Bitcoin is falling for a second straight day and is already trading over 4% lower in September after dropping 8% in August. September is typically a bearish month for Bitcoin.

Bitcoin has sold off sharply, dropping to a low of 55.7k as fears of an economic slowdown in the US hit the market mood, sending risk assets sharply lower.

The sell-off hasn’t been limited to Bitcoin, with altcoins across the board experiencing declines.

Stocks plummet in worst daily sell-off in a month.

Meanwhile, U.S. stocks saw the deepest one-day sell-off in a month. The S&P 500 closed 2% lower, and the tech-heavy Nasdaq 100 tumbled 3%. US indices are set to extend the selloff on the open today. Meanwhile, riskier currencies, such as the Australian dollar, ended yesterday 1% lower, and the safe-haven Japanese yen rallied and is extending those gains today.

Weaker manufacturing data fuels slowdown fears

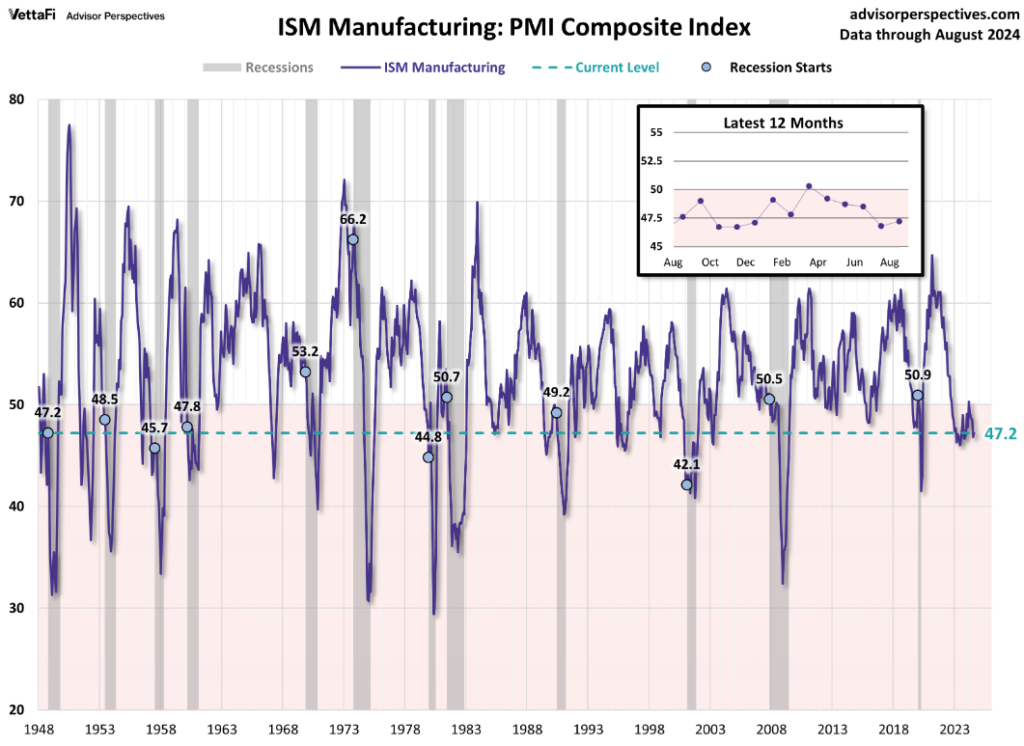

The indiscriminate selling of risk assets came after US manufacturing PMI data was weaker than expected at 47.2 in August, down from 46.8 in July. The reading came slightly below the market expectation of 47.5. A PMI reading below 50 indicates a contraction in the manufacturing sector, which accounts for 10.3% of the economy. The PMI has remained below this 50 threshold for five straight months.

The data sends warning signals on economic conditions and points to the manufacturing sector, which acted as a drag on the economy halfway through the third quarter. Meanwhile, forward-looking indicators such as order-to-inventory ratios and new orders suggest this slowdown could intensify in the coming months.

The data came as the markets were already jittery about a US recession following July’s weaker-than-expected non-farm payroll report and ahead of a busy week for U.S. economic data.

We are concerned that a potential recession in the US, the world’s largest economy, combined with disappointing data from China, the world’s second-largest economy, is hurting risk appetite. This has resulted in the selling off of risk assets such as stocks and Bitcoin.

Jolts job openings & NFP report

Looking ahead, attention will now turn to Jolts’ job openings later today. Jolts job openings are expected, to show job openings remained roughly stable at 8.1 million, in line with June. However, the ratio between job openings and unemployed looking for work is expected to fall to its lowest level in three years.

Clues over the health of the jobs market come ahead of Friday’s non-farm payroll report. The NFP report will be more keenly awaited than usual after the Federal Reserve has indicated that their gaze is turning toward risks in the labor market as inflation cools towards the 2% target. The market will be looking at this week’s jobs data to confirm or refute recession worries.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.