Silver has pushed into fresh record territory, with price action reflecting a mix of shifting macro expectations, renewed safe haven demand, and a tightening physical narrative. At the same time, silver continues to sit at the centre of several large industrial trends, including electrification and solar deployment. That combination can create a setup where macro catalysts drive momentum, while real world demand helps support the broader trend.

Why silver is rallying right now

Rate expectations and inflation supporting non yielding assets

Precious metals often benefit when markets price in lower interest rates, because the opportunity cost of holding non yielding assets tends to fall. When investors anticipate easier monetary policy, silver can attract flows as traders position for lower yields and a softer rates environment.

Inflation expectations also matter. Silver is often viewed as a partial inflation hedge, especially when markets worry that price pressures could stay sticky, or that policy makers may tolerate higher inflation to support growth. In those conditions, traders can treat silver as a way to protect purchasing power, which can add another layer of demand alongside the rate narrative.

The practical takeaway is that rate and inflation expectations can shift quickly, and silver can react fast when bond yields and real yields move. If incoming inflation or labour market data keeps reinforcing a lower rate path while inflation remains a concern, it could remain a supportive backdrop. If inflation re accelerates in a way that forces yields higher and policy expectations turn more hawkish, it could reduce some of that tailwind.

US dollar weakness and geopolitical tension are reinforcing demand

Silver is priced in US dollars, so the currency backdrop matters. A softer dollar can make silver cheaper for buyers using other currencies, which can improve demand at the margin.

At the same time, geopolitical stress often increases demand for assets perceived as defensive. Silver typically behaves as a higher volatility cousin of gold during risk off periods, which can create sharper intraday swings. That can be attractive for traders, but it also means risk management matters, especially when headlines can move the market without warning.

Silver’s industrial demand story

Silver’s strength is that it is both a precious metal and a critical industrial input. Its high electrical and thermal conductivity makes it difficult to substitute in many applications, which helps keep demand resilient even when prices rise.

A large share of industrial demand comes from electronics and electrification, where silver is used in circuit boards, switches, contacts, and high reliability components across consumer devices, data infrastructure, and power systems. This overlaps with the clean energy transition, as solar panels rely on silver in photovoltaic cells for efficient conductivity, and ongoing expansion in renewable capacity can support steady baseline demand. Electric vehicles and charging infrastructure add another layer, as EVs are packed with electrical systems that require reliable conductive materials, while the broader rollout of charging networks increases demand for silver containing components.

For traders, the key point is that industrial demand tends to be slower moving than macro headlines, but it can create a supportive floor underneath the market when sentiment shifts.

