Recent weeks recap:

US Global stocks recap

U.S. stocks fell last week, with the S&P 500 declining 1.4%, marking the worst weekly performance since mid-November. While equity markets started the week on the front foot, they quickly retreated amid concerns about AI capital expenditure and technology disruption. A stronger-than-forecast jobs report dented hopes for Federal Reserve rate cuts, while cooler inflation at the end of the week helped stocks off the lows. The USD fell across the week.

Major US data/themes

This week, data had a whipsaw effect on rate cut expectations. Data showed the US economy added 130,000 jobs in January, ahead of the 70,000 forecast, marking the largest gain since December 2024. The unemployment rate unexpectedly eased to 4.3%.

The market pushed back Federal Reserve rate-cut expectations to July from June. However, CPI was cooler than forecast at 2.4% YoY in January, down from 2.6%, and core inflation cooled to 2.5%, its lowest level since March 2021. The data lifted expectations for a third rate cut to 50% from 40%.

Gold / Silver moves

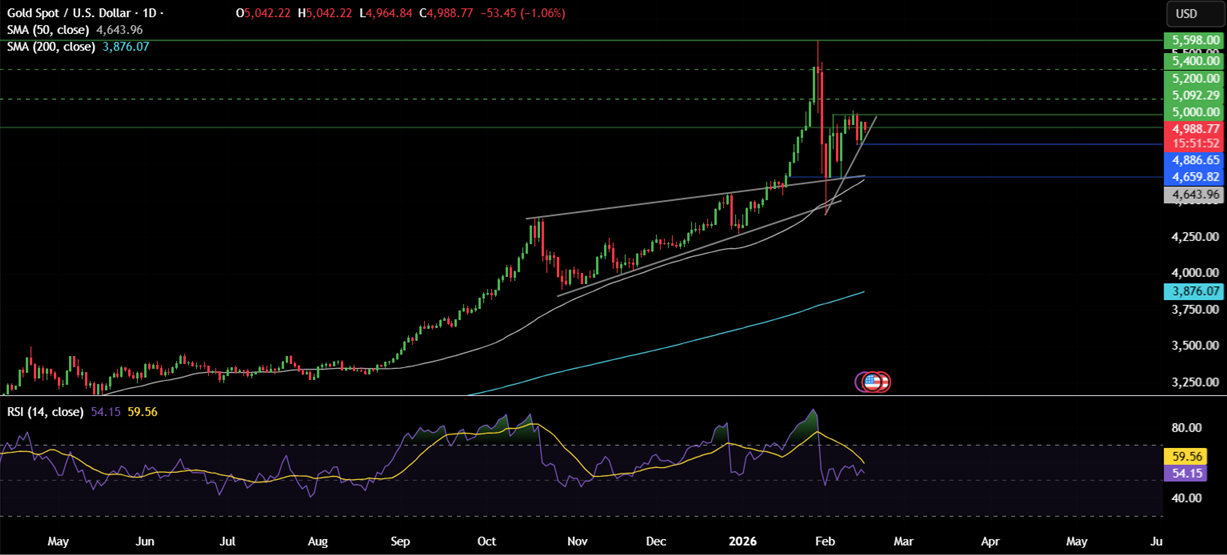

Gold gained 1.6% last week in choppy trading, rising back above 5000 only to fall sharply after a stronger-than-expected US non-farm payrolls report, to 4880, then recovering to above 5000 on Friday following cooler CPI data. Gold is being driven by expectations of rate cuts. This coming week, U.S. data will continue to drive expectations for Fed policy, particularly Core PCE data and Q4 GDP. Cooler inflation and weaker growth could put pressure on the US dollar, helping Gold head higher.

Investors closely monitor global equity indices, particularly tech stocks, given the strengthening positive correlation between precious metals and tech stocks. Gold could benefit from bullish action in the NASDAQ; however, it could come under pressure if tech falls further.

Oil moves

Oil fell 1% last week, marking the second straight weekly decline as the market continued to monitor US-Iran relations. Following talks last weekend, investors are more confident that a nuclear deal will be reached, even as the US deploys another aircraft carrier to the region. The EIA also lowered its demand growth forecast, raising concerns about excess supply and weighing on prices.

This coming week, investors will continue to assess US-Iran relations amid optimism that Iran is ready to consider a deal. Ukraine and Russia are also set to hold additional peace talks next week, which could further reduce the risk premium. US data will provide clues about the demand side.

Indian markets ended the week in the red after an 8% slide in IT stocks. Hotter inflation and weak US cues dragged the benchmark indices lower. The Nifty 50 and the Sensex both closed almost 1% lower.

Foreign Institutional Investors (FIIs) turned net sellers for the week, selling shares worth ₹4,019 crore after recent purchases.

Meanwhile, domestic investors (DII) continued to support the market, buying ₹6,883 crore during the same period.

