- Bitcoin slumps to a 2-month & is on the verge of a bear market

- Worries of a massive supply sale hit from Mt Gox coins hit Bitcoin

- US data points to a weaker economy

- Fed rate cut expectations rise

Bitcoin has slumped to a two-month low, taking out key support. The largest cryptocurrency has fallen, sliding over 8% over the past three days as traders fret about distributions from the defunct exchange Mt Gox. These could spark a massive sale of the token, increasing supply. These concerns offset optimism that the Federal Reserve could start to cut interest rates soon.

Bitcoin has fallen over 4.5% in the past 24 hours to a low of 57,100, extending losses from June. Bitcoin has now lost almost 20% since the start of June. A loss of over 20% from a recent high would put Bitcoin in a bear market.

Mt Gox distribution & mass sale fears

The crypto Bitcoin market is on edge ahead of an expected distribution by Mount Gox. The exchange’s liquidators have signaled that they will start returning Bitcoin and Bitcoin cash stolen during a 2014 hack to clients around the start of July.

The exchange was seen mobilising around $9 billion worth of Bitcoin earlier this year although it’s still unclear exactly how much of this will be distributed.

The other is unknown, and the market is speculating on whether the Bitcoin receivers will be inclined to sell them, given Bitcoin’s huge gains over the past decade. Such a scenario would increase the supply of Bitcoin, putting selling pressure on the price.

Concerns over increased supply come as the German government was also seen offloading Bitcoin, which it recovered from a piracy website. At the same time, some whales are also seen mobilising Bitcoin this week, heightening anxiety in the market.

Fed rate cut expectations rise

These concerns have overshadowed rising expectations of a rate cut from the Federal Reserve in the coming months.

Federal Reserve chair Jerome Powell adopted a more dovish stance in a speech this week. The chief of the US central bank acknowledged that the Fed had made progress in cooling inflation. The market interpreted these comments as a signal that the Federal Reserve could move sooner to cut interest rates.

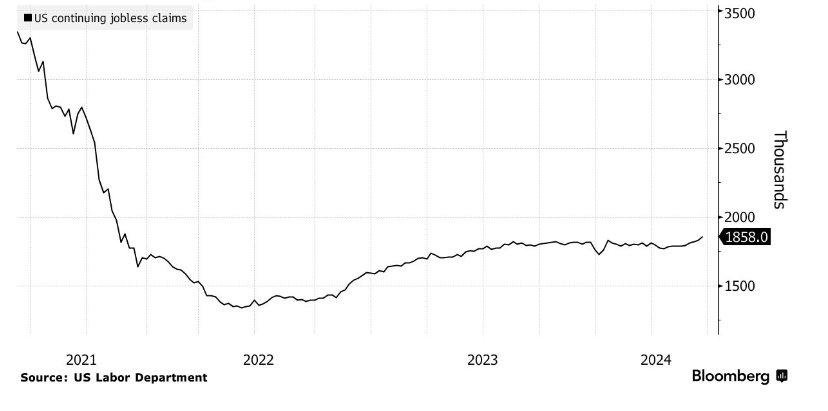

U.S. data has also pointed to a softening in the US economy. Continuous jobless claims, which measure the number of Americans receiving unemployment benefits, rose for a ninth straight week, the longest rising streak since 2018. Continuous claims rose to 1.86 million, a level last seen in November 2021. This, combined with ADP payroll data falling to 150k, also pointed towards a cooling US labour market ahead of Friday’s nonfarm payroll report.

However, there are concerns that the U.S. economy could be slowing too much, as the ISM services PMI fell to 48.8, its deepest contraction since 2021.

According to the CME, the Fed watch tool, the market is now pricing in a 69% probability that the US central bank will cut interest rates as soon as September, up from 56% a week ago.

While a low interest rate environment is good news for risk assets such as Bitcoin. Signs that the US economy could be slowing too much would be bad news for risk sentiment and Bitcoin.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.