ETH would move from PoW to PoS. While the Merge was a successful one, controversies regarding its centralization as well as which fork would eventually become the dominant PoW chain took centre stage. There were lots of bantering amongst BTC maximalists and ETH PoS supporters and ETH Pow supporters as well as each had their own take on which was the “better” chain.

ETH Price Dips After Successful Merge

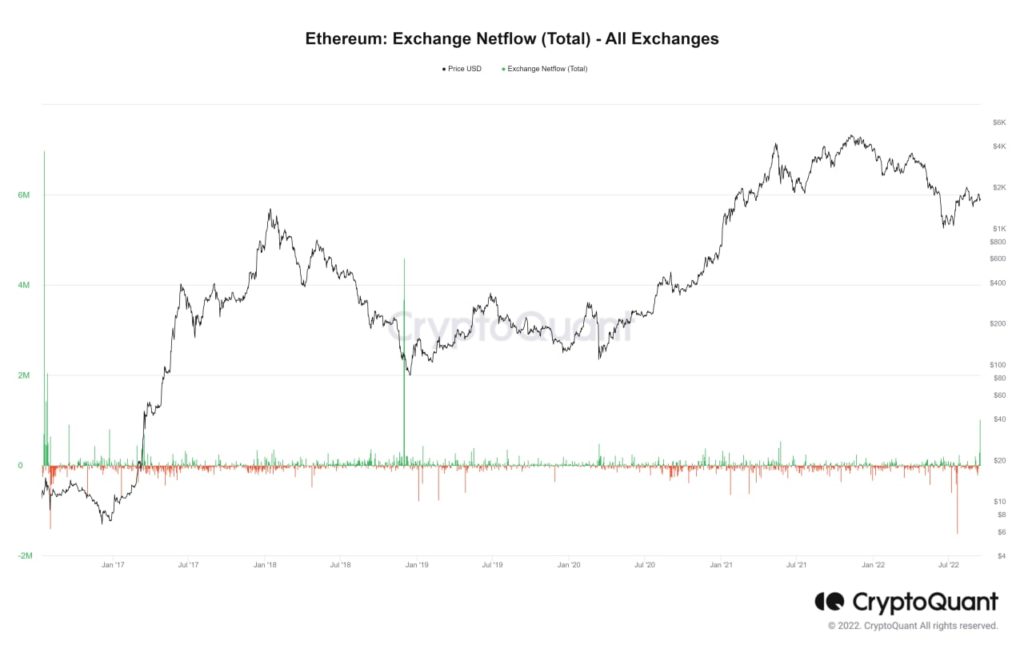

On ETH, as the Merge approached, large volumes of ETH were seen sent to exchanges as investors who were buying for the fork prepared to sell after the snapshots were taken.

This caused the price of ETH to retreat after news of a successful fork was announced and that snapshots had been taken.

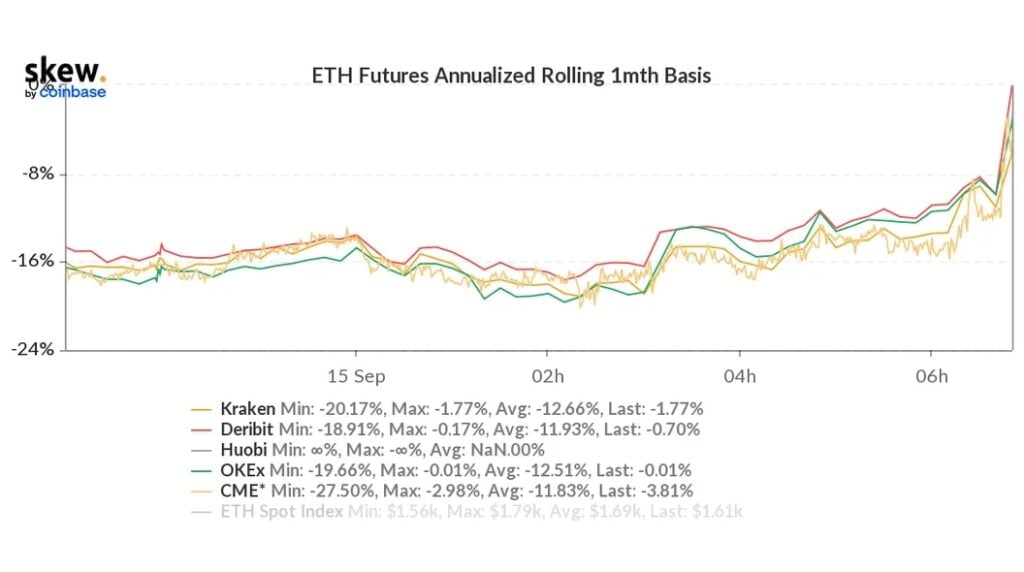

As shorts on the ETH futures markets were no longer required for hedging, traders closed their short positions on ETH futures and caused the futures basis to go back to zero. At its highest point, the 1 -month futures were trading at $20 discount to spot, but this has reverted to zero following the successful Merge. The price of ETH has also declined by more than 20% over the week since the Merge.

