Bitcoin prices fell on Wednesday amid a decline in risk sentiment after a heated presidential debate raised the chances of a closely contested 2024 presidential election.

Bitcoin trades over 1% lower, with other digital coins also in the red. Ether is falling 2% lower, and Solana has dropped 3%. Meanwhile, US futures also point to a lower start.

Who won the debate?

Democratic nominee Kamala Harris was seen as performing better than Joe Biden in the debate against Republican candidate Donald Trump. However, the two clashed in a fiery display, with both candidates accusing the other of lying while claiming their own policies were superior.

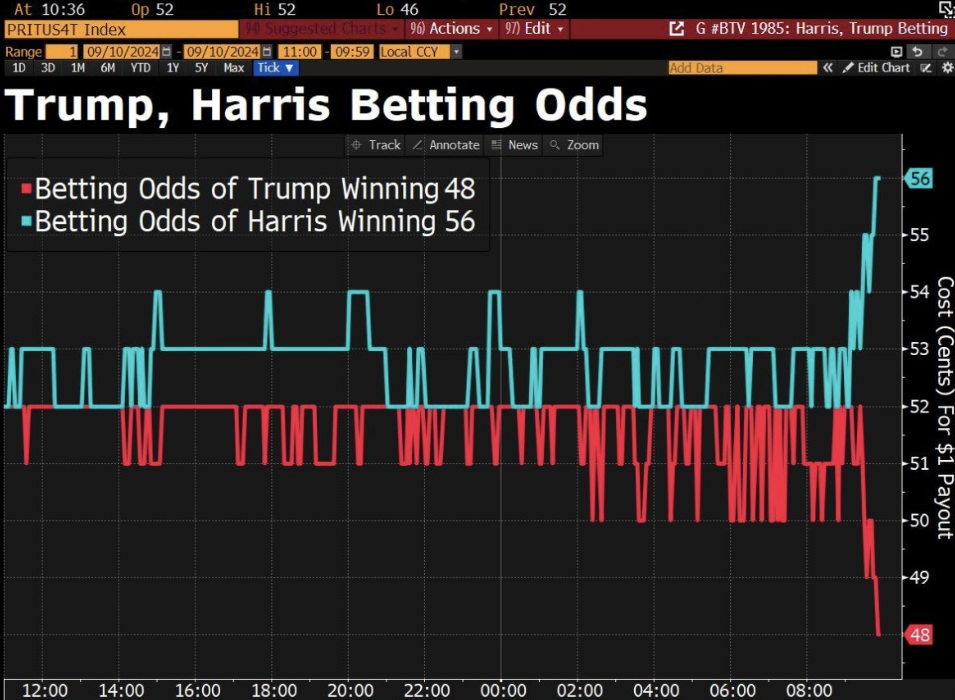

According to a CNN poll of voters watching, Harris performed better, and the betting market said the same.

Increased competition for Trump has raised anxiety in crypto markets, given that he has openly declared his support for digital assets and the crypto industry throughout his election campaign.

Meanwhile, Kamala Harris has made no official comments on crypto or crypto regulation, and it’s broadly assumed that she will continue the Biden administration’s tougher stance on the sector.

Bitcoin, nor the crypto industry were mentioned in Tuesday’s debate, and Trump made no reference to the industry while discussing his economic policies, which may have disappointed some.

US CPI inflation data

What to expect

Attention is now turning to US inflation data as measured by CPI. Economists expect CPI to ease to 2.6% in one year in August, down from 2.9%. This is the last major US data release ahead of the Federal Reserve monetary policy meeting next week, where the central bank is expected rate cut rates.

The data may well decide which path the Fed will take and whether the central bank will cut rates by 25 basis points, which is currently 65% priced in. However, weaker-than-expected US inflation data could bolster expectations that the Fed will cut rates by 50 basis points. According to the Fed funds, this is 35% priced in ahead of the data release.

How might Bitcoin react to US inflation data?

Cooling inflation would support the view that the Fed will start a rate-cutting cycle. This would improve liquidity in the market, boosting demand for risk assets such as Bitcoin and stocks, while the USD could move lower. This could help Bitcoin return to $60,000.

If inflation comes into too low, recession fears could be revived, which would be bad news for Bitcoin. Meanwhile, if inflation were to come in higher, it would be a major surprise and could also trigger a Bitcoin sell-off.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.