- Bitcoin holds steady at 66.5k after falling from 68.5k

- Kamala Harris gains the support of the Democrat party

- Kamala Harris is ahead of Trump in the polls

- Bitcoin ETFs break 12-day winning run

- Mt Gox moves $3 million worth of Bitcoin

After reaching a peak of $68,500 at the start of the week, Bitcoin has fallen lower and is now holding steady around the $66,500 level. This is amid uncertainty over the US political outlook and as risk sentiment takes a hit.

Bitcoin has come under pressure this week amid increasing uncertainty surrounding the US presidential race. At the weekend, President Joe Biden announced that he would no longer be seeking re-election and instead endorsed Vice President Kamala Harris.

Kamana Harris has swiftly gained the support of the Democratic Party and is widely expected to be nominated as the party’s presidential candidate.

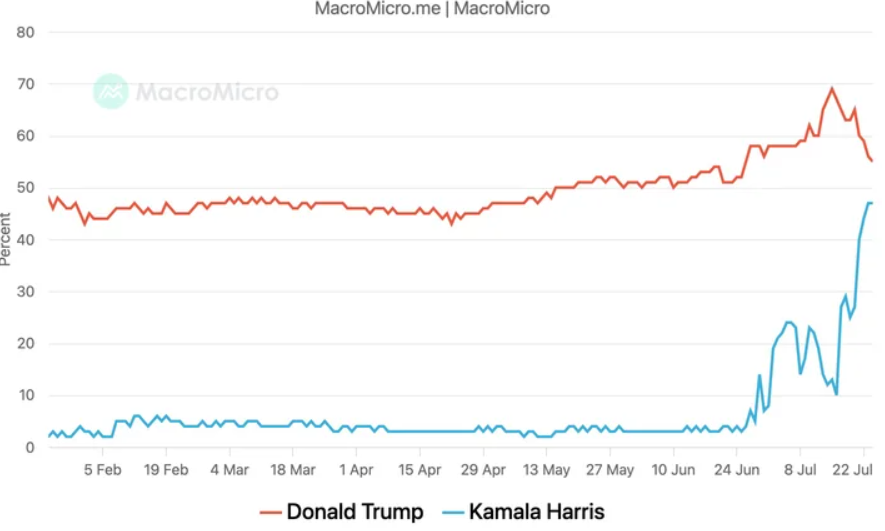

Prior to Kamala Harris’s endorsement, Donald Trump had been well ahead of both Biden and Harris in the polls. Expectations of a Trump presidency had helped fuel gains in crypto, lifting Bitcoin to a 6-week high last week. Trump has maintained a positive stance towards crypto throughout his campaign and is set to speak at the Bitcoin conference in Nashville on Saturday.

However, Harris is now seen pulling ahead of Trump in the latest Reuters/Ipsos poll conducted earlier this week. Other sites show that Harris has closed the gap considerably with Trump. As a result, some of that Trump trade, which had helped boost Bitcoin, has been unwinding.

BTC ETFs break 12-day winning run, ETH ETF started to trade

Meanwhile, Bitcoin exchange-traded funds (ETFs) broke a 12-day inflow streak as investors withdrew a net of $78 million. Bitwise led with $70 million in outflows, followed by ARK, which saw $52 million in outflows. BlackRock was the only spot Bitcoin ETF with net inflows, which totaled $72 million.

This activity occurred as the Ether ETF went live, with $107 million in net inflows, and trading volumes breached $1 billion.

Despite the spot-Bitcoin ETF outflows, the Bitcoin price has remained above $66,000 in quiet trade. The market is in wait-and-see mode ahead of Trump’s speech at the National Bitcoin Conference on July 25th. Rumors are circulating that Trump could announce that Bitcoin would be used as a strategic reserve should he return to the White House. Such a development could trigger a parabolic rally in Bitcoin’s price.

A strategic reserve is a store of assets, such as Gold, oil or Bitcoin, kept on hand and designed to be deployed in emergencies or to guarantee debt.

Mt Gox moves $3M worth of Bitcoin

Elsewhere, defunct Bitcoin exchange Mt Gox moved a fresh batch of Bitcoin to new wallets. Data from Arkham showed that Mt Gox moved 37,400 Bitcoin worth $2.5 billion from its main wallet to a new wallet, “12GWS9E,” and another $300 million to an existing cold wallet. This month the exchange began repaying creditors for a hack in 2014 with over $9 billion worth of Bitcoin to be distributed. Mt Gox is still sitting on around $6 billion worth of Bitcoin.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.