The price of ETH could have been weakened further by comments made by SEC Chairman Gary Gensler on Thursday post the ETH Merge that most PoS blockchains could pass the Howey Test and be considered securities. While his comments were nothing new, the fact that he reiterated them straight after ETH moved to PoS unsettled many ETH investor nerves.

BTC Exchange Inflow Spiked, Is Dump Imminent?

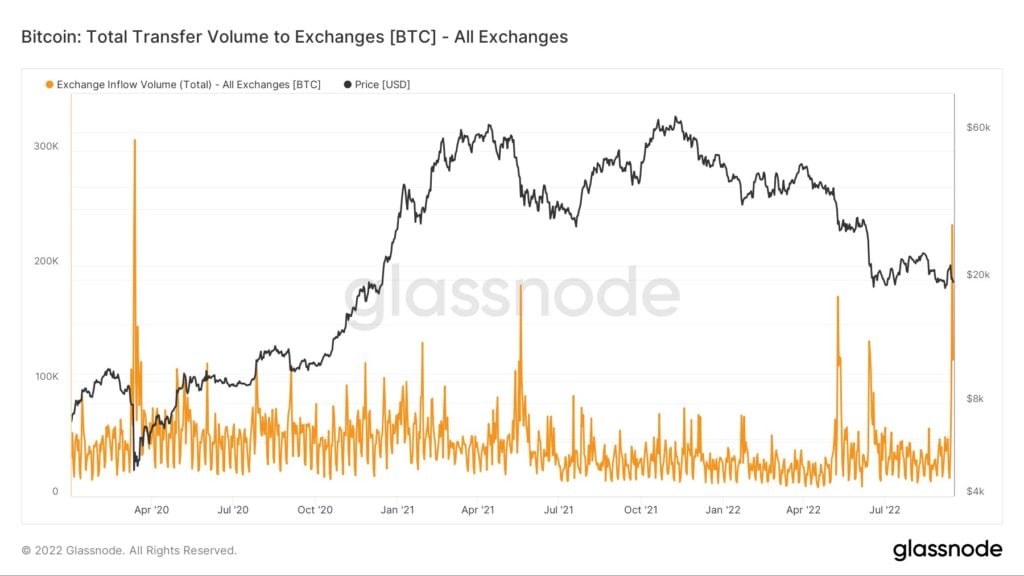

Inflows to exchanges is not a problem peculiar to ETH. Even BTC metrics are showing that large volumes of BTC have been flowing into exchanges over the last week and a half. Specifically, between the 7th to 14th September, around 1.7 million BTC have moved to exchanges, CeFi and DeFi combined.

Wednesday saw the largest inflow of the week, with 236,000 BTC flowing into 11 centralised exchanges, possibly as a reaction to the US CPI figures released on Tuesday.

The last time similar large transfers into exchanges occurred was back in May when the price of BTC dumped from $40,000 to $30,000 during the Terra-LUNA collapse. This time, the volume of BTC being sent to exchanges is even higher than that in May. Could this then hint of another impending big dump on BTC?

While the overall inflow chart looks ominous at the beginning, the inflow appears to have dipped back to normal, which implies no new inflows. This movement has been in line with BTC’s dip from $22,800 to below $20,000 last week, which may imply that those BTC could have already been sold.

That said, there is no sure way of knowing if all 1.7 million units of BTC have been sold as they could still be sitting on the exchanges. Checking BTC exchange reserves shows that while quite a lot of that BTC could have already been sold, exchange reserves are still much higher than what they were back in June and July, which means there is still more BTC that could be sold.

Use volatility - trade on PrimeXBT

Hence, another way to gauge where the price of BTC could go this week would be to watch if there are new BTC exchange inflows over the next few days. Inflows starting to pick up again will not be a very good sign.

With the current price nearing the $17,500 support and the Fed meeting on Wednesday, things appear to be shaping up for a nail biting week for BTC.

