- Risk sentiment weakens on Tuesday on US growth worries

- 50% of Bitcoin supply is inactive- a sign of longer-term conviction

- Bitcoin trading volumes tumbled, but interest in BTC ETFs remains strong

Bitcoin is edging lower after briefly rising above $70k yesterday before retracing to the familiar 68k-69k region, where it has traded sideways in recent sessions.

Similarly, Ether ran into selling pressure at 3840 before returning to its current level of around 3700.

The cryptocurrency market is falling alongside the broader financial markets as the market mood sours. Yesterday’s weak US manufacturing data raised concerns over the strength of the US economy, putting US economic exceptionalism into question. The market mood has deteriorated, even though the recent string of weak data means the Fed is more likely to cut rates sooner.

The market is currently pricing in a 62% probability of a Fed rate cut in September, up from 50% last week.

Yet, even in the face of struggling risk sentiment on Tuesday, the longer term outlook for Bitcoin stands strong and supportive, providing a reassuring anchor for the investors.

According to data from CryptoQuant, 50% of the Bitcoin supply was inactive; in other words, it was showing no signs of movement across wallets or exchanges. This is typically considered a sign of strong longer-term conviction, which could point to price gains going forward.

The price has remained relatively steady in a holding pattern despite negative headlines last week surrounding Mt Gox, which could raise supply in the near term.

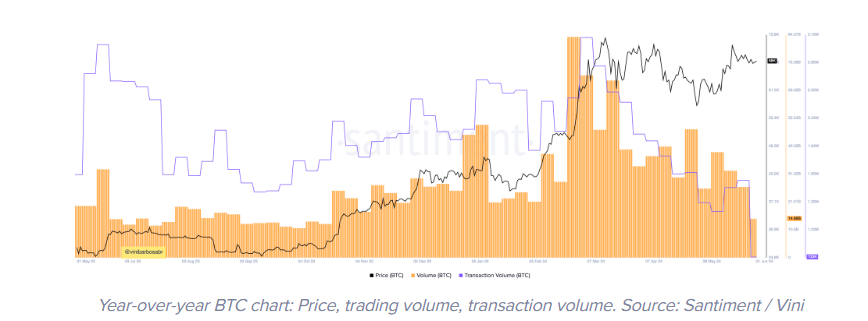

Data from Santiment also shows that Bitcoin trading volumes have tumbled. Bitcoin spot trading and on-chain transaction volume plummeted, although ETF demand remains solid.

The data showed that Bitcoin’s 7-day trading volume dropped below $14 billion, the same level it was when it traded below $30k last year.

The network saw just 722,000 Bitcoin moved in seven days, which is significantly down from 1.79 million moved in October 2023, with a similar trading volume but half the price. Instead, interest is primarily on ETFs and derivatives, with speculative activity increasingly directed through these financial instruments.

Bitcoin ETF interest remains strong.

Strong interest in Bitcoin ETFs has been almost continuous since their approval in early January. Global digital asset investment products saw $2 billion of inflows in May, led by Bitcoin and Ether ETFs. Meanwhile, BlackRock‘s spot Bitcoin ETF (IBIT) also became the largest spot Bitcoin ETF by asset, passing Grayscale’s GBTC for the top spot. IBIT’s assets were $19.5 billion compared to Grayscale’s GBTC’s at $19.35 billion.

Australia Bitcoin ETFs start trading.

Today, the first spot-Bitcoin ETF, the Monochrome Bitcoin ETF, began trading on the CBOE, marking a significant milestone for Bitcoin adoption in Australia. CBOE is the first Australian exchange to list Bitcoin ETF, beating the larger Australian Securities Exchange (ASX), which is reportedly planning to approve spot Bitcoin ETFs by the end of the year.

These launches, combined with those in Hong Kong, tap into a growing demand for exposure to Bitcoin without direct ownership. Increased demand through ETF products can lift the price.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.