Indian retail inflation, the first in the new data series, rose to 2.75%, moving within the Reserve Bank of India’s 2% to 6% range and up from 1.33% YoY in December under the old series. Still, India’s tax cuts and recent trade deal with the US will help boost the economy and could add inflationary pressure.

Key Indian market drivers this week include the AI Indian summit, which will attract some of the biggest names in artificial intelligence. Big names such as Sam Altman and Sundar Pichai are expected. In addition to CEOs, 20 heads of state and government are expected. This comes amid deepening AI anxiety in the market, where investors are selling stocks they consider at risk of AI disruption, compared with those they see as benefiting from it. Indian PMIs on Friday could also influence market moves.

USD/INR fell 0.05% last week, closing Friday at 90.55 as the Rupee showed limited benefit against a weaker USD.

Pakistan markets

The Pakistan Stock Exchange (PSX) finished in the red for the third consecutive week, with the KSE 100 index falling below 180,000 amid lingering economic and security concerns. Sentiment remained weak, pressured further by disappointing corporate earnings and a lack of positive news flows.

Data showed remittances for January were up 15% YoY but fell 4% MoM. The auto sector also saw a 36% increase in sales. However, political ad security issues contributed to market volatility, leading to significant selling across sectors such as oil, gas, banks, and fertilisers.

Looking ahead, we could see some weakness as Ramadan begins, although earnings reports this week could provide support. Economic data, such as trade figures and the current account balance, will be in the spotlight.

USD/PKR remained broadly stable, declining 0.03% last week, closing Friday at 279.62. The State Bank of Pakistan’s foreign exchange reserves rose by $20.6 million to $16.18 billion.

Week ahead (US & Asia)

Monday, the US is closed for Presidents’ Day, so volumes are expected to be low.

FOMC minutes (Wednesday)

The minutes relate to the February meeting, which saw the Federal Reserve leave interest rates unchanged, with two dissenters, Miran, who voted to cut rates, joined by Fed governor Christopher Waller. He may have hoped a dovish vote would secure his nomination as Fed chairman. Instead, Trump announced that Kevin Walsh will be replacing Powell in May. Still, with little evidence of a significant slowdown in the US economy, inflationary pressures are easing, and jobs data are stabilising.

The Fed is weighing up a mixed picture. The market will closely monitor arguments about inflation and the jobs market outlook, which could affect the USD and stock indices such as the Nasdaq.

India PMIs (Friday)

The HSBC flash PMIs are expected to show that the services and manufacturing sectors grew faster in February. The services PMI is forecast to rise to 59.2 from 58.5 in January, while the manufacturing PMI is expected to rise from 55.4 to 56.7. As a result, the Composite PMI, a good gauge of business activity, is expected to rise to 59.3 from 58.4, with strong new orders continuing to drive growth and prompting businesses to step up hiring.

New orders rose to the strongest pace in 4 months in January despite the US trade tariffs. With the US-Indian trade deal now in place, activity could ramp up further, boosting sentiment for the Rupee and stocks such as the Sensex.

Japan CPI (Friday)

Japanese CPI is expected to slow sharply, with headline inflation seen at 1.5% year-on-year, down from 2.1%. This deceleration is largely due to government energy subsidies and a steadying of food prices. Inflation could moderate further in the coming months, reinforcing expectations that price pressures could remain contained in the near term.

The data is specifically in focus after the GDP data at the start of the week, given the strong moves in the yen following Takaichi’s landslide victory in elections earlier this month. Takaishi is expected to bring growth to Japan. However, the BoJ will likely wait until the Shunto spring wage negotiations to assess the path for further hikes.

US Core PCE (Friday)

This data is critical for policymakers in weighing up the outlook for interest rates. Expectations are for the Federal Reserve’s preferred gauge of inflation to tick higher to 3% YoY in January, up from 2.9% in December. This comes as food and producer prices point to upside risks and from price increases caused by tariffs. This comes despite the cooler CPI reading on Friday, as PCE data gives greater weight to categories where prices are rising more sharply.

The Fed pencilled in one further rate cut this year, although policymakers have indicated that this is dependent on progress in inflation. The market sees two rate cuts in 2026. Cooler-than-forecast PCE data could lift market rate-cut expectations, pulling the USD lower while boosting Gold and stocks. Hotter inflation could have the opposite impact.

US Q4 GDP (Friday)

The US economy expanded at an annualised pace of 4.4% in Q3 of 2025, its strongest advance in two years, and accelerating from Q3’s 3.8%. The strong growth was driven by resilient consumption and robust exports, whilst imports and inventory adjustments provided headwinds. Overall, the data showed the economy was resilient despite the tariff uncertainties and the softening labour market.

However, the 43-day U.S. government shutdown last year will have impacted growth, with GDP expected to moderate to 3.5%. That said, the effects should be short-lived, and a rebound from the shutdowns’ impact could come in Q1. Strong growth could support a rotation away from tech stocks into cyclicals and lift the Dow Jones and the USD.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.