Weekly recap:

US Global stocks recap

Risk sentiment recovered in the holiday-shortened week, with U.S. stocks pushing higher amid expectations that the Federal Reserve is on track to cut rates again in December. The S&P gained 3.7%, its strongest weekly performance since mid-June. Tech stocks led the charge, with the tech-heavy Nasdaq 100 rising 4.9% across the week, compared with 3.1% in the Dow Jones.

Meanwhile, the US dollar fell 0.72% marking its sharpest weekly decline since mid-October.

Major US data/themes

Dovish Fed commentary combined with weaker-than-expected data, including softer retail sales and a slump in consumer confidence to the lowest level since April, added to expectations that the central bank will reduce rates by 25 basis points next month.

Meanwhile, the prior week’s concerns over the AI trade took a back seat as Alphabet, Google’s parent, hit $4 trillion in market capitalisation after seeing surging demand for its new Gemini 3 AI model.

Gold moves

Gold broke out of its recent tight range, surging 1.7% on Friday alone and jumping 4% across the week, its largest weekly rise since mid-October. XAU/USD rallied 5.4% across the month, its fourth straight monthly rise as it trades 28% higher across the period. This is also the longest winning run since April, when Gold prices rose for four consecutive months. The price is surging on increasing expectations of a December rate cut.

Rising expectations that Kevin Hasset will be picked as the next Fed Chair are also supporting Gold prices higher. Heavy central bank buying and inflows into ETFs have added persistent demand, putting Gold on track for its strongest annual performance since 1979. Looking out across this week, there is plenty of US data that could drive short-term volatility.

While Gold impressed, Silver stole the spotlight, reaching a fresh record high. While Silver undoubtedly benefits from Gold’s momentum, its bullish narrative also hinges on a potent mix of booming industrial demand and constrained supply.

Oil moves

Oil prices edged 0.8% higher last week, paring earlier gains amid rising optimism about a Russian-Ukrainian peace agreement that could see sanctions on Russian oil removed, increasing supply. Meanwhile, demand worries remained after an unexpected surge in US crude oil inventories signaled weaker demand. The only real positive came from Baker Hughes, which reported that US oil rigs fell to a 4-year low, signaling smaller US oil production in the near term.

Over the weekend, OPEC+ met virtually and left its oil production policy unchanged, as expected. At the November meeting, the oil producers’ group said it would keep output unchanged in Q1 of 2026, after lifting production by 137k barrels a day in December. Looking ahead to this week, data from China and US manufacturing figures could impact oil prices, as could any developments in the Russian-Ukrainian peace process.

Indian markets

Indian markets saw a third straight week of gains, with the Nifty 50 and the Sensex rising 0.5% reaching fresh record highs. Improved investor sentiment was driven by expectations of a December Fed and RBI rate cuts and by hopes of a US-India trade deal. Domestically, the mood was lifted by robust consumption growth in October, combined with a brightening earnings outlook. Stocks rose across November, putting key Indian indices on track to extend a yearly winning streak to a tenth year.

Foreign Institutional Investors (FIIs) remained net sellers for the fifth consecutive week, offloading Rs 3659 crore. Year to date, FIIs have posted net outflows of Rs 2.58 lakh crore.

In contrast, Domestic Institutional Investors (DIIs) continue to provide strong support, recording solid net inflows of Rs 22,763 crore. Year-to-date, DIIs have recorded net inflows of Rs 7.01 lakh crore.

Data last week showed Indian GDP expanded much faster than expected, growing 8.2% year on year in the July to September quarter. This was well ahead of the 7.3% forecast and up from 7.8% in the previous quarter.

This places India as the fastest-growing major economy, boosted by robust consumer spending and growth in manufacturing and services, which outweighed the impact of US tariffs on exports.

USD/INR fell 0.32% last week, settling at 89.35 on Friday, down from its record high.

Pakistan markets

The KSE 100 rose 2.8% last week, settling on Friday at 166,677. This marked a third straight weekly rise and the strongest since late September, boosted by renewed institutional buying, improving macro indicators, and upbeat economic projections from Pakistan’s finance minister. Expectations are for the economy to grow 3.5% in the current year, with 4% GDP growth expected over the coming two years.

