Bitcoin halving is an event that occurs every four years, or more precisely, every 210,000 blocks. This time, it will be when the block height reaches 840,000, which is expected in mid-April.

Key takeaways:

- Bitcoin halving events, occurring every 210,000 blocks (approximately every four years), reduce the reward for mining Bitcoin by half

- There is speculation that reduced mining rewards post-halving could lead miners to seek more lucrative transaction processing opportunitiesast

- BTC Halving events have been followed by periods of price increases for Bitcoin, but historical performance is not a guaranteed predictor for the current year

Will the price rise or fall after the Bitcoin halving event?

Bitcoin halving is when the reward for mining Bitcoin is halved, reducing the pace of issuance and maintaining scarcity. Economic Theory says that with reduced supply, the price will increase as long as demand remains constant. This will be the fourth halving event for Bitcoin, and the previous halving cycles support this view, with the price of Bitcoin soaring across each cycle.

However, once the next halving takes place, the possibility also exists that miners could shift transaction processing power away from Bitcoin as they look for more transaction fees elsewhere to compensate for lost Bitcoin revenue. Fewer miners would mean a less secure network.

History has taught us that this hasn’t been the base-case scenario so far. This could be because the prospect of higher prices from the supply shock would be an incentive for miners to keep processing.

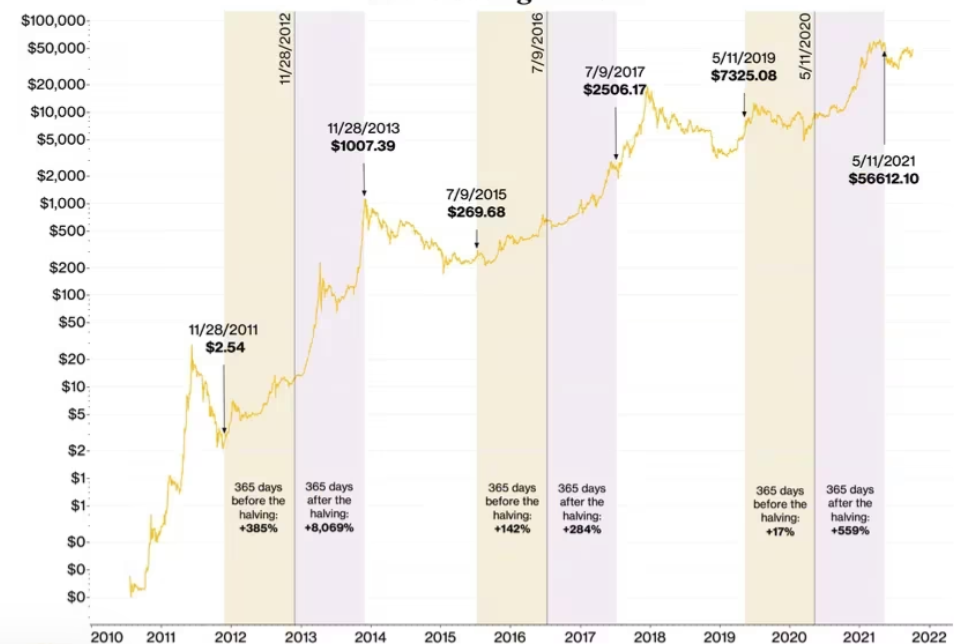

Halving historical price patterns

The chart above shows how the reduced supply has lifted the price of Bitcoin in the previous cycles. It’s important to note that this is not a case of the Bitcoin price doubling in the immediate aftermath of the halving event. Instead, historical data shows that the price increase is gradual, and it is often the years that follow when Bitcoin experiences fresh all-time highs.

However, it is also important to note that historical performance doesn’t predict future performance, and a range of other factors, including macroeconomic conditions, technology, regulation, and adoption rates, also influence Bitcoin’s price.

Heading towards March and April and ahead of the halving event, BTC/USD has surpassed $50,000 for the first time in two years. While some of this can be attributed to growing excitement and demand ahead of the halving event, the surge in demand from the recently launched ETFs is also boosting BTC/USD.

ETF inflows and Bitcoin’s March outlook

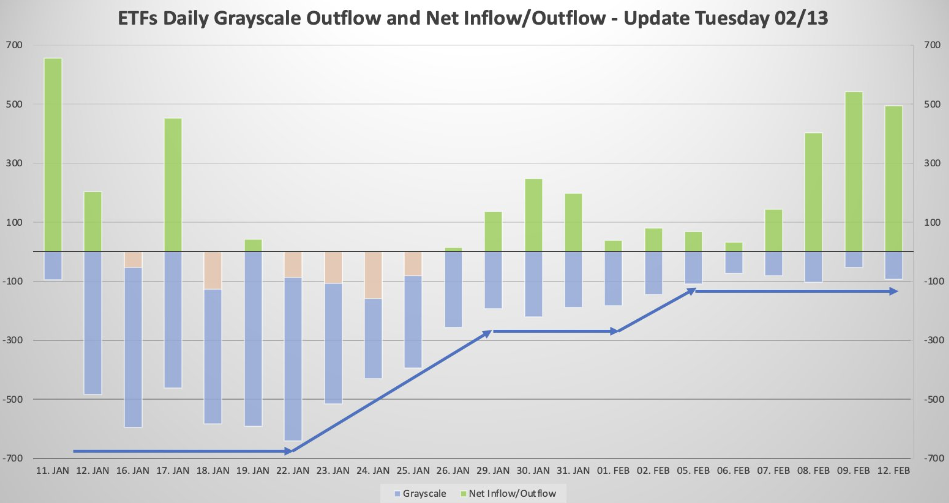

Spot Bitcoin ETFs have continued to see massive inflows. On Monday, $493.3 million net inflows were recorded, the third largest net inflow to date and equivalent to around 10,280 Bitcoin.

BlackRock continues to outperform, recording inflows of $374.7 million, with total inflows now at $4.126 billion. Meanwhile, Fidelity’s and ARK 21Shares BTC’s inflows reached $151.9 million and $40 million, respectively. At the same time, Grayscale saw $95 million in outflows.

The recent surge in BTC/USD comes as demand for spot Bitcoin ETFs outpaces new coins mined by over ten times daily.

A combination of solid spot ETF inflows combined with the halving event in April could see BTC/USD rally towards $55,000 sooner rather than later.

Conclusion

Economic Theory and historical price patterns suggest that halving events are bullish for the Bitcoin price. However, the price rise is often a gradual trend rather than an immediate surge post-halving. BTC/USD has risen above $50,000 on Bitcoin halving excitement and as spot ETF Bitcoin demand outpaces coin creation by ten times.

Sources

https://www.coindesk.com/learn/bitcoin-halving-explained/

https://coingape.com/bitcoin-etf-inflows-supply-dynamics-pushing-btc-price-towards-55k/amp/

https://www.ccn.com/news/bitcoin-etfs-inflows-outpace-mining-10-times/

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.