Bitcoin is holding steady at 61K after four straight days of losses. October, which is typically a bullish month for Bitcoin, has started off on the wrong foot, with the cryptocurrency down 3.8% so far in October and down 7% so far this week.

Bitcoin is struggling in a risk-off environment as tensions in the Middle East escalate, raising concerns of a broader conflict in the region. Bitcoin has fallen sharply since Middle Eastern tensions have ramped up more recently with Israel’s incursion into Lebanon and Iran’s missile attacks.

However, it’s not just geopolitical uncertainty that is affecting Bitcoin. The world’s largest cryptocurrency has also been under pressure amid expectations that the Federal Reserve will be patient with its rate-cutting cycle and as investors digest the latest developments in the US port strikes.

A series of stronger-than-expected jobs data this week has shown that the US labor market is showing resilience ahead of Friday’s non-farm payroll report. Yesterday, ADP data showed 143k private payrolls were added in September, well ahead of the 125k forecast, while JOLTS job openings also unexpectedly increased, although the hiring rate fell to the lowest level since the pandemic.

While the labor market is cooling, it is by no means collapsing, which paves the way for a 25-basis-point cut rather than a 50-basis-point cut in November, which changes liquidity expectations moderately.

Trades are also monitoring the latest developments surrounding the port strikes in the US. This is important because, as highlighted by the S&P global market intelligence, the strike, if it is not resolved soon, could eventually affect shipping or 40 to 50% of US imports. These disruptions would put upward pressure on goods prices, raising inflation, which would, in turn, complicate the Federal Reserve’s plans to lower interest rates.

Some may consider that Bitcoin was, in fact, created in order to combat these issues, defying the sway of central banks and administrators, but at least for now, that doesn’t seem to be the case. Instead, the largest cryptocurrency in the world continues to be hampered by bad economic and geopolitical news while maintaining an elevated correlation with the S&P 500.

While Bitcoin is falling, the USD has surged. The US dollar index, which measures the USD against a basket of currencies, has risen for a fifth straight day on safe-haven demand and as the market lowered its rate cut expectations.

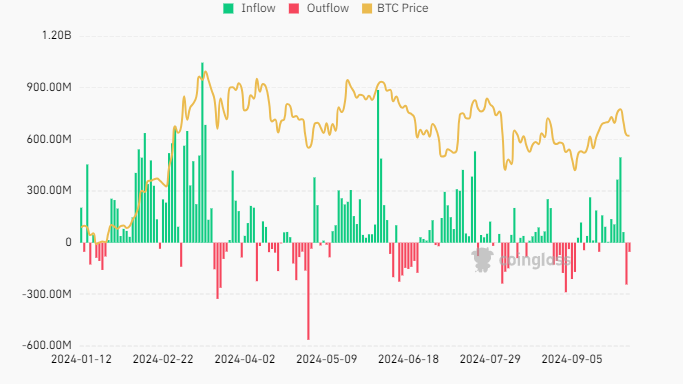

BTC ETF outflows & ETH ETF inflows

Spot Bitcoin ETFs experienced net outflows of $52.9 million yesterday. According to data from SoSo value, this followed outflows of $242.6 million on Tuesday, marking the worst day for ETF outflows since September 3rd.

Interestingly, yesterday, Ether ETFs attracted $19.8 million in total inflows. The divergence between BTC and ETH ETFs highlights ongoing market volatility and institutional investors’ selective positioning.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.