Key technical levels to watch on silver

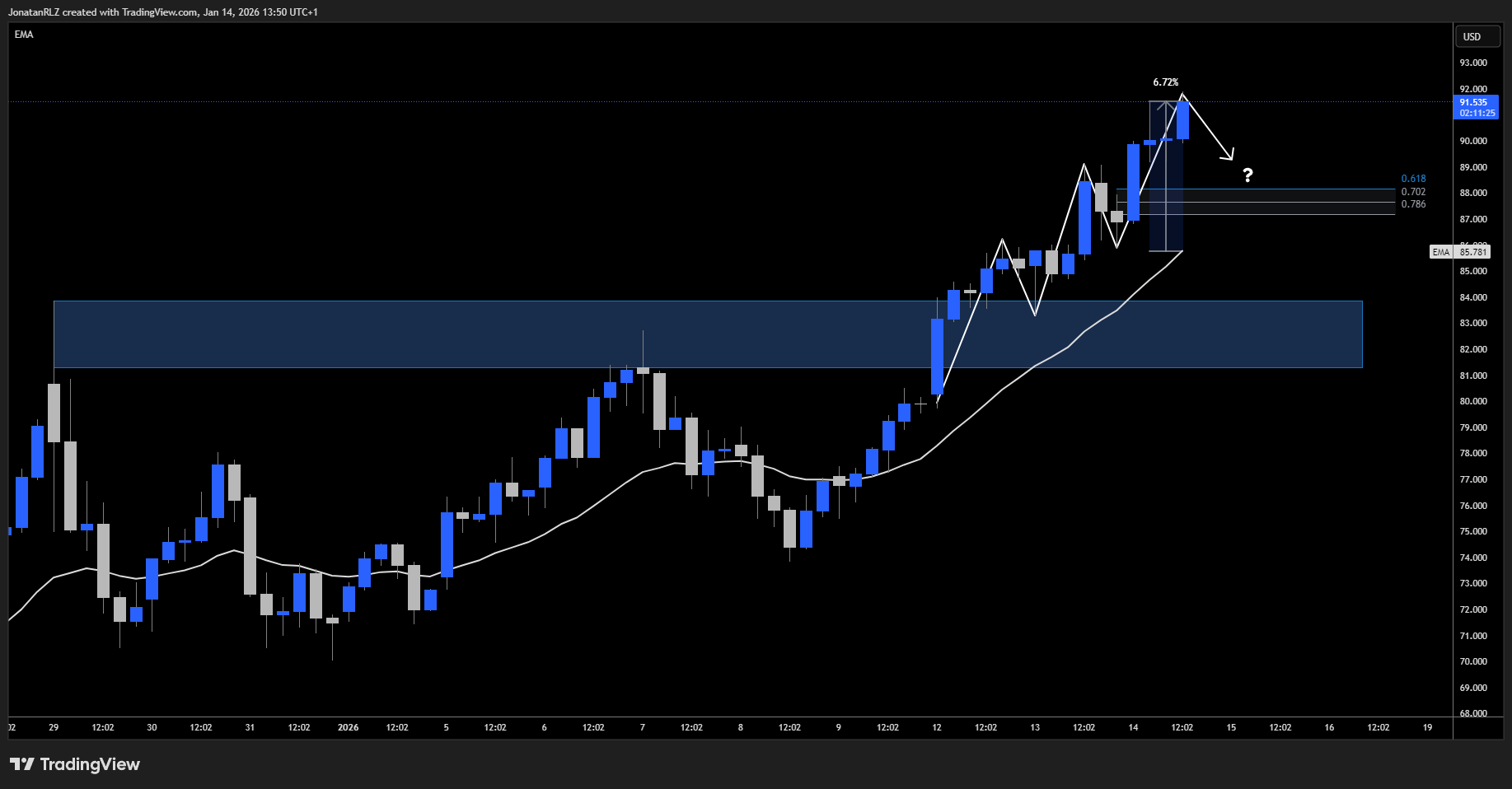

Silver has been moving aggressively, up more than 25 percent so far this year, after rallying almost 150 percent last year. The latest leg higher accelerated after the $83 area broke on 12 January, which acted as a clear trigger for trend continuation and helped push price into steeper, more momentum driven territory.

On the 4 hour chart, momentum is easy to spot through the behaviour of the 20 exponential moving average, shown as the white line on the chart. Price has remained extended above this moving average for an extended period, and at the time of writing we are still around 7 percent above the 4 hour 20 EMA. That is a historically meaningful deviation from the mean, signalling an overextended condition where two different trader groups often begin to position in opposite ways.

Mean reversion traders will typically view this type of extension as a potential opportunity to fade the move, expecting price to rotate back toward its average. Trend following traders, on the other hand, often look for the market to form a higher low so they can buy the dip within the broader uptrend, rather than chasing strength at stretched levels.

Using the Fibonacci retracement tool from the most recent swing low to the swing high, an area of interest begins to stand out around $88. This zone aligns with the so-called reload zone, defined by the 0.618 to 0.786 retracement levels. In many strong trends, this is where pullbacks can stabilise and offer a cleaner risk framework, as profit taking from late longs meets dip buying interest from traders looking to rejoin the trend.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.