Bitcoin is rising modestly towards 67k, recouping Tuesday’s losses. After hitting a record high of 73k in early March, Bitcoin continues to trade within a familiar range, between 60k and 70k.

So far, the weekend’s halving event and the launch of the Runes protocol, which briefly pushed transaction fees to record highs, have spurred little change in the Bitcoin price.

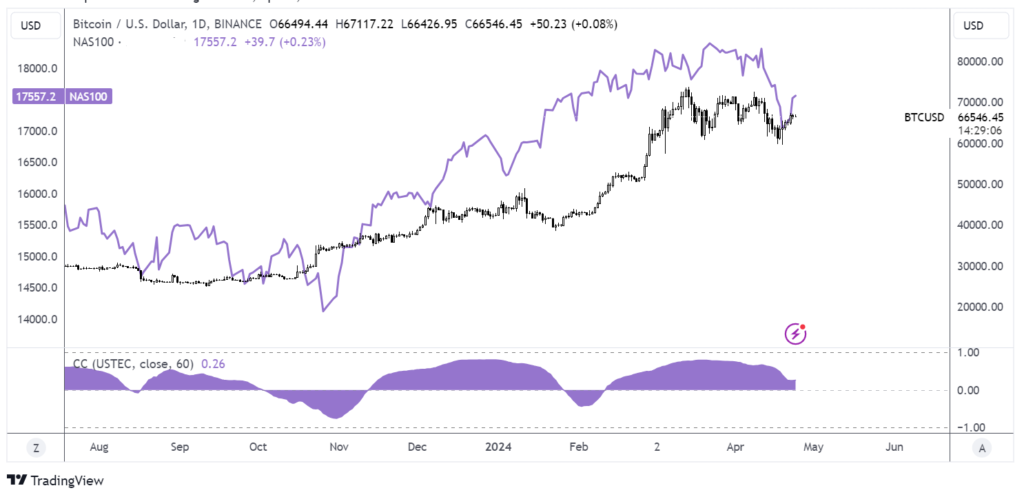

The Bitcoin price has seen limited gains despite a substantial rise in technology stocks. These stocks have rebounded sharply this week as tech earnings come into focus. Historically, Bitcoin has traded in close correlation to tech stocks, which make up the Nasdaq 100 index. This correlation isn’t that surprising considering that Bitcoin is a technology, and many tech stocks in the Nasdaq have a clear tie to the crypto space.

BTC – Nasdaq correlation

The long-running correlation between Bitcoin and the Nasdaq is 0.85, which is pretty high. The number 1 indicates a perfect correlation, and -1 is when two assets trade inversely. However, despite the historically high correlation, there are periods when the correlation weakens or even breaks down. This can be due to various factors, such as regulatory changes, market sentiment shifts, or significant news events in the tech or crypto space.

According to the BTC Pearson Correlation chart, a tool used to measure the strength and direction of a relationship between two variables, the 30 BTC Nasdaq correlation is at 0.47. This is down from 0.83 at the start of the month, signaling a weaker correlation between Bitcoin and the Nasdaq, which would explain why Bitcoin is seeing limited gains despite the Nasdaq rising just shy of 3% so far this week.

After falling 6% last week, the Nasdaq is recouping those losses this week as tech earnings come into focus.

Tech earnings

Tesla released Q1 earnings overnight, which saw revenue miss estimates by almost $1 billion. Earnings Per Share (EPS) were also weaker than expected at $0.45, half what they were a year ago. However, the market looked past weak earnings and instead was encouraged by an accelerated launch of more affordable EVs, sending the share price 12% higher in pre-market trade.

Looking ahead, Meta’s earnings are due today. The social media giant is expected to post solid earnings and revenue growth. Meanwhile, Microsoft and Alphabet are due to release earnings tomorrow. Upbeat numbers could help lift the Nasdaq higher.

Conclusion

The correlation between the Nasdaq and BTC has eased from 0.83 at the start of the month to 0.47%. While the Nasdaq has risen almost 3% this week, gains in Bitcoin have been limited. However, there is still some level of correlation, so a strong rise in the Nasdaq in tech earnings season could still result in some gains for Bitcoin.

Sources

https://www.ft.com/content/d8afadd2-9d67-4a4c-b6e8-c7d4dda7521b

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.