- BTC/USD has risen over 605 this year

- ETF net inflows have reached $7.5 billion

- Whales are still adding, so prices may have room to rise further

- BTC/USD & Gold rose to record levels as Fed rate cut bets rise

Bitcoin briefly rose past $69,000, setting a record high for the cryptocurrency at $69,191 before sellers stepped in for a bout of profit-taking, pushing the price lower.

Record rally

Bitcoin has surged more than 63% since the start of the year and is up 50%, outperforming global stocks and pretty much any other asset. The surge has come after US regulators approved spot BTC ETF in early January.

The spot Bitcoin ETFs allow investors to have direct exposure to the cryptocurrency without the risks associated with unregulated crypto regimes, flinging the door open to institutional investors and boosting demand.

BTC ETF inflows

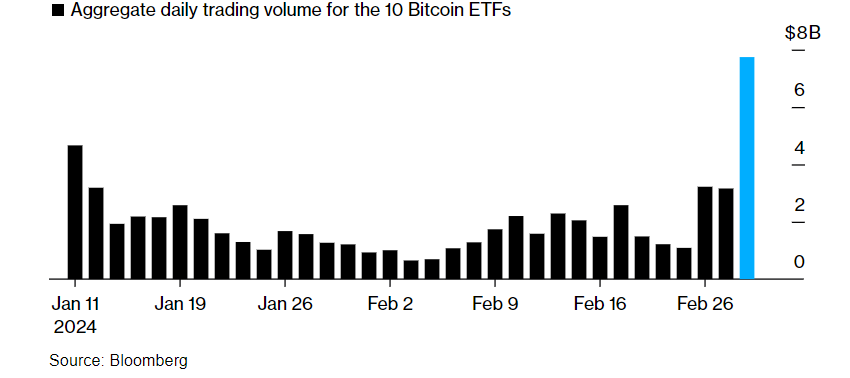

Spot Bitcoin ETF inflows have been mind-blowing and have now become a key metric used to help explain and forecast Bitcoin price movements.

Over $7.5 billion worth of capital has flowed into the Bitcoin ETFs since their first day of trading on January 11. Last week alone, spot BTC ETF net inflows were $1.7 billion, and on March 4th, they were $562 million, ten times the amount of new Bitcoin added to the supply through mining activities. The simple economic story of supply and demand supported the higher price, and this could be increasingly the case after the event next month, which will reduce supply.

We know the market doesn’t move in one direction (although you may be forgiven for thinking it does after eight straight weekly gains in BTC/USD). The volatility that Bitcoin is famed for came back with a bang yesterday as the price quickly plunged 10% before settling 6% lower on the day.

It’s worth keeping in mind that at the point when BTC/USD rose over $69,000, almost everyone who had bought Bitcoin was in profit, so there was a good chance that we would see a round of profit taking, but that doesn’t necessarily mean its downhill from here.

Whales are still buying

Recent on-chain data show that large Bitcoin holders, known as whales, have been adding to their holdings in recent days, suggesting that BTC/USD could have room to run higher. According to data from IntoTheBlock, whale addresses have bought up 4,177 BTC (approximately $279 million. This behavior goes against historical trends when whales typically buy during periods when the Bitcoin price is lower.

Gold & BTC/USD

While inflows and the halving event are key parts of the Bitcoin bullish equation, we can’t ignore the fact that BTCUSD rose to fresh all-time highs in parallel with Gold.

Gold and Bitcoin are non-yielding assets, so they tend to perform better in periods of lower interest rates. The market has become increasingly convinced that the Fed will start cutting rates in June, following weaker-than-expected data on Friday, fueling the latest leg higher for crypto and the precious metal. According to the CME Fed watch tool, the market is pricing in an 85% probability of a June rate cut.

Sources

Related Blog Posts

https://primexbt.com/for-traders/what-is-a-bitcoin-etf/

https://primexbt.com/for-traders/bitcoin-price-prediction-forecast/