Welcome back to a fresh technical analysis update on the S&P 500.

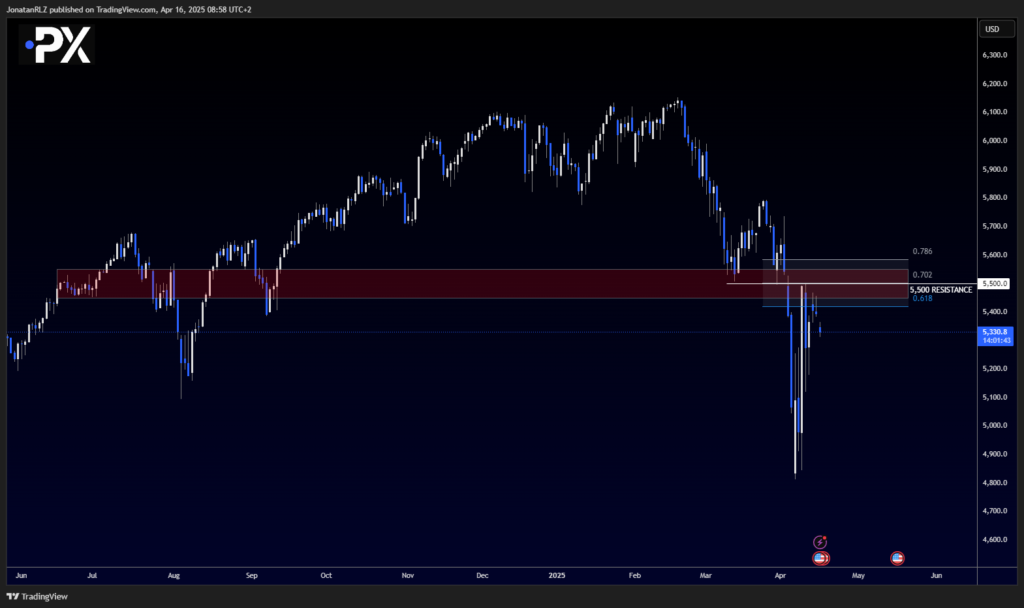

Today’s session opened with a gap down on the daily candle, reinforcing the bearish pressure we’ve seen building in recent sessions. However, price remains firmly within the longer-term range that we’ve outlined in previous updates.

Looking at the daily timeframe, we continue to monitor a key resistance zone between 5,450 and 5,550, with 5,500 acting as the midpoint and a critical reference level. This level is also in perfect confluence with the 0.702 Fibonacci retracement, adding further technical significance to the area.

From a broader structural perspective, this continues to reflect a high timeframe bearish leaning, with sellers still appearing to hold the upper hand unless a clean breakout occurs.

Let’s now jump into the lower timeframes to see how price is behaving intraday and what levels might be in play for short-term decision-making.

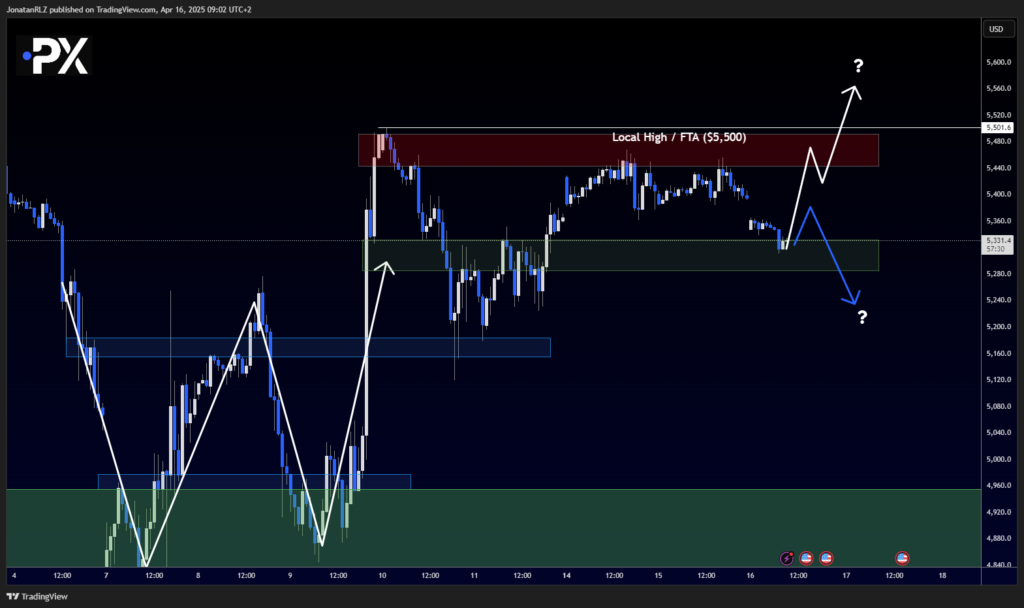

Intraday View – S&P 500 (1H Chart)

On the 1-hour timeframe, the S&P 500 continues to range between support at 5,300 and high timeframe resistance at 5,500. Price is currently testing the lower boundary of this range, which may act as support in the short term.

Intraday traders are likely viewing this level as a key area to manage risk on potential long positions. However, as long as price remains within this range, there is no clear directional bias, aside from the broader bearish structure evident on the daily chart.

It’s also worth noting that U.S. retail sales data is expected later today, which could serve as a potential catalyst for a breakout or breakdown. While the direction is uncertain, being aware of both range boundaries can help traders stay flexible and risk-aware.

This is why daily updates and clearly defined levels are so valuable—they help build context and support better decision-making regardless of market conditions.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.