Weekly Recap:

US Global stocks recap

U.S. stock markets pulled back from record highs at the start of November as AI enthusiasm cooled amid concerns over valuations. Corporate earnings were strong, and AI spending showed no signs of slowing, suggesting the pullback reflects sentiment and valuation adjustments rather than a sell-off driven by corporate fundamentals. CEOs of US investment banks warned over the likelihood of a correction.

Major US data/themes

The US government shutdown meant US data was once again in short supply. The focus was on private US data, with ADP payrolls rebounding to 42k. However, the Challenger report showed that 153k jobs were cut in October, the highest level for that month in 2 decades, raising concerns over the deteriorating US labour market.

A combination of macroeconomic worries and concerns about overstretched tech valuations weighed on sentiment. The Nasdaq 100 posted its worst weekly decline since April, and the USD also fell over the last week.

Gold moves

The Gold price was unchanged last week, as it hovered around the $ 4,000 psychological level. The precious metal remained unchanged despite the market’s risk-off mood. However, Gold has jumped 2% higher in early trade on Monday, benefiting from the weaker USD and rising expectations that the Federal Reserve could cut rates again in December. The FedWatch tool points to a 66% chance of a rate cut in December, up from 62% a week ago.

Oil moves

Crude oil prices fell 2% last week, marking the second straight weekly decline. Oil sold off last week amid concerns about excess supply and slowing US demand. The unexpected build of 5.2 million barrels in US crude inventories reignited supply fears. Concerns about the impact of the most prolonged U.S. government shutdown in history also pressured prices, as flights were reduced due to a shortage of air traffic controllers. Data from China was weak, with exports unexpectedly falling. However, China’s crude imports in October rose 2.3% from September and up 8.2% from a year earlier. Oil is rising at the start of the new week, boosted by optimism over a move to reopen the US government.

Indian markets

Indian markets ended a volatile week on a softer note, extending the losing streak for a second straight week. Mixed corporate earnings and uncertainty over US tariff discussions damaged sentiment. Meanwhile, persistent selling by Foreign Institutional Investors added to the pressure. The Nifty 50 closed at 25,492, down 0.8% while the Sensex settled at 83,216, posting a weekly fall of 0.8%.

Foreign Institutional Investors (FIIs) continued their selling streak, offloading equities worth Rs 1632 crore so far in November, reflecting a cautious stance amid global uncertainties.

In contrast, Domestic Institutional Investors (DIIs) have remained steady buyers, investing Rs 16,677 crore in equities in the same period. These inflows offset the FIIs’ withdrawals.

Indian manufacturing activity rose to an almost 17-year high amid strong domestic demand. However, the service sector saw activity slow to a 5-month low amid competition and heavy rains. The services PMI eased to 58.9 in October, and the manufacturing PMI rose to 59.2.

USD/INR fell -0.12% last week, settling at 88.66 on Friday.

Pakistan markets

The KSE 100 fell 1.26% across last week, marking a third consecutive weekly decline, settling at 159,592 on Friday. Higher-than-expected inflation data, combined with a broad risk-off mood across global markets, dragged on the index. However, the index is starting the new week on the front foot, along with gains in global indices.

Pakistan’s CPI accelerated to 6.2% year on year in October, up from 5.6% in September, and is above the finance ministry’s estimate of 5% to 6%. On a monthly basis, CPI rose 1.8% in October, up from 2% the previous month, marking the highest level since November 2024.

USD/PKR fell 0.01% last week to settle at 283.175 on Friday.

Week ahead (focus US & Asia)

US Government to reopen?

The US government shutdown is entering its 40th day of political gridlock, but the longest government shutdown in US history could end soon.

With flight cancellations rising and as the key Thanksgiving holiday approaches, there could be greater motivation to reach a deal. Reportedly, Senate Democrats have signaled a readiness to advance bipartisan spending bills to end the record-long shutdown, which has furloughed 75k federal workers, disrupted key services, and withdrawn liquidity from the market. The news is boosting sentiment, and once open, the rise in liquidity could lift stocks such as the Dow Jones Industrial Average. How quickly the US data will be released once the government is reopened is unclear.

China CPI (Sunday)

China’s consumer price index (CPI) unexpectedly rose in October as holidays during the month boosted travel, food, and transport demand. CPI rose 0.2% from a year earlier after falling 0.3% in September. Expectations had been for a 0.1% drop. Service costs edged up 0.2%, after a 0.3% decline in September, and contributed to the rise in inflation. However, this uptick has been firmly attributed to a holiday boost; in other words, deflationary pressures remain entrenched. Factory gate deflation also eased, although it persisted for a 37th straight month. PPI fell 2.1% year on year compared with a 2.3% drop in September. The Hang Seng is rising at the start of the week.