Looking ahead, the market is expected to maintain its positive tone, supported by expectations of IMF approval and improved reserve prospects. The IMF will meet on 8 December and is expected to approve a $1.2 billion tranche under the Extended Fund Facility and the Resilience Sustainability Fund. Approval would reinforce stability.

USD/PKR slipped last week, settling at 282.57 on Friday. The pair is falling on Monday.

Week Ahead (focus US & Asia)

Indian-US trade talks

US-India trade talks remain a key factor. Negotiations between the US and India appear to be progressing, with most major issues having been resolved, according to India’s Commerce Secretary, Rajesh Agarwal. The first phase of the Bilateral Trade Agreement, which focused on tariff rationalization and market access, is reportedly expected to be finalised before 31 December. A trade deal could help support the Rupee, which has fallen 4.3% so far this year, making it Asia’s worst-performing currency this year.

However, if the trade deal remains stuck, the Rupee could soon weaken past 90.

Indian Manufacturing & Services PMIs (Monday & Wednesday)

India’s manufacturing PMI expanded in November, but growth lost pace. The PMI was revised lower to 56.6 in November, down from preliminary estimates of 57.4 and October’s reading of 59.2. This marks the slowest growth since February, although the sector remains above its long-term average of 54.2. Delving deeper into the figures, domestic orders rose modestly while new export orders increased at the slowest pace in every year.

Meanwhile, business confidence for the year ahead remained positive, though optimism fell to its lowest level since mid-2022.

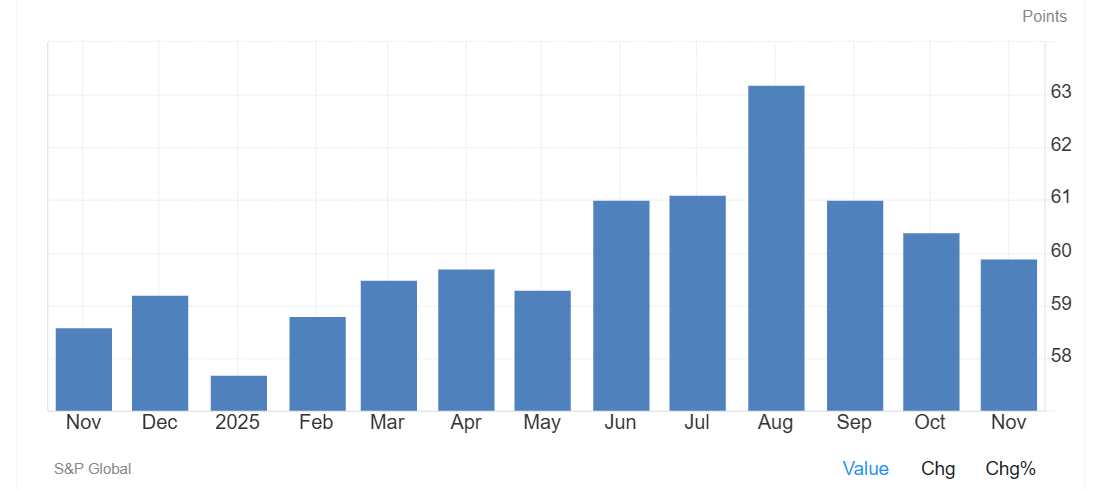

On Wednesday, the services PMI for November will be released. The India services PMI rose to 59.5 in November, in the preliminary reading, up from October’s five-month low of 58.9. The composite PMI for November was 59.9 in the preliminary reading, down from a final reading of 60.4 the previous month, pointing to its lowest level since May.

However, it remains above the long-run average of 54.9. These PMIs are final readings and tend not to be as market-moving as preliminary data releases.

US ISM Manufacturing PMI (Monday)

The manufacturing activity index attracts attention, given Trump’s desire to bring manufacturing back to the US. However, recent data suggests that activity is slowing. Expectations are for the contraction to deepen to 48.6 from 48.7. Looking to the S&P manufacturing PMI for comparison, this fell to a four-month low of 51.9 in November, down from 52.5 in October, as the report noted a marked decline in new orders and a fifth straight monthly fall in export orders, putting downward pressure on output.

