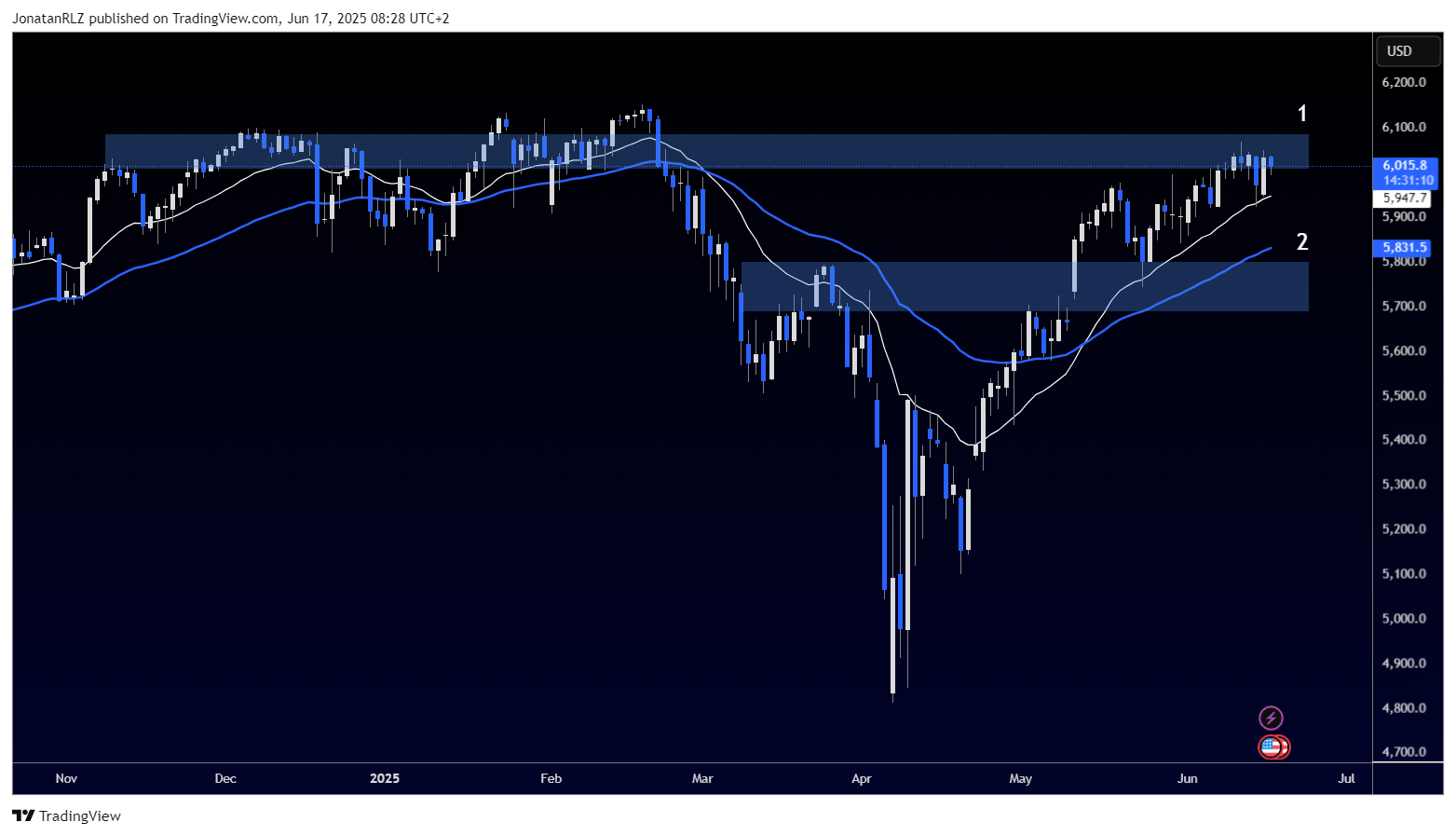

Following the sharp sell-off earlier this year triggered by Trump’s tariffs, the S&P 500 has posted an impressive recovery. On the weekly timeframe, price has printed a clear V-shaped reversal, reclaiming all of the prior downside and now trading comfortably above the 6,000 level.

The index is now approaching a high time frame resistance zone marked with number 1, an area that has historically acted as a ceiling during periods of extended rallies. Whether this level holds or breaks will depend largely on both technical momentum and broader macro factors, particularly ongoing geopolitical tensions between Israel and Iran.

On the daily chart, the structure remains strong. Price is forming higher highs and higher lows, while holding above the 20 EMA, shown as a white line. The 20 EMA also remains above the 50 EMA, shown as a blue line, reinforcing bullish momentum. The current resistance zone between 6,000 and 6,100 is the next major test for bulls, marked with number 1 on the chart.

If price is rejected at this high time frame resistance zone, the next probable support zone starts at 5,800, marked as number 2. These levels are likely to be closely watched by investors looking for structural confirmation before entering or exiting positions.

Zooming into the 4-hour chart, we can see that the bullish trendline (2), which had defined the previous trend, has now been broken. Multiple bearish retests of the trendline have taken place, indicating that while the structure is still constructive, it is no longer cleanly trending.

Two important short-term levels to monitor are 5,950 and 6,040, marked as numbers 3 and 5 respectively.

A confirmed breakout above 6,040 could increase the probability of continuation and possibly signal a breakout through the high time frame resistance zone. On the downside, a break below 5,950 would shift focus to the support zone beginning at 5,850, marked as number 4.

From an intraday risk management perspective, levels 5,950 and 6,040 are key boundaries to watch for potential setups and short-term trend direction, particularly in light of heightened global uncertainty.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.