Cost Basis Says BTC Not at Bottom but Near

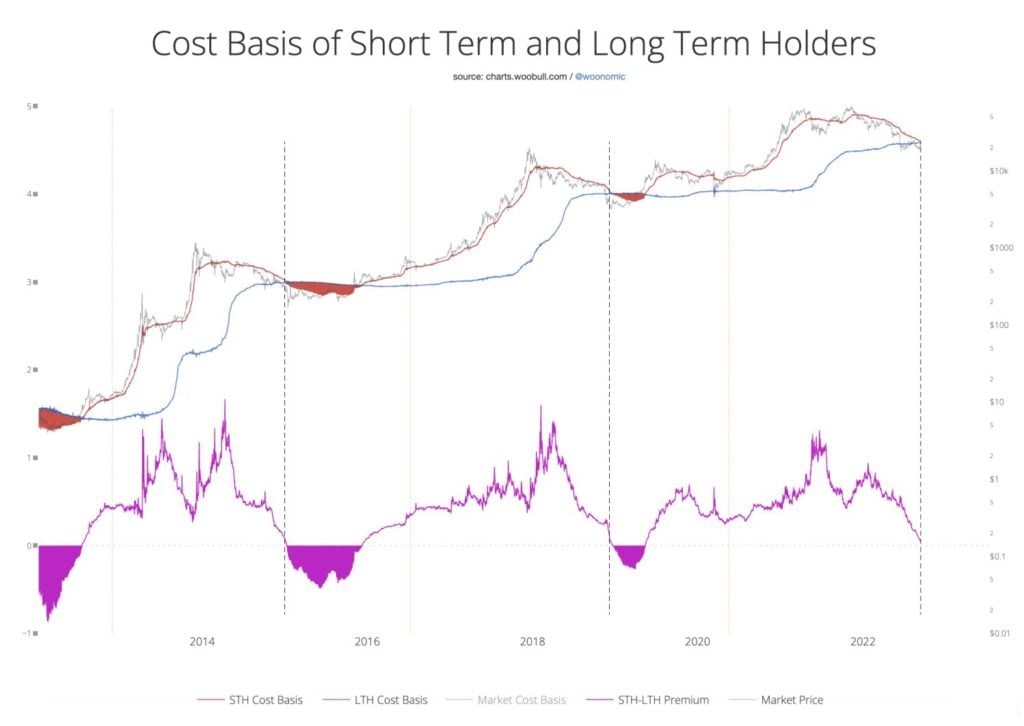

As traders debate whether BTC will survive $17,500, a look at the STH vs LTH cost basis of BTC suggests that we are near, but not yet at the cyclical low in BTC’s price.

According to onchain analyst Willy Woo, the price of BTC had bottomed when short-term holders’ cost basis per BTC was lower than that of long-term holders in previous cycles.

In this cycle, as can be seen in the diagram below, STHs cost basis has not yet dipped below that of LTHs, even though we are getting very close. This may imply that there could still be a bit of pain ahead.

The Week Ahead, Central Bank Meetings!

This week, attention would be on the US Fed meeting on Wednesday, where the interest rate decision would affect all assets prices significantly. Investors are mixed as to how the stock market would react under different circumstances as traders have already priced in the worst outcome. However, the move in the dollar could affect the forex and crypto markets as the price of BTC comes dangerously near to the recent low of $17,500. Would an aggressive Fed narrative force BTC to break below $17,500, or could the price of BTC keep afloat?

BTC holders will also have to content with the 135,000 BTC from Mt Gox that has begun to be gradually released until 31 December. However, as we have seen above that BTC has managed to absorb a selling pressure of more than 1 million BTC over the past week without tanking much more than 10%, 135,000 BTC is not exactly a big number to be afraid of.

Traders should not forget about another central bank that is growing in significance as it has a monetary policy starkly different from the rest of the world and a change in tone could send shockwaves across the forex space. The BOJ is also to meet this week to discuss its monetary policy. With the yen weakness already causing some Japanese ministers to make noises, we shall see what the central bank chief Haruhiko Kuroda says on Thursday morning, only hours after the Fed. Eyes will be on the USDJPY as the pair gets locked in the crossroads of two central banks within a span of 12 hours, especially since Japanese ministers have been scrutinizing movements in the USD/JPY pair recently.

Meanwhile, other than Japan, Thursday has another two other central bank meetings lined up. The Bank of England and the Swiss National Bank are both also meeting on Thursday to discuss their monetary policies.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.