With Bitcoin (BTC/USD) breaking above $100,000 and Ethereum (ETH/USD) rallying more than 30% in just days, the broader altcoin market is showing signs of strong momentum. One of the leading names in this rally is Solana (SOL/USD), which has now gained over 75% from its recent lows.

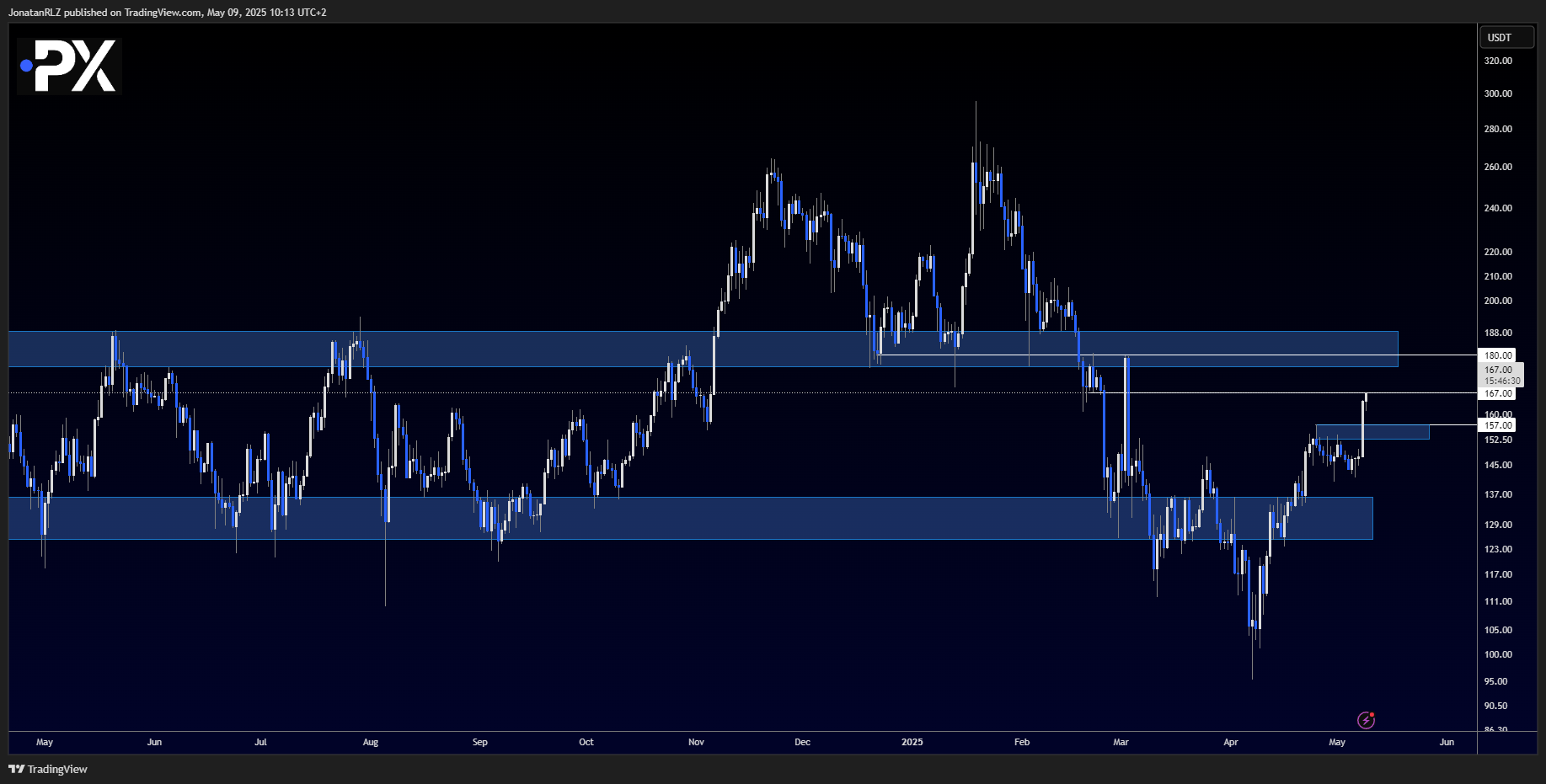

Following a clear local breakout yesterday, Solana is continuing to push higher. Price is currently testing a minor resistance zone around $167. If bulls can push through this area, the next major level to watch is the high time frame resistance at $180. This level has acted as an important cap in previous cycles and may once again offer strong resistance.

If price fails to hold above $167, or faces rejection at the $180 level, traders will likely look for support at the breakout zone near $157. A clean pullback to that level could offer a possible throwback entry.

Looking at the 4-hour chart, two important Fibonacci retracement zones stand out. The first is the 50% retracement level around the $157 breakout zone, measured from the recent local low (marked as a white up arrow) to the current high (marked as a yellow down arrow). This aligns nicely with yesterday’s breakout level and adds technical significance as potential support.

The second Fibonacci zone is a projected reload zone, calculated using the 180 level as a potential high. This area, between the 0.618 and 0.786 retracement levels, overlaps with the current $157 zone as well. The confluence of these Fibonacci retracements strengthens the case for this area as a technically important level, whether price retraces now or after reaching $180.

Solana continues to show strong bullish structure, but with key resistance just overhead, these retracement zones offer useful insight for managing risk and planning re-entries if the rally pauses or pulls back.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.