US ADP 4-week average (Tuesday)

Given the US government shutdown and the shortage of U.S. data, private payroll report provider ADP’s private payrolls are more in focus than usual. Data from ADP payrolls last week showed a recovery in the labour market, with private payrolls rising by 42,000 after falling by 32,000 the previous month. The market will be looking towards the ADP employment change for the 4-week average, which will be released on Tuesday, and isn’t usually a macro report that would catch the market’s attention. However, given the lack of data, any figures on the US labour market are in focus. The previous release showed a rise of 14.25K. A lower four-week average would support the view that the US labour market is deteriorating and could raise worries over the outlook for the economy, particularly given the shutdown, which in itself is expected to harm the economy and could pull US stock indices and the USD lower.

Indian retail inflation (Wednesday) & WPI (Friday)

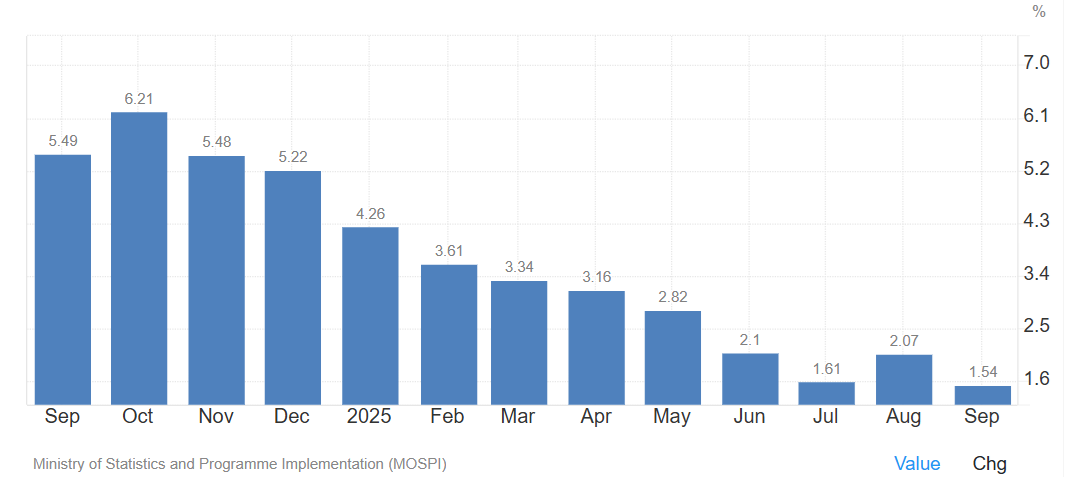

Indian CPI and wholesale inflation data are expected to set the market’s direction, particularly regarding interest rate expectations and overall economic momentum. CPI on Wednesday is expected to cool to 0.48% YoY in October, down from 1.54% in September (an 8-year low) as food prices ease further. This could mean that inflation remains below the RBI’s tolerance band for a second straight month. Meanwhile, WPI, which measures wholesale inflation, is expected to fall -0.6% annually in October, down from 0.13% in September. However, the RBI is expected to act cautiously on the key policy rate and could take more cues from growth data, given the impact of the US trade tariffs. A rate cut could come in December as the risk to growth is high. A prolonged period of low inflation is not considered positive for the growth outlook, as consumers could delay buying decisions, which could hurt sentiment and demand for stocks.

Chinese retail sales / industrial production (Friday)

Expectations are for industrial production and retail sales to slow in October, adding to concerns about the slowing economy. Economists expect industrial production to ease to 5.6% year over year in October, down from 6.5%. Meanwhile, retail sales are expected to decline to 2.7% down from 3% in the previous month. Weak spending has been a significant source of concern across the Chinese economy. The data comes after figures last week showed weakness in Chinese exports, which contracted in October, dropping 1.1% from a year earlier, as global demand failed to offset the slump in shipments to the US. Together, these figures raise concerns about the outlook for the Chinese economy, which resilient exports have supported to date. Chinese external resilience is starting to falter amid high tariffs and global trade uncertainty, underscoring the need for Beijing to continue supporting domestic demand. Weak retail sales and industrial production could pull AUD/USD lower.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.