After shooting past the key 100K milestone yesterday, Bitcoin rapidly slipped back below the psychological level on profit taking and in anticipation of more clues over US interest rates.

The world’s largest cryptocurrency soared on Thursday to an ATH of 103.6 on optimism of crypto-friendly regulation in Washington in the second Trump presidency. The market cheered Trump’s crypto-friendly candidate, Paul Atkins, to lead the SEC.

Profit-taking & corporate selloff

However, a 7% flash crash in Bitcoin took the price to a low of 92k before steadying at 98k at the time of writing. The move was partly attributed to institutional sell-offs, most notably Meitu, “China’s MicroStrategy,” which sold all its Bitcoin holdings as the price surged to 100k.

The flash crash highlights the potential market impact when larger holders, such as corporations with substantial holdings, decide to sell. MicroStatregy’s Michael Saylor’s intentions were likely being questioned amid his controversial past from the dot.com bubble, which could add to investors’ caution.

As of this week, MicroStrategy owns 402,100 bitcoins, with an average purchase price of $58,219 and a total cost of $23.41 billion. The holdings’ value today is just below $40 billion.

The selloff has come as demand has increased for bearish bets, such as put options, which provide the right to sell at a pre-determined price within a set period of time. The most notable activity was for put options with strike prices between 95k and 100k.

Trump’s crypto Czar adds to a crypto-friendly cabinet

Bitcoin has rebounded from the lows, supported by Trump’s ongoing pictures of a crypto-friendly cabinet. The latest addition is venture capitalist David Sacks, who will take up a newly created role advising the White House on crypto and AI regulation.

The move follows the creation of a crypto Advisory Council, and as Trump’s pick for Treasury Secretary and Secretary of Commerce, we’re also seen as supporting a friendlier crypto regulatory space.

Bitcoin’s uptrend still feels like it has room to run higher. Proft taking along the way is to be expected, especially when looking back at previous cycles. Drawdowns of 20% to 40% in bull markets are not unusual.

TRON (TRX) +54% this week as Altcoin season begins

This week has seen the start of altcoin season, which is marked by at least 75% of the Top 50 coins performing better than Bitcoin over the last 90 days. Today, the index is at 86%. During this period, altcoin typically outperforms Bitcoin

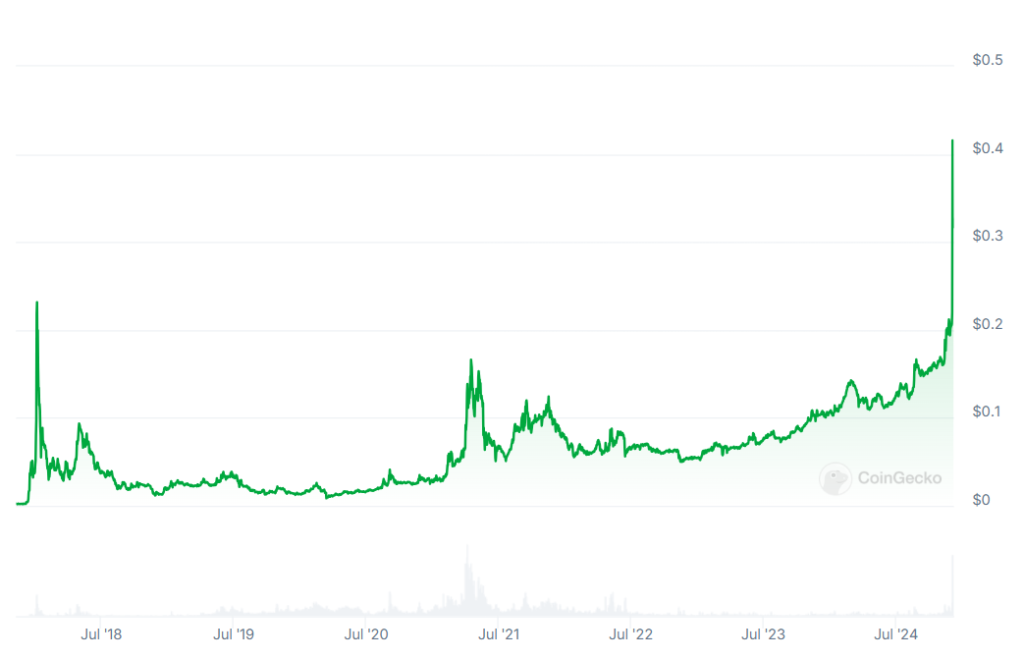

TRON (TRX) has been a standout performer, benefitting from the start of the altcoin season. While TRX/USD is falling 5% today, it still trades up 54% so far this week after hitting an ATH of $0.45 on Wednesday. This marked its first ATH in 7 years, boosted by positive sentiment surrounding the altcoin market.

The TRON blockchain has also seen significant growth, growing its global user base to over 270 million accounts and 8.8 billion transactions. TRON is creating strategic partnerships and growing its use case, which is helping to increase adoption. More recently, Tron has announced a partnership with the Chainlink Scale programme, providing developers with Oracle services while expanding the prospects for both Chainlink and Tron’s stablecoins.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.