Bitcoin rose 10% across the previous week and is extending those gins, reaching an all-time high of just shy of 82k. The world’s largest cryptocurrency slipped to a low of 66.7K last Monday as election jitters set in before rebounding higher and surging above 73,750, the previous all-time high, on Wednesday. The rally has shown no signs of slowing, soaring above 80k this weekend and 81.8k on Monday as BTC extends its break out.

Bitcoin now has a market cap of $1.5 trillion. For perspective, only five companies in the S&P 500 are worth more than Bitcoin, including NVIDIA, Microsoft, Apple, Alphabet, and Amazon. Some say that Bitcoin is the eighth component of the “Magnificent 8.”

The rally was seen across the board. Ethereum jumped 16% last week and is breaking out with a potential 40% upside to its all-time high. Solana gained 22%, and Dogecoin booked gains of over 25% across the previous week, up a further 25% at the start of the week.

The next Dogecoin

As we know from previous cycles and how Bitcoin performs, it rarely comes close to the real winners. In the last bull cycle, Dogecoin surged 37000% in a little over a year. The market will be looking out for moves like this.

Dog Wif Hat recently rallied 7000% in three months, reaching a market cap of $4.5 billion. POPCAT has gained 34,000% over the past ten months, hitting a market cap of $1.4 billion, which would make it a midcap if it were a stock. The latest monster has been FWOG, which already has a market cap of $0.5 billion and is up 400% this past month.

Trump wins the election

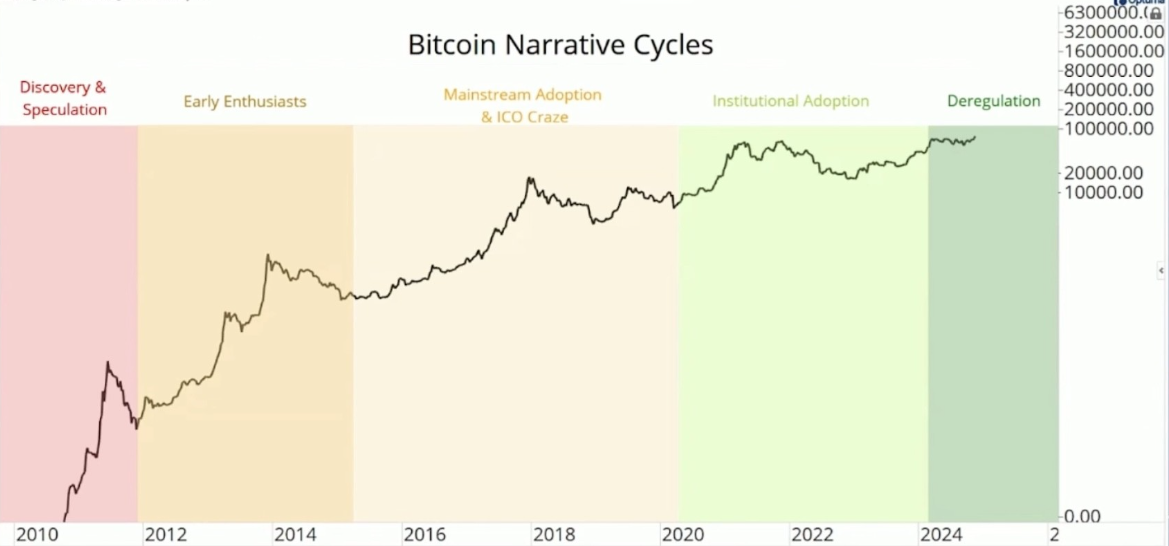

Former President Trump defeated Vice President and Democrat nominee Kamala Harris by a wide margin in the US elections on November 5th. The Republicans also won the Senate and have made gains in the House of Representatives. However, these full results have yet to be declared and could point to a red sweep. What is clear is that Trump has a strong mandate on a solid platform to implement his crypto-friendly policies.

According to Stand with Crypto, the House of Representatives gained 263 pro-crypto candidates versus 118 anti-crypto candidates, and the Senate gained 18 pro-crypto candidates versus 12 anti-crypto candidates.

Note that the crypto-supportive candidates have been elected from both sides of the aisle, which sets up expectations for a friendlier regulatory environment in the US. Expectations of deregulation in this sector could pave the way for crypto to soar.

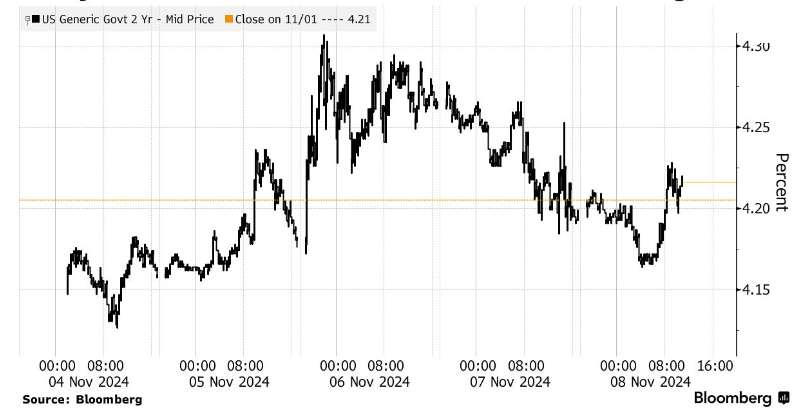

Fed cuts rates

In addition to the US election, the Federal Reserve was also in focus, with the central bank cutting interest rates by 25 basis points on November 7. Federal Reserve chair Jerome Powell alluded to the idea of a different pace of rate cuts related to the possibility of expansionary fiscal policies under the Trump administration. While the Fed is still expected to cut interest rates by 25 basis points in December, the outlook for rate cuts in 2025 is less clear. The markets now price fewer rate cuts than the 100 basis points implied before the election.

