Weekly Recap:

US Global stocks recap

US stocks finished last week mixed, with the Dow Jones Industrial Average and the S&P 500 posting modest gains, while the tech-heavy Nasdaq fell for a second straight week. Concerns about elevated valuations and increased scrutiny of AI spending drove a rotation away from growth and tech stocks, which had helped propel indices to recent record highs.

Major US data/themes

In positive news, the US government reopened after the longest shutdown on record, following President Trump’s signing of a bill to fund the government through 30 January. While this has removed a significant headwind, stocks fell sharply on Thursday amid questions over when data releases will restart.

The White House warned that October inflation and non-farm payroll data may never be released, meaning that the Fed may be flying blind into the December FOMC meeting, hitting risk sentiment. The BLS announced it would release the September jobs report on 20 November.

Worries over a lack of data, combined with hawkish Federal Reserve commentary, saw the market rein in December rate-cut expectations to under 50% from 94% a month ago and 67% a week ago.

Gold moves

After jumping almost 5% higher in the first three days of last week, Gold reached $4245 before rebounding lower to close the week at $4079. Gold fell 3% on Friday alone, weighed down by hawkish Federal Reserve comments that lowered market expectations of a Fed rate cut, pulling non-yielding gold lower.

Furthermore, the steep sell-off in the equities market also impacted Gold. Rather than safe haven flows, trades, margin calls, and liquidations meant that traders were closing everything to free up margin. Looking ahead, market sentiment and Friday’s NFP report could be the primary drivers of Gold.

Oil moves

Crude oil prices experienced volatility last week, driven by geopolitical tensions and over supply worries. Oil prices ended the week about where they started. Oil fell 4% early in the week after the IEA warned of intensifying oil surplus, predicting that supply would exceed demand by 2.4 million barrels per day this year and by 4 million barrels next year.

However, the price pared these losses in the second part of the week on reports that Ukrainian drone attacks on a Russian port have resulted in suspended oil exports, raising concerns of supply disruptions. This week, API and EIA inventory data will be key, along with USD moves.

Indian markets

Indian markets closed the week on a positive note, with the Nifty 50 and the Sensex gaining over 1.5%. Market sentiment was boosted by strong domestic earnings, a positive growth outlook from Moody’s, and the NDA’s landslide victory in the state of Bihar.

Foreign Institutional Investors (FIIs) continued their selling streak, offloading equities worth Rs 13,652 crore so far in November, reinforcing the trend of sustained foreign outflows.

In contrast, Domestic Institutional Investors (DIIs) have once again proved to be a strong support, investing Rs 41,352 crore in equities this month. These inflows offset the FIIs’ withdrawals.

Indian retail inflation fell to an all-time low of 0.25% YoY in October, down from 1.44% in September, driven by a sharp fall in food prices and tax cuts on consumer goods. This offset the pressure on the economy from punitive tariffs on Indian exports.

The economy, which grew at 7.8% in the April to June period, is expected to slow in the second half of the year. The record low inflation rate was below the RBI’s 2%-6% target range, paving the way for a rate cut.

USD/INR rose 0.03% last week, settling at 88.71 on Friday.

Pakistan markets

The KSE 100 rose 1.5% last week, marking its most substantial weekly rise since late September. The index rallied after three consecutive weeks of losses, boosted by political clarity and investor confidence, despite two terrorist attacks.

The passage of the much-watched 27th Constitutional Amendment and confirmation that the International Monetary Fund (IMF) Executive Board will meet next month to approve a $1.2 billion disbursement helped steady nerves and spark buying.

On the data front, Pakistan Automotive Manufacturers Association reported car sales of 17,333 units, up 32% YoY and 1% on a monthly basis. Worker Remittances rose 12% YoY to $3.4 billion in October.

USD/PKR fell 0.04% last week to settle at 282.529 on Friday, marking the fourth straight weekly decline.

Week Ahead (focus US & Asia)

Indian-US trade talks

Progress in US-India trade talks will remain a key driver of sentiment and foreign investor flows. Indian agricultural exporters are among the winners from U.S. President Trump’s exemption of dozens of food items from his reciprocal tariffs regime announced on Friday. According to the Federation of Indian Export Organisations, exports worth between $2.5 billion and $3 billion will benefit from the tariff exemptions, after India was hit with 50% tariffs on imports of certain goods.

This move is also seen as a positive signal for ongoing US-India trade talks, which could ease export pressures. Exports of Indian goods to the US fell almost 12% year on year in September to $5.43 billion after tariffs were raised. Improving India–US relations could drive FII inflows, lifting stock indices such as the Sensex.

Fed minutes (Wednesday)

As expected, the FOMC cut interest rates by 25 basis points to an upper level of 4% with Trump appointee Stephen Miran voting for a 50 basis point cut, whilst Schmidt voted to leave rates unchanged. The split highlighted the committee’s divergence. The minutes should provide further insight into these divisions, providing more colour over the likelihood of a December rate cut. Following the meeting, Fed chair Powell highlighted the cloudy economic outlook and warned the market against running away with rate cut expectations.

