The September Non-Farm Payrolls (NFP) report has been released, revealing job gains of 119,000 for the U.S., well above the 50,000 forecast. There was a downward revision for the two previous months, but only by 33,000.

The U.S. unemployment rate unexpectedly rose to 4.4% from 4.3%, marking a 4-year high, and wage growth cooled to 0.2% MoM, below the 0.3% forecast.

The data paints a mixed picture amid solid job creation and rising unemployment, complicating the Federal Reserve’s decision next month. The market is only pricing in a 27% chance of a 25-basis-point rate reduction in December, approximately unchanged from before the data release.

DOLLAR INDEX (DXY):

Following the release of the NFP results, the Dollar Index has erased gains from earlier in the day. The USD traded +0.18% prior to the release and trades +0.04 at 99.80 following the data. On the 4-hour chart the price trades above its rising trendline and hovers close to the November high.

EURO VS DOLLAR (EUR/USD):

If we take a closer look at the technicals, we can observe how EUR/USD was trading at 1.1515 before the data release, and post the release we have seen price action push higher to the 1.1530 region.The price continues to trade below its falling trendline, 50 & 200 SMA. Support is seen at 1.15.

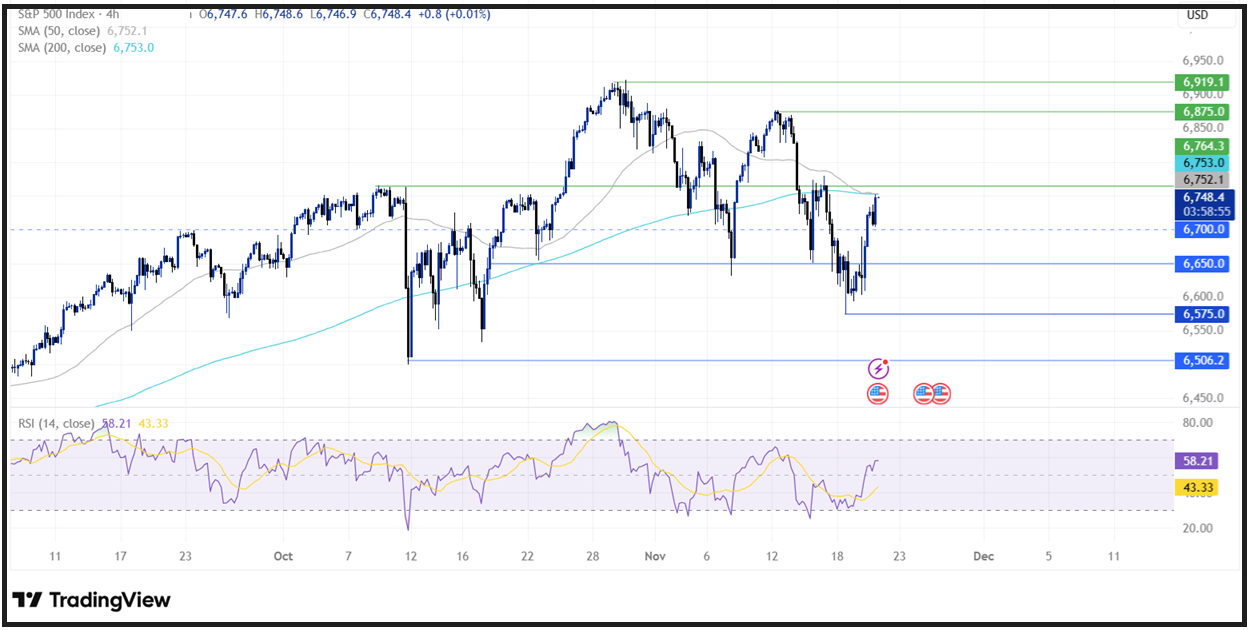

S&P 500 (SDX):

The S&P 500 has risen after the NFP data result release, as we saw price trading at just above 6720 before the announcement, and currently we are trading just above 6750 a 3 day high. The price is testing the the confluence of the 200 SMA and the 50 SMA. A rise above here and 6760 creates a higher high, changing the chart’s structure..

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.