- Bitcoin trades at a 20-month peak

- Spot BTC ETF, halving & US elections support the price

- A fresh all-time high could come October 2025

- Bitcoin whale activity has reached an almost 2 year high

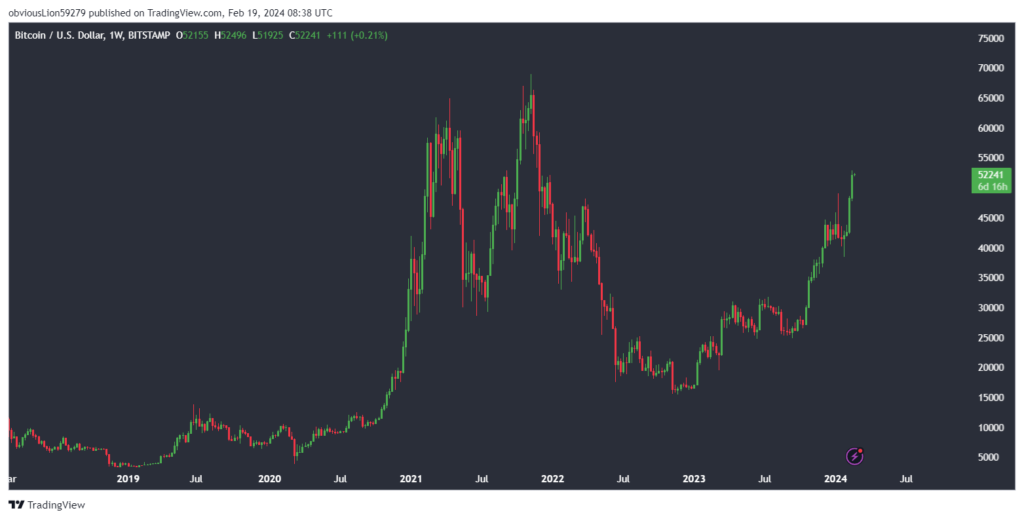

Since its beginning in 2009, Bitcoin has captured the attention of investors, tech enthusiasts, and the media, with the price soaring from just $500 in 2013 to an all-time high of $69,000 in 2021.

The cryptocurrency has experienced high levels of volatility. At the start of 2023, BTC/USD fell below $17,000 before rallying an impressive 150% across 2023 and extending that rally in 2024 to its current level of $52,000. The surge in BTC/USD has many market participants wondering whether Bitcoin will reach an all-time high this year.

Why might Bitcoin rise to an all-time high?

Several developments could help Bitcoin rise to a record high.

Spot Bitcoin ETF

On January 10, the US Securities and Exchange Commission approved the first Bitcoin ETF. This is important because it enables providers to create ETFs that directly purchase and hold bitcoins on behalf of investors.

This development increases Bitcoin’s accessibility as an investment, drawing in investors and institutional investors and cementing cryptocurrency’s status as an asset class.

The figures speak for themselves. Spot ETFs are boasting $10 billion of assets under management in less than a month, with inflows reaching $1 billion in one day alone.

As with any asset, Bitcoin’s price is set by supply and demand, and the launch of Bitcoin ETFs means that a vast new source of demand is lifting the price.

Bitcoin Halving

Bitcoin is about to undergo another halving in April. This event, which happens every four years, sees the number of Bitcoins rewarded to miners cut by half, reducing supply. In the last cycle, Bitcoin took 18 months to make a fresh all-time high at $69,000 following the halving. This was the same for the previous cycle, 18 months after halving making this an interesting statistic and one we should watch. This could mean a fresh all-time high could be reached around October next year. However, it is essential to note that past performance is not a future price indicator.

Source: Stockmoney Lizards

Election Year

The US will hold Presidential elections in November with the possibility of a Republican administration inspiring crypto investors.

Bitcoin Whales

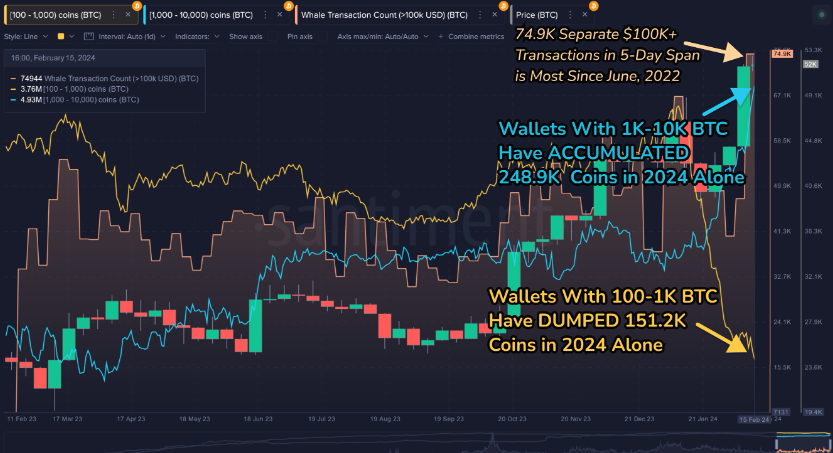

According to data from online intelligence tracker Santiment, Bitcoin Whales has engaged in the highest activity level in almost two years. Large wallet investors are independent of the vast inflows from ETFs but paint a similarly encouraging picture.

Bitcoin whales, with 1000 to 10,000 BTC in their wallets, have added $12.95 billion worth of assets so far this year, the highest level since June 2022. This is overshadowing a sell-off in those with 100 to 1000 BTC in their wallet, which dumped $7.89 billion in 2024. These figures show that Bitcoin’s recent price rise has generated interest among market participants, which could point to further gains should the price keep rising.

Source: FXStreet

Will Bitcoin See a Correction Before Reaching New All-Time High?

Bitcoin has a history of volatility and price swings. The Bitcoin price has crashed on several occasions. While several factors drive the Bitcoin price higher, there are still several risks. Increased regulatory issues could be one of the most significant risks for Bitcoin, with any anti-crypto legislation likely to hurt demand.

Environmental concerns could also result in further regulation or a move to other cryptocurrencies.

Conclusion

BTC/USD has risen to a 20-month high after spot ETF approval and ahead of halving and US elections. These factors could help BTCUSD reach a fresh record high in the coming 18 months. Bitcoin whales are also showing rising interest as the Bitcoin price increases.

Sources

Bitcoin Price Prediction 2024 – Forbes Advisor UK

Bitcoin whales hit 20 month peak in activity as BTC price sustains above $51,000 (fxstreet.com)

Bitcoin Price Prediction: Can BTC Reach $100,000? – Forbes Advisor

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.