Short-dated US treasury yields rose on expectations that the Fed will cut rates at a slower pace in 2025.

China stimulus

China’s National People’s Congress Standing Committee was another major macro event scheduled to finish after the US elections. The group approved further fiscal stimulus of $1.4 trillion, which was more or less in line with market expectations. However, whether this will be sufficient to offset potential tariffs on Chinese goods in 2025 from the US remains to be seen.

Macro outlook

Overall, the macro environment for crypto performance over the coming quarters is expected to be supportive, thanks to the Fed easing monetary policy and stronger U.S. economic conditions. Meanwhile, a Trump administration expected to increase deficit spending should translate into greater risk-taking, which, combined with Trump’s deregulation, is likely to be a win-win situation across the crypto sector.

BTC ETFs

The Bitcoin macro story remains compelling, as evidenced by the massive increase in US spot Bitcoin ETF inflows this week. According to SoSo Value data, spot Bitcoin ETFs saw $1.63 billion in inflows last week, marking the fifth straight week of net inflows.

On a daily basis, BTC ETFs posted a record $1.3 billion in inflows on Thursday, a day after Republican Donald Trump won the presidency. Blackrock’s IBIT took over $1.1 billion in net inflows, the highest among all the products, and a record high since going live in January.

Of note, BlackRock’s Bitcoin ETF, IBIT, surpassed the size of its gold fund amid record demand for crypto ETFs. This marks a significant milestone for IBIT, which investors have poured more than $27 billion into since its launch in January, making it the fourth-best-performing fund globally in terms of flows this year. However, IBIT still has a long way to go to catch up with the SPDR gold shares, the largest gold ETF with over $76 billion in assets.

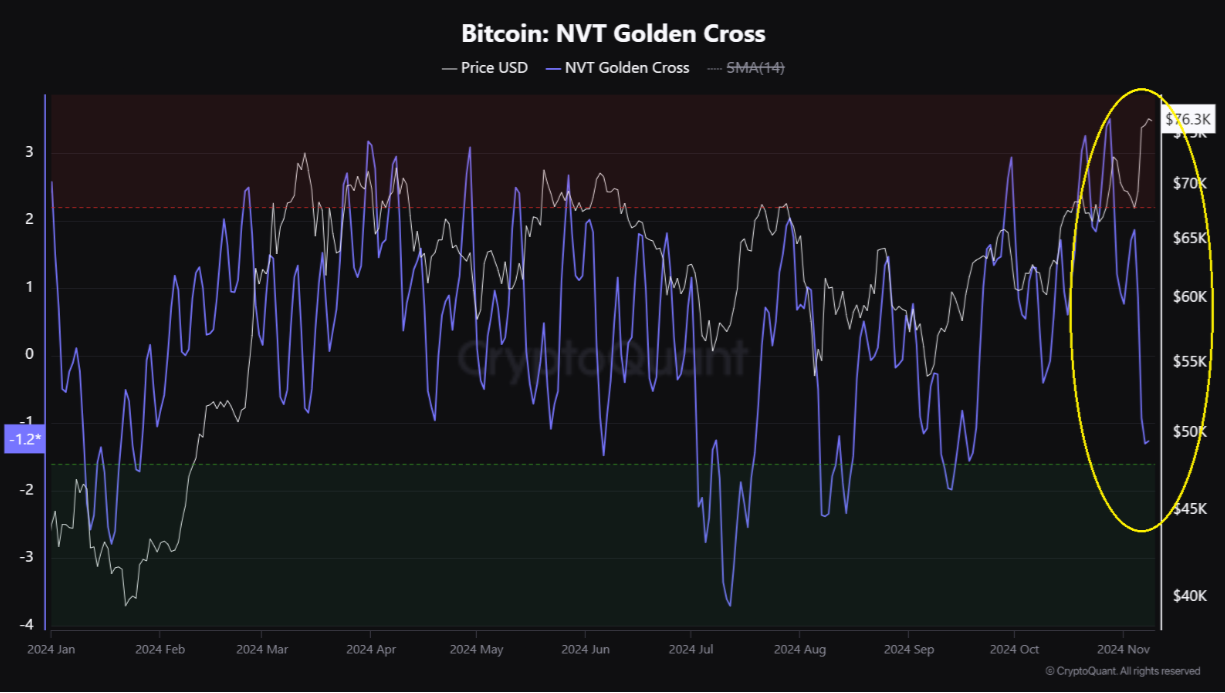

While the BTC ETFs are surging, the Bitcoin price is reaching new highs; the NVT Golden Cross metric is declining, showing an interesting dynamic. This suggests that institutional investors are increasingly entering the Bitcoin space, fueling price growth even while on-chain activity remains relatively low.

Unlike past cycles when retail trades have led the change, this new phase suggests a shift to institutional-driven growth, establishing strong foundations for Bitcoin’s rally.

Does Bitcoin have further to run?

Despite Bitcoin hitting an all-time high, it could see additional gains. Bitcoins’ Market Value to Realized Value ratio (MVRV) suggests that the price is far from being overstretched compared with the cost basis. The MVRV is still below 2, and is usually above 3 in periods of euphoria.

This ratio, which is used to assess an asset valuation, suggests that the price has not yet been overloaded and that the top crypto asset is still undervalued in line with historical peaks seen in overheated markets. This implies that the present price rally of Bitcoin may still be in the early stages and has significant potential for further upside before reaching the speculative bubbles stage.

Looking ahead

This week, we expect the market to continue considering what a Trump presidency could mean for the crypto sector. The market will closely scrutinize any tweets by Trump for clues into his policy plans.

Attention will also turn towards U.S. economic data, with the release of inflation figures and US retail sales numbers.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.