The Bitcoin price is falling for a third straight day as it moves further away from the key 70k psychological level that it failed to take at the start of the week. Uncertainty surrounding the upcoming US elections, combined with expectations of more gradual rate cuts from the Federal Reserve, has weighed on crypto cryptocurrencies and, more broadly, the market mood.

Global equities are also trading lower this week, and gold is at a record high, highlighting the weaker risk sentiment across the markets.

The market mood is being affected by uncertainty surrounding the upcoming US elections. While optimism of a Trump win helped push Bitcoin to rally almost 10% in the previous week, the reality is the race is still very tight, with just two weeks remaining until America votes on November 5th.

USD strength & gradual Fed rate cut expectations

Bitcoin is also under pressure amid a stronger USD. The USD has risen 3.2% against its major peers so far this month and trades at a level last seen in early August. The USD is being boosted by expectations that the Federal Reserve will cut rates at a slower pace after a slew of upbeat data that has highlighted the resilience of the US economy.

The market is pricing in a 90% chance that the Fed will cut rates by 25 basis points in November rather than a 50 basis point rate cut expected just a month earlier. The market is also pricing in a slightly higher terminal rate, as seen by the rise in US treasury yields.

Higher interest rates bode poorly for riskier assets such as crypto, as they mean that less liquidity is available.

Bitcoin ETFs bleed on Tuesday.

Bitcoin institutional investors are pausing after a week-long bullish run. Spot Bitcoin ETFs turned negative on Tuesday for the first time in two weeks. BTC ETFs showed $79.1 million in outflows on Tuesday as the price struggled around $67k.

Last week, Bitcoin ETF net inflows crossed $20 billion for the first time. In Q3, Bitcoin saw Bitcoin ETF inflows of over $5 billion, highlighting the strong demand by institutional investors for direct exposure to Bitcoin.

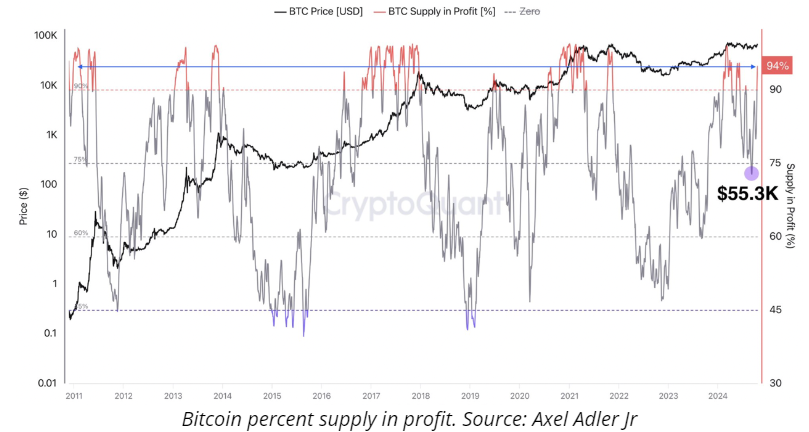

94% of Bitcoin holders were in profit

Data from CryptoQuant showed that 94% of the Bitcoin supply was in profit at the start of the week when the price rose above 69k, with the majority of tokens having been purchased around 55k. History shows that such a high supply of Bitcoin in profit has usually been a precursor to a price drop. In late September, this metric reached similar levels before the price fell from 65.8k to 60k. A similar scenario was soon in March.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.