USD/JPY has plunged roughly 520 pips from its post-election spike at 157.70 to a fresh 2026 low near 152.50, and Japan hasn’t spent a single yen on actual intervention. Meanwhile, the Nikkei 225 just broke above 58,000 for the first time in history. These two moves are opposite sides of the same coin. PM Sanae Takaichi, who markets had priced in as a dovish, weak-yen leader, blindsided everyone after her LDP’s historic landslide by warning she will “take all necessary measures” against speculative yen moves. Finance Minister Katayama confirmed “close contact” with US Treasury Secretary Bessent, while BoJ board member Masu stated that “further rate hikes are necessary,” with Japan’s policy rate already at 0.75%, its highest since 1995.

On the dollar side, the picture is just as bearish. The DXY is sitting near 96.8 after its worst stretch in over three decades, Commerce Secretary Lutnick publicly said the greenback had been “artificially pushed higher,” and Chinese regulators told banks to limit US Treasury holdings. Capital is rotating out of US assets and into Asia at a record pace. KOSPI is up 27% year-to-date and international equity ETFs absorbed their largest monthly inflows in history. The Nikkei’s breakout to all-time highs while USD/JPY collapses tells you exactly where the money is going.

The rate differential that kept the carry trade alive is compressing fast. The Fed is expected to cut two to three more times this year while the BoJ is hiking, and tomorrow’s delayed US CPI print at 8:30 AM ET could pour gasoline on this fire if it comes in soft. Let’s break down the charts to identify where both of these moves are heading next.

USD/JPY 4-Hour Chart

Looking at the 4-hour chart, USD/JPY is sitting in severely oversold territory with the RSI down at 35. But what makes this interesting is what’s happening underneath the surface. The RSI is starting to print higher lows while price is printing lower lows, which is the early stages of a bullish divergence. This same type of setup has historically preceded short-term relief rallies, and it’s worth paying close attention to here.

On Balance Volume is telling a similar story. OBV is forming a range structure that looks very similar to the range it created around January 28th, which was the last time price tested this level. The key observation is that while price has come down to create equal lows near 152, OBV is holding higher lows, which is another form of bullish divergence. Volume is not confirming the downside move, and that’s a warning sign for bears.

The level to watch here is the OBV range highs, marked by the white horizontal line. A break above that level could signal that buyers are starting to take control. On the price side, a break and retest of the 153.40 area could potentially be the confirmation that a move higher is underway. The upside target from there is the 156 region, marked with a “1” on the chart, where the local Short Reload Zone converges with the descending trendline. That confluence makes 156 a high-probability area where sellers could step back in, so it works as both a target for longs and a level to reassess the trade.

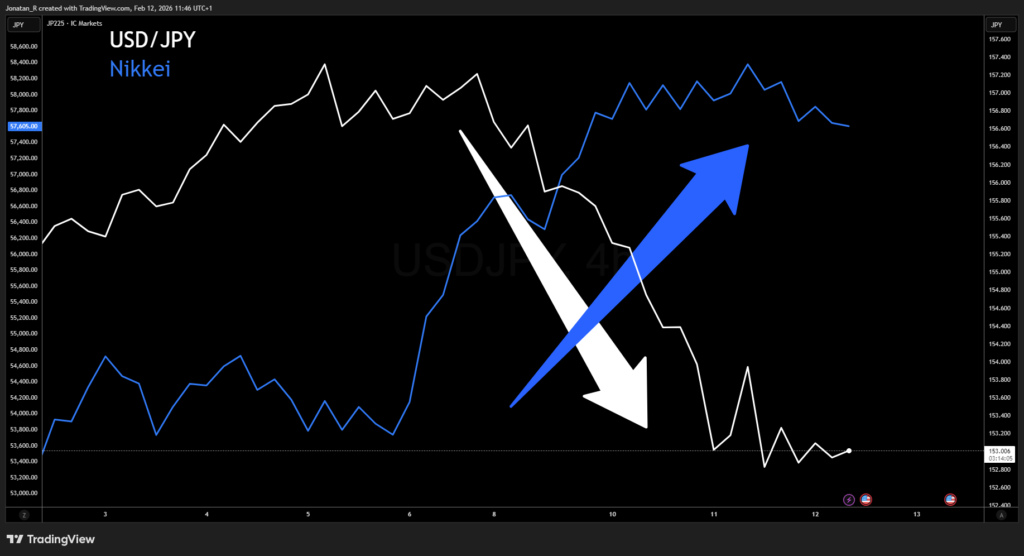

USD/JPY and Nikkei Inverse Correlation

When we overlay USD/JPY (white) and the Nikkei 225 (blue) on the same chart, the relationship becomes very clear. Since the beginning of February, these two have been moving in opposite directions. As USD/JPY has collapsed from 157.70 down to 152.50, the Nikkei has surged from the 53,000s to fresh all-time highs above 58,000. This inverse correlation makes sense when you consider the macro backdrop. A weaker dollar and stronger yen reflects capital flowing into Japanese assets, and that capital is showing up directly in the Nikkei.

The reason this matters for traders is simple. If USD/JPY continues to bounce from oversold levels toward the 156 target outlined above, the Nikkei could pull back in tandem. That potential pullback is exactly what sets up the next part of this theory. If this inverse correlation holds, a relief rally in USD/JPY could create a buy-the-dip opportunity in the Nikkei at lower levels. Let’s look at where those levels are.

Nikkei / JAPAN225 4-Hour Chart

The Nikkei’s 4-hour chart shows the explosive breakout that kicked off earlier this month, rallying from the low 53,000s to above 58,000 in a matter of days. That kind of vertical move rarely sustains itself without some form of retracement, and the Fibonacci levels give us a roadmap for where buyers might step back in. The key levels to watch on a pullback are the 0.5 retracement around 55,600, the 0.618 level near 55,200, and if sellers push harder, the 0.702 at 54,400 and the 0.786 at approximately 54,000. That deeper zone also aligns with the previous resistance area from late January that could potentially now act as support.

By projecting the potential timeline of the USD/JPY move to the upside, based on how long similar distance moves have taken in the past, we could be looking at roughly 5 to 10 days for that bounce to play out. That puts us somewhere around February 18th as a key date to watch. If USD/JPY rallies into the 156 Short Reload Zone and descending trendline target outlined earlier in this article, while the Nikkei simultaneously retraces into the Fibonacci support zone, it could set up a clean two-part trade. This could present an opportunity to take profits on a USD/JPY long and look for a potential Nikkei entry. The inverse correlation we just covered is what ties these two ideas together, and the timing of both moves converging around the same window is what makes this setup worth watching closely.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.