- Bitcoin eases back to $70k but ETH hold above $3700

- Fed speakers dampen rate cut bets

- FOMC minutes will be released later today

- Nvidia is expected to post stellar results, which could bode well for Bitcoin

Bitcoin is falling on Wednesday, dropping back to 70,000 ahead of more cues from the Federal Reserve over the future path for interest rates and ahead of Nvidia’s earnings. However, Ether holds onto ETF-inspired gains.

Source: Trading View

Ether is holding steady above $3700 at a two-month high after reports earlier in the week indicated that the Securities and Exchange Commission appeared to be making progress toward the approval of spot Ether ETFs. The regulator’s decision is due later this week.

Fed speakers dampen rate cut bets.

However, warnings from a slew of Federal Reserve officials over sticky inflation and the need to keep interest rates high for longer have resulted in a cautious market mood, pulling Bitcoin back from recent highs.

After reaching a peak of 71,900 yesterday, Bitcoin trades down 1.5% across the past 24 hours and is testing support at 70,000.

Overnight, Federal governor Christopher Waller said that he would need to see several more months of good inflation data before he would consider cutting interest rates. Cleveland Federal Reserve president Loretta Mester echoed his comments. Meanwhile, Atlanta Federal Reserve president Rafael Bostic said that he would not expect a rate cut before the final quarter of the year despite inflation cooling in April by more than expected.

Attention will now turn to the minutes of the Federal Reserve’s late April meeting for more clues on when the central bank could start cutting interest rates. In the April meeting, the Fed left rates unchanged at 5.25% to 5.5%, and in the press conference following the meeting, Federal Reserve chair Jerome Powell said that the next move by the Fed would be unlikely to be a hike.

High interest rates for longer bode poorly for crypto assets, which often perform better in low-interest rates environments with higher liquidity.

Nvidia Q1 earnings – what do they mean for Bitcoin?

Attention will also be on Nvidia’s earnings. The AI darling of Wall Street is expected to produce strong results in the first quarter of this year thanks to surging demand for its AI chips.

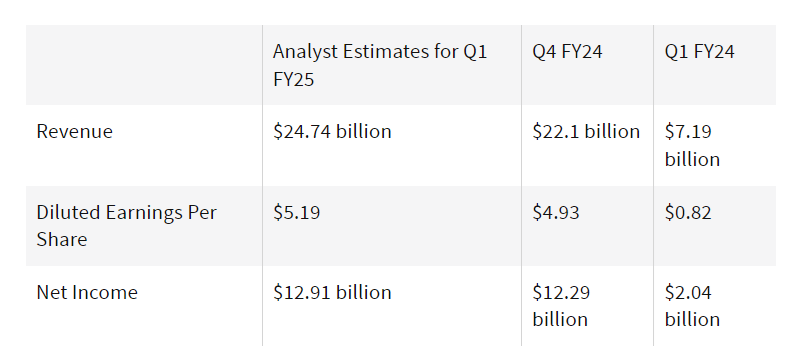

Source: Investopedia

Nvidia is expected to post a 242% increase in revenue to $24.65 billion, up from $7.19 billion in the same quarter last year. Meanwhile, earnings are expected to rise, with EPS expected at $5.17, up from $0.82 in the same quarter a year ago.

The earnings come as Nvidia’s share price has risen 100% so far this year and 200% over the past 12 months, far outperforming the broader market.

Strong earnings from Nvidia could send the tech-heavy NASDAQ 100 on its next leg higher to fresh ATHs. This is important for Bitcoin because, according to Bloomberg, the Nasdaq100—Bitcoin correlation is at its highest level since late August, so a strong rise in the index could point to more gains for Bitcoin.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.