While the US economy has reopened, the Fed continues to fly blind due to the lack of official BLS statistics on the US economy. The minutes should provide more colour to the potential timing of the next rate cut. The market has lowered rate-cut expectations to 50%. Weak data could pull the USD lower.

Nvidia Q3 earnings (Thursday)

Nvidia will release earnings after the close on Wednesday, 19. This is the last of the magnificent 7 to report and comes at a time when the market needs some reassurance regarding the AI trade. SoftBank sold its entire Nvidia holding the previous week. However, CEO Jensen Huang also announced that Nvidia had secured $500 billion worth of orders for its Blackwell and next-generation Rubin chips through 2026.

In terms of expectations, Q3 eps is expected at $1.24 on revenue of 54.41 billion. Breaking this down further, the data centre business is expected to post revenue of 48.3 billion. Guidance will also be key with Q4 profit expected at $1.42 and revenue at $60.82 billion. These figures are expected to influence sentiment across the globe.

Japanese CPI (Thursday)

Expectations are for core CPI to rise to 3% YoY in October, up from 2.9% in September. Price increases are expected to be broad-based, consistent with the Tokyo CPI print. Signs of growth and inflationary pressures could increase the chances of a December BoJ rate hike. Japan’s preliminary Q3 GDP data is due on Monday.

The data releases come after the yen fell to an 8-month low against the USD last week, following Prime Minister Sanae Takaichi’s call for the BoJ to be cautious about hiking interest rates and to coordinate policy closely with the central bank in order to achieve growth objectives. The PM supports an expansionary fiscal policy, which could further complicate the BoJ’s job. Hotter-than-expected inflation could lift the yen, pulling USD/JPY away from 155.

US non-farm payroll report (Thursday)

Following the reopening of the US government, the Bureau of Labor Statistics will release the first backlogged monthly jobs report for September on Thursday, with a flood of other data likely to start flowing soon. The Bureau of Labour Statistics also said a delayed report on inflation-adjusted earnings would come on Friday, 21 November. Job site for protecting important given the shaky health of the US labour market has become a growing concern, and Fed officials have been divided over whether persistent inflation or a sluggish labour market is the greater economic threat, clouding the path for interest rates.

The latest monthly jobs report, published on 5 September, showed that employers added 22,000 jobs in August and that the unemployment rate ticked up to 4.3%. The September report was supposed to be released on 3 October. Weak data could fuel expectations of a Fed rate cut and lift stock indices such as the Dow Jones Industrial Average. However, very weak data fuel slowdown worries and pull on stocks.

Indian PMIs (Friday)

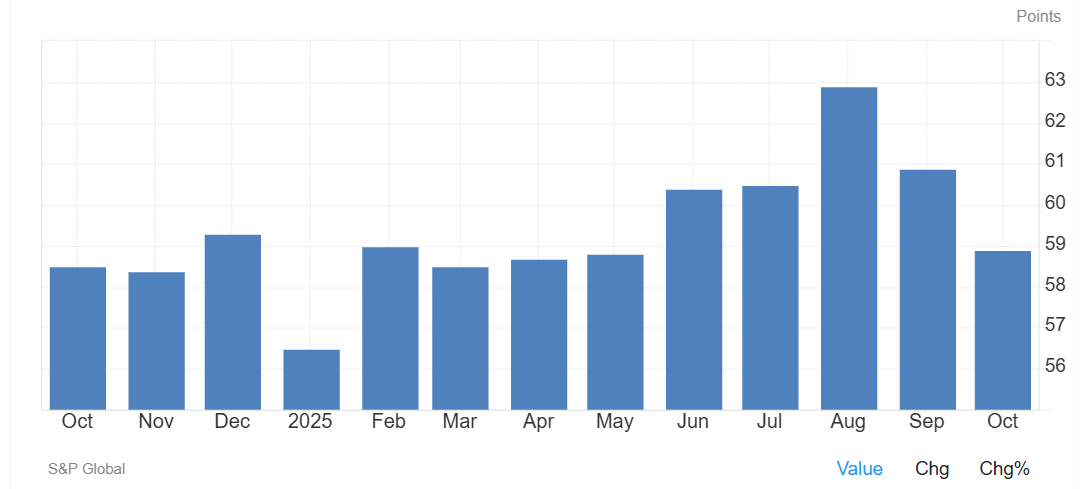

With the second-quarter earnings season almost over, domestic indicators such as services and manufacturing PMIs will influence sentiment. In October, the manufacturing PMI showed activity expanding at a faster pace, rising to 59.2 from 57.7 in September. This was above estimates of 58.4 and marked the strongest pace in five years. While international sales growth weakened, domestic demand grew.

Meanwhile, the service sector slowed in October with the PMI slipping to 58.9, marking its lowest level since May. This is still in a strong expansion mode, but the figures suggest that momentum has eased as heavy rain, flooding, and stiffer competition put the brakes on growth. International demand is also weak, with export order growth touching a 5-month low. Investors will be looking to see whether these trends continue. Although the PMIs remained comfortably above 50, signalling the economy is still expanding. Upbeat data could help boost sentiment, lifting stocks.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.