After falling over 8% in the previous week, Bitcoin prices are inching higher as September kicks off, the seasonally bearish month.

Bitcoin is rising, recovering from a low of 57,500 reached early on Monday. The price now trades just above 59k. Traditional markets and ETFs were closed on Monday owing to the Labour Day holiday. Spot Bitcoin exchange-traded funds (EFTs) posted total net outflows of $175 million on Friday, extending a losing streak to four days. Meanwhile, ether ETF had net $0 inflows or outflows despite experiencing $173 million in trading volume.

What is seasonality?

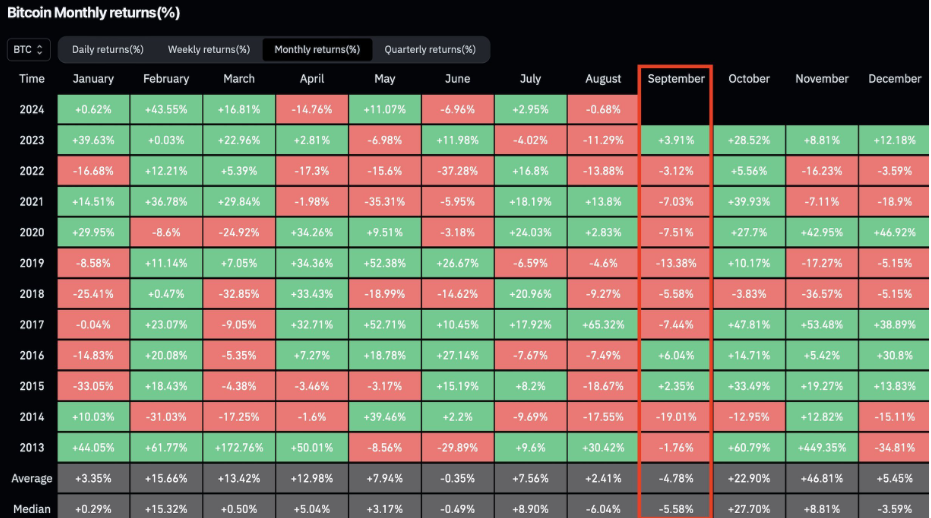

As the new month begins, seasonality should be an important factor. Seasonality is the tendency of an asset or market to experience regular and predictable changes in certain months of the calendar year. While these may appear random at first, with time, patterns can be seen. For example, profit-taking is sometimes seen around tax season in April and May, which can cause a drawdown, whereas the Santa Claus rally in December can also help prices push higher.

How does Bitcoin perform in September?

September is historically a negative month for Bitcoin. The world’s largest cryptocurrency has devalued by around 4% on average since 2009. Furthermore, in six of the past seven years, September has been a bearish month, with the value of the digital currency lower by the end of September than at the start. As a result, traders could be feeling a little nervous heading into September.

How do stocks perform in September?

September isn’t just a bearish month for Bitcoin; it is also historically the worst month for U.S. stocks. History suggests that September is the worst month of the year in terms of stock market performance, with the S&P 500 generating an average monthly decline of 1.2%. The index has only managed to finish higher 43% of the time in September, dating back to 1928, according to data from the Dow Jones market.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.