Following the US strike on Iran over the weekend, oil gapped up on market open and continued its rally, extending the momentum that has driven prices higher since the start of this latest conflict in the Middle East. However, after the initial surge, oil has since retraced a significant portion of the gap during early European trading hours.

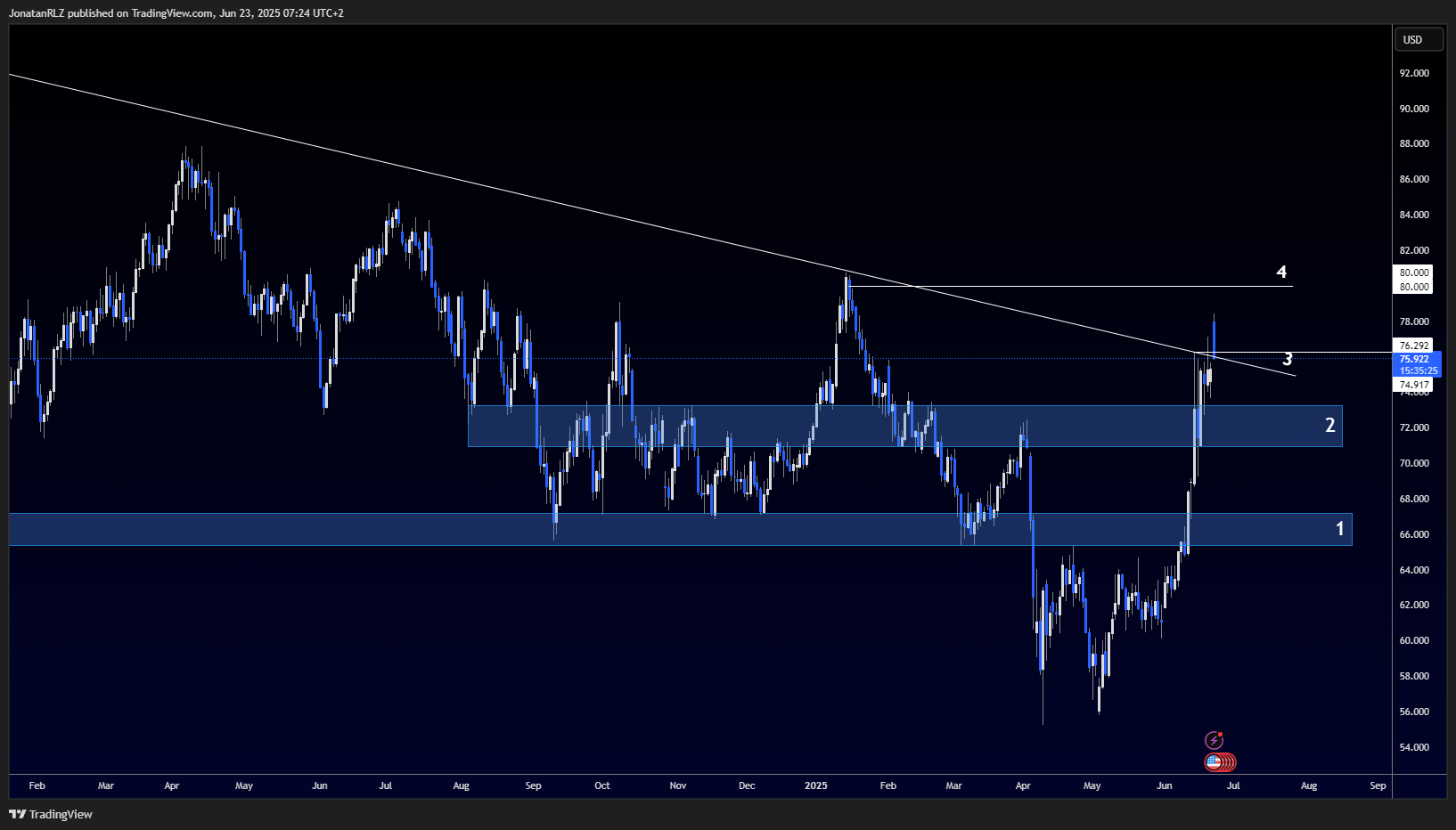

At the time of writing, price is trading around 76.00, sitting directly on a key descending trendline marked with number 3 on the daily chart. While volatility remains high, the gap created at the open has nearly been filled, which raises the question of whether this level will act as support or lead to further downside.

If price can stabilise here and begin to form a base, we may see a renewed move toward the high time frame resistance level around 80.00.

On the 4-hour timeframe, the opening gap lines up perfectly with the local reload zone, as well as an ascending trendline that has defined the recent bullish structure. If oil can hold within this zone and trigger a bullish reaction, there is a clear path back toward the 80.00 level in the near term.

However, if the gap is completely filled and price breaks below the 73.65 level, marked as number 1 on the chart, the local bullish trend may fail. In that scenario, price could revisit lower support zones seen on the daily chart, particularly the 72.00 level, and if pressure continues, potentially all the way down to 66.00, the prior breakout area.

For now, the reaction around the current confluence zone will determine whether this is a short-term reset before further upside or the beginning of a deeper pullback.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.