Bitcoin is holding steady on Thursday at 60,000, supported by improving market mood as participants are increasingly convinced that the Federal Reserve will cut rates in September. However, speculation over further distributions from Mt Gox is capping gains in Bitcoin.

Fed minutes point to September rate cut.

The minutes of the latest FOMC meeting showed that the US central bank is heading towards a September rate cut. The vast majority of officials said they expect a rate cut next month, and some policymakers, according to the minutes, would have even been willing to reduce interest rates at that July meeting.

The market expects the September meeting to start a Federal Reserve monetary policy easing cycle, with as many as 1% of rate cuts expected by the end of the year.

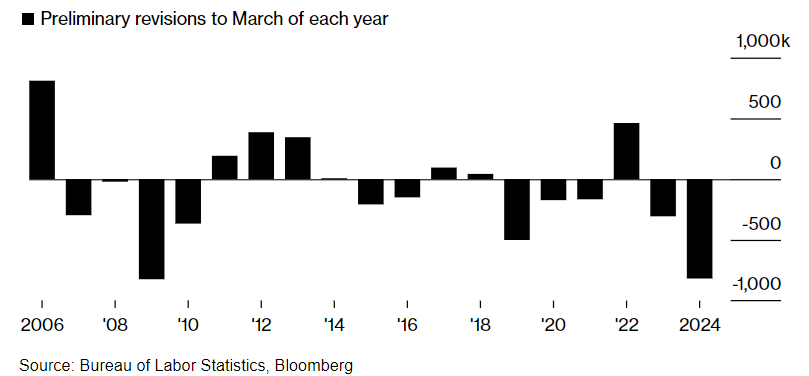

US payrolls are revised sharply lower.

With the Federal Reserve becoming increasingly confident that inflation is cooling to the 2% target, attention is turning toward the employment component of the central bank’s dual mandate.

Data yesterday showed that US payrolls were revised lower by a chunky 818K, the largest downward revision since 2009. This means that rather than the reported 2.1 million jobs added in the year to March 2024, only 2.1 million jobs were added. This means that average monthly payrolls saw gains of only 178,000 compared to the previously reported 246,000. The sizable downward revision is likely to push the Federal Reserve to cut interest rates in September.

Financial markets are currently favouring a 25 basis point rate cut on September 18th, which comes after better retail sales and a sign of resilience in jobless claims. Attention will be on the September 6th non-farm payroll report for August, which has the potential to have a big impact on the market. A rise in unemployment to 4.5%, up from 4.4%, could boost the case for a 50 basis point rate cut in September.

Lower interest rates increase liquidity, which bodes well for risk assets such as cryptocurrencies and stocks. However, revived concerns of a recession could quickly see risk sentiment deteriorate.

Mt Gox distribution concerns remain.

Separately, the defunct crypto exchange Mt Gox has been seen mobilising around $700 million worth of Bitcoin. The latest developments come after moving around $2 billion worth of tokens last week. The exchange started returning tokens taken from clients during a hack a decade ago in July. The market has been concerned that an increase in Bitcoin supplies adds selling pressure on Bitcoin.

The exact amount of Bitcoin that Mt Gox holds is unclear. Coindesk estimated the figure could be around 46,000 tokens valued at around $28 billion.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.