Inventories of finished goods increased at the fastest pace in the survey’s 18-year history, suggesting a buildup of unsold stock. However, input price inflation cooled to the lowest level since February, although it remained above recent averages. Weaker data could reinforce expectations of a Fed rate cut, lifting stocks such as the Dow Jones Industrial Average.

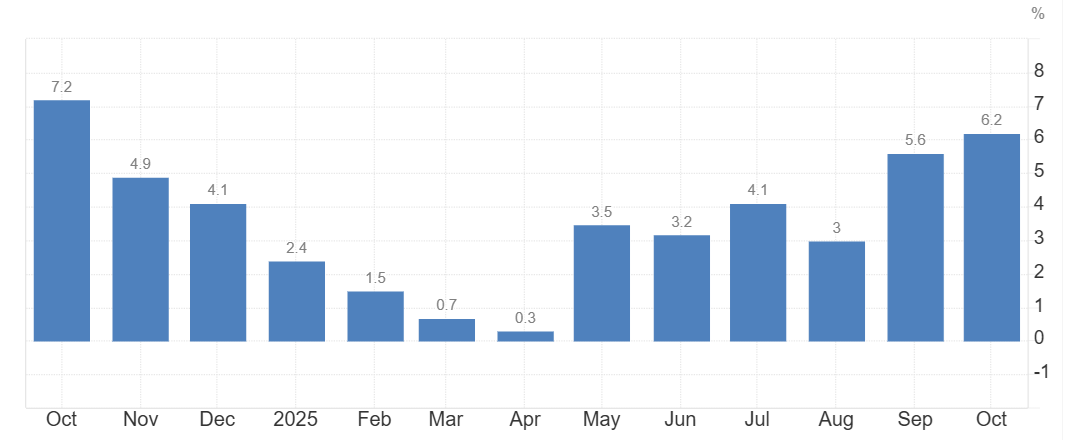

Pakistan Inflation (Tuesday)

Pakistan’s consumer inflation is expected to rise in November, with CPI reaching 7% YoY, up from 6.2% in October. On a monthly basis, CPI is expected to rise 0.8% MoM amid higher food prices driven by supply disruptions linked to recent floods and the closure of the Afghan border. With CPI elevated, real interest rates for November are projected at 400-450 basis points, well above the historical average of 200-300 bps.

US ISM services PMI (Wednesday)

The service sector is the largest contributor to the US economy. Therefore, the ISM services PMI carries weight with the markets. As a basis of comparison, the S&P services PMI for November showed the index rising to 55, up from 54.8, marking a four-month high and posting the largest rise in new business so far this year.

Given the focus on US inflation and the health of the jobs market, the report’s input prices and jobs subcomponents will be closely watched. In October, import prices rose at the fastest pace since January 2023, mainly driven by tariffs and higher wages. Service-sector job creation is expected to remain modest and slower than in October. Stronger-than-expected data could boost the USD, lifting USD/JPY.

US core PCE (Friday)

Following the US government reopening, the missed September core PCE and personal income spending report has been delayed until December 5th. Core PCE is the Federal Reserve’s preferred inflation gauge and therefore has the potential to move markets. As a point of comparison, September CPI showed inflation was 0.3% MoM, down from 0.4% while core CPI rose 0.2% weaker than the 0.3% expected. PPI data showed a 0.3% MoM increase, lifting the annual rates to 2.7% from 2.6%.

Overall, the relevant CPI and PPI components feeding into the PCE report point to a rather subdued monthly PCE rise. The data comes ahead of the FOMC meeting on 10-11 December, where the Fed is expected to cut rates by 25 basis points and is expected to continue cutting rates next year.

Recent expectations of a rate cut have been boosted by dovish Fed commentary. Cooler-than-forecast core PCE could help drive stocks like the S&P500 and Gold higher and the USD lower.

Indian RBI Rate Decision (Friday)

The RBI will meet for the final time this year on December 5th. The RBI left the repo rate unchanged at 5.5% at the October meeting, in line with expectations. The December rate decision comes as inflation fell to a record low of 0.25% YoY in October, driven by a sharp fall in food prices and a tax cut on consumer goods.

Low inflation, combined with global trade uncertainties, could prompt the RBI to cut rates again, following a cumulative 100-basis-point reduction since the start of the year. Lower rates could help boost stock indices such as the Sensex.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.